SHIB_Investment_Turns_30K_into_26M_in_52_Days

1. Preface

Many friends, both online and offline, have asked how I managed to hold onto $shib. I’ve recounted my $shib journey countless times with different people. Last year, amid continuous losses, I lacked the motivation to organize it. Now, during this exceptionally dull market, I’m revisiting that experience to summarize lessons and insights for myself and others to reference in the next bull market.

This essay isn’t about bragging—the profits I made from big waves vanished completely, leaving nothing to show off. I simply aim to survive the bear market and rise again alongside my peers.

In late January to early February 2021, $doge surged 10x. When BTC dropped from 40K to below 30K, I was stopped out of my $doge long positions, filled with regret. That $doge rally taught me a crucial lesson: if another opportunity arose, I had to follow Elon Musk closely. This planted the seed for my later entry into $shib.

That period remains unforgettable: slacking off at work by day, sleepless nights, and obsessively engaging in group chats to soothe my anxiety. Waking at midnight to see peers flaunt 10x or 100x gains became routine.

Before buying $shib, many crypto-savvy friends had already hit A8 status by holding bnb/cake or mining defi. I started in 2019 with a 200,000 RMB loan from CMB, which dwindled to 100,000 RMB by 2020. By early 2021, I held at most 200 coins, trailing far behind my group. Comparing myself mentally, I realized sticking with mainstream or common altcoins would never let me catch up—I’d just become their bag holder. I desperately needed to seize a hot opportunity and craved a dramatic surprise.

2. The Wheels of Fate Start Turning

Reflecting now, it’s been two and a half years since this chart, yet it feels like yesterday.

