Bitbond Blockchain-based Lending Security Token Project Review

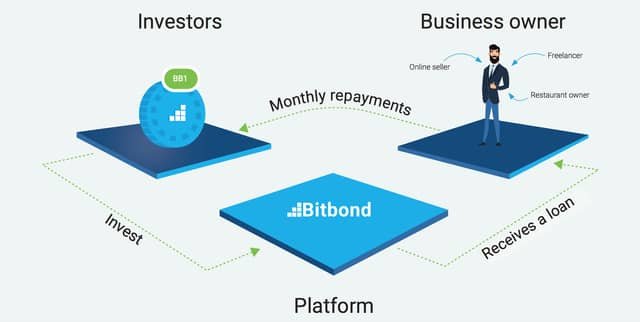

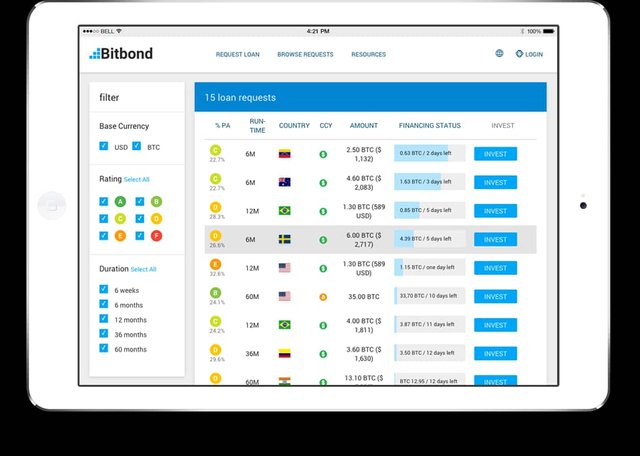

Bitbond is a lending platform giving working capital financing to little and medium size organizations all over the globe. They characterize themselves as the first cryptographic money based lending platform for business advances that works all inclusive.

Working since 2013, they went through the primary years building up the verification of idea. In 2016, they got a permit from the German financial controller BaFin. They were among the main directed financial services suppliers in the whole blockchain space.

As indicated on their site, Bitbond as of now have more than $1 million in business advances each month. A large portion of the borrowers are little and medium size organizations originating from Europe and Africa however they intend to expand the extent of clients from location point of view and regarding the businesses they serve.

The borrowing procedure with Bitbond is clear. Organizations initially need to finish an online application to get a customized offer. Bitbond takes close to 24 hours to affirm or decline the advance application on account of a automated credit scoring system. When affirmed, borrowers can have moment funding access through their platform. In an ongoing meeting, the CEO was clarifying Bitbond is utilizing the Stellar blockchain for payment handling which enables them to do exceedingly efficient and quick worldwide transactions.

The team, partnerships and investors for the most part gives a decent image of the organisation. First thing we can notice is that they are absolutely transparent on those issues.

Putting Resources Into Bitbond

Bitbond as of late propelled its first security token offering which is as yet going on as I am composing this article now. The security tokens sold are called BB1 and are filling in as token-based bonds.

When you realize how bonds work, the BB1 token financial matters is entirely clear. The fund raising target is set to be 100 million BB1 tokens. Tokens are possibly created on the off chance that they are purchased during the security token offering (STO). Each BB1 token has a face value of €1. Thusly, the issue will be utilized to raise funds of as much as 100 million euros.

I officially expressed that one BB1 token is worth €1. The development of the bonds is 10 years, BB1 proprietor will get back €1 in 10 years from BitBond once the bonds develop. There is a fixed intrigue payment of 1% each quarter (4% every year without considering intensifying impact). The most fascinating part is presumably the variable segment of the coupon token holders get once per year. The variable segment will be equivalent to 60% of the pretax benefits of Bitbond Finance shared between token holders. The evaluated all out yearly return is to be around 8%.

The BB1 security token is identified with the Stellar Lumens blockchain in various ways. To begin with, the token is taking a shot at the Stellar blockchain. It will be conceivable to move BB1 tokens between outstanding addresses and the tokens will be tradable on excellent decentralized exchanges (Bitbond additionally plans to negociate with centrally controlled exchanges later on). Likewise, the reimbursement and intrigue payments due during the term will be made straightforwardly on the outstanding Blockchain to the token holders and solely in the cryptocurrency Stellar Lumens (XLM). The measure of XLM sent will rely upon XLM esteem in euro when installment is expected.

The Token Potential

As token-based bonds, the BB1s shouldn't be contrast and value tokens or utility tokens regarding returns and dangers. For most value tokens or utility tokens, returns are obscure and depends for the most part on theory around the development of the system or the organisation when the arrival of BB1 are truly very much expected and ought to be around 4% to 8% per year during ten years.

The dangers are likewise explicit to bonds. The significant dangers is most likely the default of an excessive amount of borrowers which could affect Bitbond ability to pay intrigue and reimbursement. You can locate a broad arrangements of the hazard in the bonds outline.

The Security Token Offering

As referenced before, the BB1 security token offering is occurring at the present time.

You can buy token with BTC, ETH, XLM and EUR and it's available to anyone on the planet aside from US and Canadian residents.

The STO started on the eleventh of March and as indicated by the site, 1.7 million euros was at that point funded. It appears the hardcap of 100 million will scarcely be met. Since there are fixed issuance costs ( more subtleties on expenses in the following area), I don't know what is the base sum required for the token to be issued.

WEBSITE: https://www.bitbondsto.com

TELEGRAM: https://t.me/BitbondSTOen

LIGHTPAPER: https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

PROSPECTUS: https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

ANN THREAD: https://bitcointalk.org/index.php?topic=5130337.0

FACEBOOK: https://www.facebook.com/Bitbond/

TWITTER: https://twitter.com/bitbond

MEDIUM: https://medium.com/bitbond

REDDIT: https://www.reddit.com/r/BitbondSTO/

INSTAGRAM: https://www.instagram.com/bitbondofficial/

YOUTUBE: https://www.youtube.com/user/Bitbond

Author's Details

Bitcointalk Username: Ajaone

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2587917

My Affiliate Link: https://www.bitbondsto.com/?a=DSGBHW