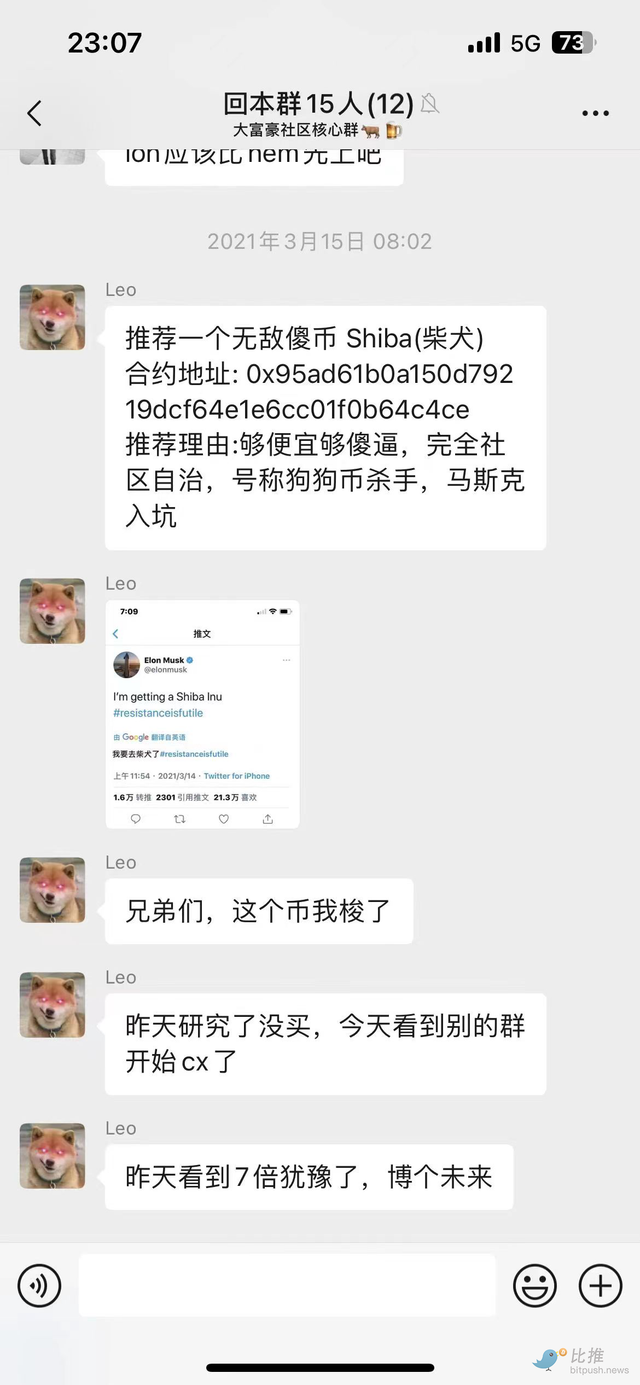

On the morning of March 15, I shared a message in a small group—those few lines packed critical insights. I’d researched it the night before (March 14). While I wasn’t the absolute first domestically to discover it, my WeChat searches showed no mentions. With no one discussing it, I hesitated to enter that night. On the 15th, spotting the big shot CX in another group, I followed his lead to buy. That influencer was the renowned Mr. Li @liping007.

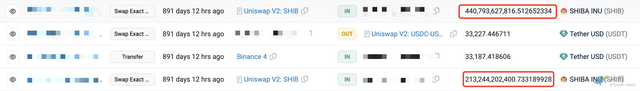

Records show I bought roughly 650 billion that morning. At the time, that equaled 0.00000817650000000000 = $5.31 million USD, or at $shib’s peak, 0.00008836650000000000 = $57.43 million USD. Of course, this is theoretical—actual gains were far lower.

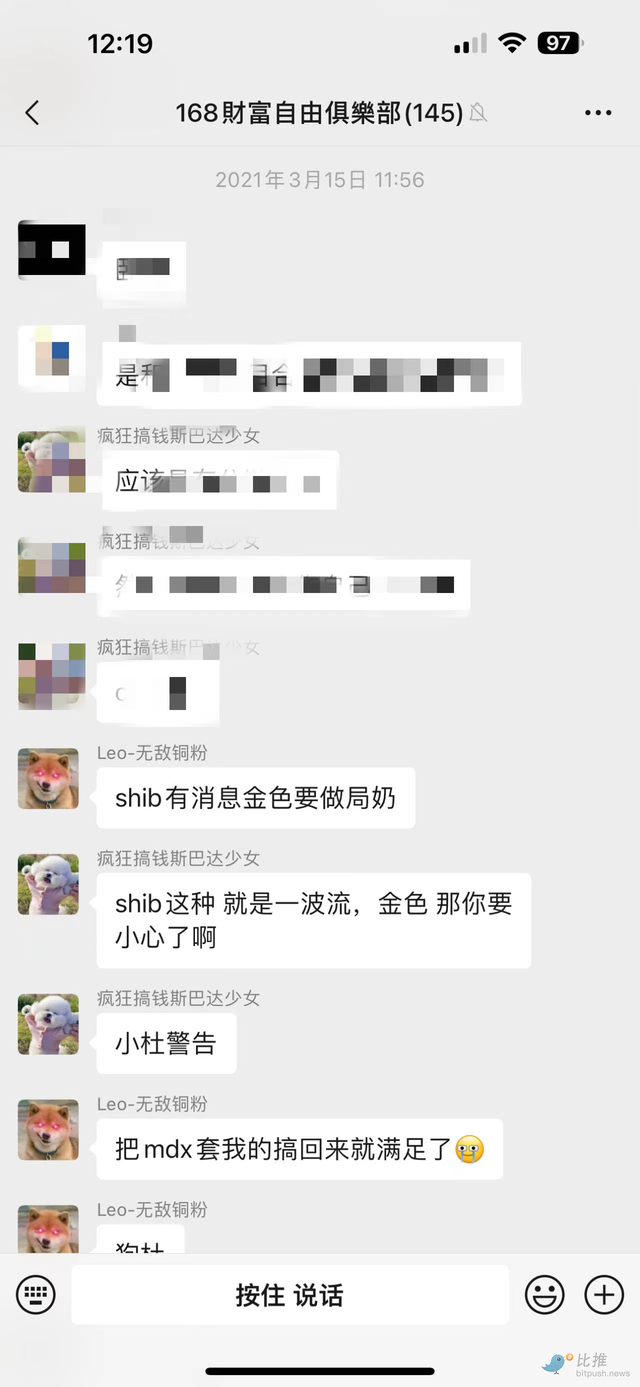

The next image is a side note: Jinse Finance did release a $shib news flash then, but details escape me. After reading it, I CX’d to group mates, but Jinse’s unreliability meant most ignored it.

After buying on March 15, $shib rose less than 2x before slowly declining. From purchase to its April 16 surge on MEXC, I was locked in $fei with no capital. I sold $20K at cost and held $30K, which later halved to $15K.

By late March, the entire network was FOMOing into stablecoin $fei. I went all-in with ~2 million RMB. During $SHIB’s stagnant phase, it was brutal—no funds to trade, forced to watch peers’ coins moon. I genuinely feared the money was gone forever. Recalling how hard I’d earned it in the bull market only to lose it all felt despairing. Thankfully, the darkness lifted half a month later.

3. $shib’s First Crazy Pump (Resignation Incident)

April 16, an ordinary Friday: $SHIB launched on MEXC. Business partners visited Shenzhen; we dined, got massages, and reminisced. That weekend, I barely slept, chatting while glued to MEXC.

From April 16-19, it pumped over 20x. My $fei lockup no longer mattered.

I’m unsure why I held $shib so firmly—perhaps an overwhelming hunger for fortune. I recall staying clear-headed, even attempting swing trades for cheaper entry.

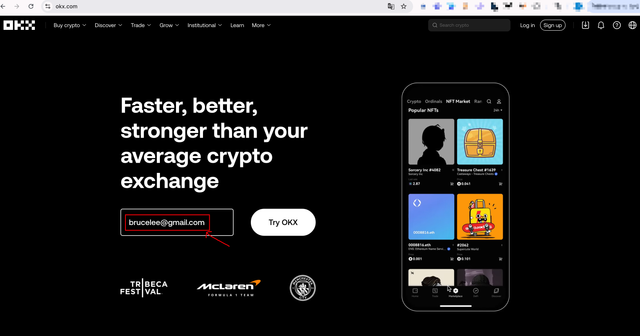

On-chain recharge to gate.io

Here, I must praise gate.io. Despite disliking its UI, it retains all trade records—unlike others purging after a year—and queries are lightning-fast.

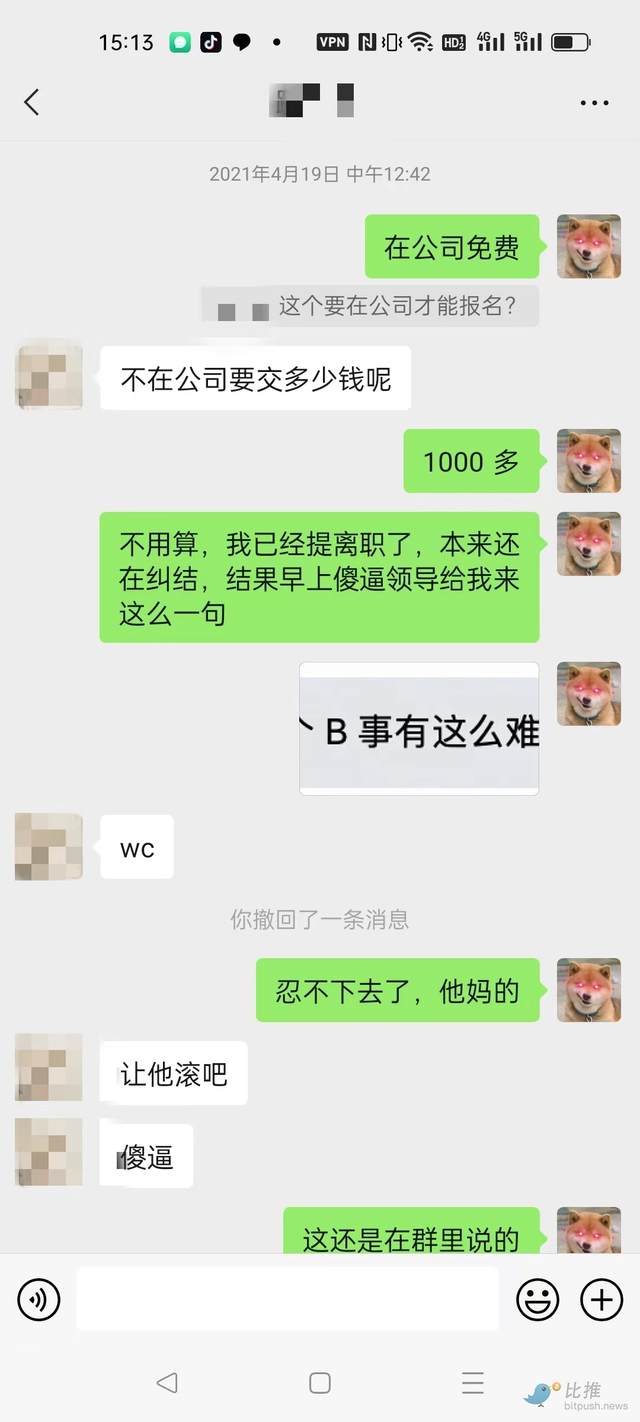

April 19, Monday: Around 10 AM, I arrived at the office, opened WeCom, and began organizing work. When I asked my leader to confirm a procedure, he snapped back:

Fuming internally, I thought, “Screw this.” Later, he summoned me to his office. After 30 minutes of nagging, I cut in: “Done?” At his yes, I declared, “I’m resigning.”

It felt like a cultivation novel’s heroic reversal—I’d endured his constant nitpicking for too long.

Looking back, I regret not being harsher—too concerned with face. I should’ve called him out in the group chat. Truly: bottling anger fuels resentment; retreating costs more.

My $shib was then worth ~$600-700K USD, plus $fei, totaling ~$900K-$1M USD.

A funny aside: I didn’t reveal my gains, claiming instead I needed to return to Guangzhou for my partner. He spent half a month trying to retain me. At a team event, he cornered me for a “retention talk.” Finally, I admitted I’d made money and wanted rest. When he pressed, I said 7-8 million RMB. He scoffed, “That’s nothing—a Shenzhen house eats that.” I didn’t argue.

The punchline: A week later, after I’d exited positions, he asked about crypto. I replied, “That 7-8 million? Nearly 20 million now.” He fell silent—no more face-saving.

4. Clearing Out (Crazy Zoo)

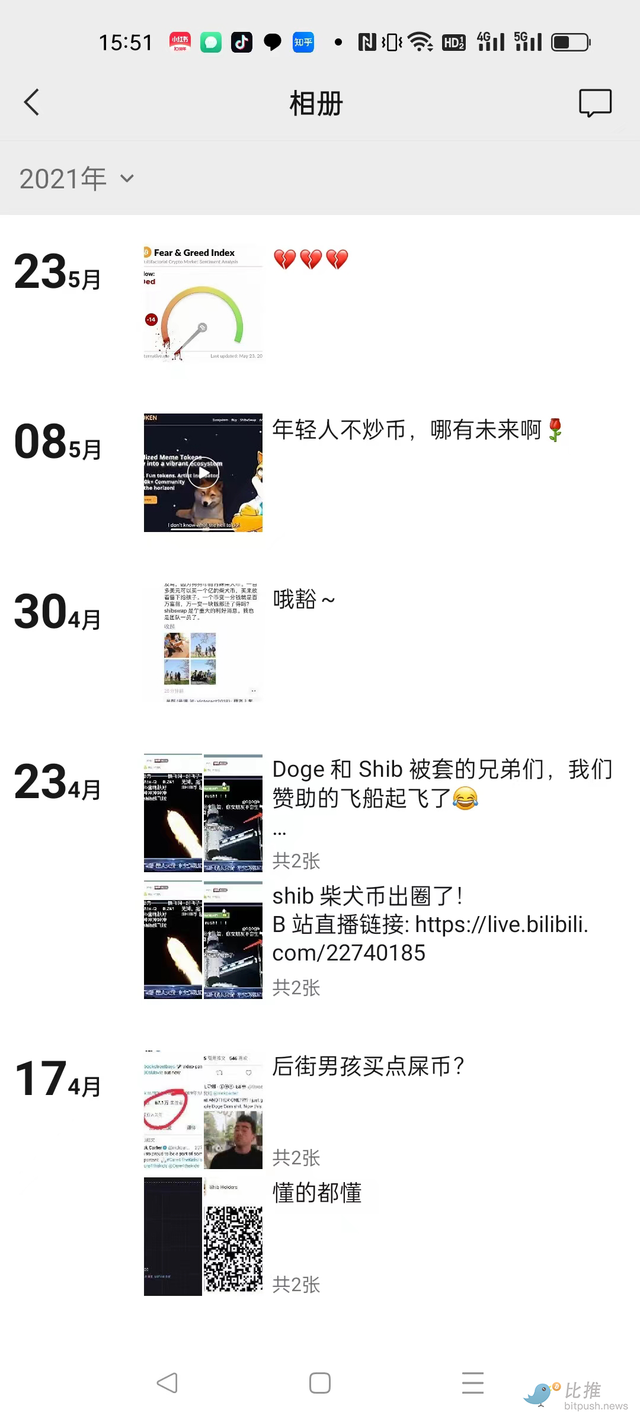

After the April 20 pullback, $shib stabilized and climbed steadily. This steadiness let me hold; a continued crash might’ve made me flee. Over the next half-month, bullish news flooded in: $shib discussions surged, Elon Musk’s rocket launch sparked frenzy, and everyone anticipated further gains. Crucially, the top three exchanges hadn’t listed it yet. By late April, Xue Manzi joined, publicly shilling buys. Days later, OKX (a top-three exchange) listed it.

Mr. Li energetically pumping everywhere

Never seen such insane coin CX-ing on WeChat Moments

I vividly recall $shib’s May 8 noon listing on OKX. An OKX friend hinted at a 12 PM launch, but I was lunching with my leader (still resigning) and wandered parking lots/elevators with poor signal, missing the peak sell. This deepened my loathing for him.

Huobi (HTX) listed shortly after. I assumed Binance—the largest exchange—wouldn’t list so fast, so I exited fully, planning to rebuy on a deep dip. But shameless Binance listed it on the 10th—under 48 hours later—making me miss half an A9 opportunity.

The rest is history: the “zoo” frenzy raged for a week, culminating in the May 19 explosion. My $shib saga ended.

Three big exchanges listing in two days

5. Lessons & Summary

Big wins involve luck on a small scale, fate on a larger one. Yet fate-changers aren’t accidental—they meet preconditions. Truly giving up? Even immortals can’t save you.

Dream big to earn big. I thought: “Why can peers succeed but not me?” Of course, I say this only because I won; bad luck would’ve made my story ordinary.

Fate drives fortune, but effort is foundational. I pushed hard then—even developed kidney stones from sleepless, erratic hours. I bought every new project blindly, studied it, and leveraged that knowledge next time.

Persistence is key. This grit helped me surpass most schoolmates. In crypto, you might pause trading, but never leave the circle. Fate’s wheel will turn to you.

Risk management (position control) is investing’s core. My bear market losses stem from ignoring this. Next bull run, I’ll prioritize it.

Finally, I wish all crypto fortune-seekers find their own $shib.

🎁 Limited-Time Bonus — New Users Get a Bitcoin Mystery Box Worth 20+ USDT, Guaranteed!

Sign up for top exchanges like OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack & more—all in one place!

👉🏻 Bookmark the latest official backup domains to avoid missing out: https://linktr.ee

🔥 Recommended Reading

OKX This Month’s Promotions

New users registering this month get blind boxes or Dogecoin gift packs. Register directly: Click here to register an OKX account (some regions require VPN) or Alternate link

🔥 How to Solve Access Issues to OKX Exchange from Mirror Sites

Exchange domains often face blocks or slow speeds due to overseas servers. Users may mistake this for platform failure, but it’s usually network issues. OKX, Binance, and others update backup domains regularly for uninterrupted access.

- OKX backup domains: OKX Overseas – VPN required or Alternate link

- Binance backup domain: Binance

- Bitget backup domain: Bitget

- Bybit backup domain: Bybit/Bybitglobal

- Huobi HTX backup domain: Huobi (HTX)

- Gate backup domain: Gate.io

🔥 Alpha Tools for Hunting Dogecoin

1️⃣ Axiom Doge Hunter: https://axiom.trade

2️⃣ Gmgn Doge Hunter: https://gmgn.ai

3️⃣ dbot Doge Hunter: https://app.debot.ai

4️⃣ Morelogin Multi-account Fingerprint Browser: www.morelogin.com

Popular Searches

Bitcoin purchase, Bitcoin, Trump Coin, domestic Bitcoin purchase, crypto exchanges, OKX download & registration, OKX recharge, Binance app registration, Binance app download, Binance buying tutorial, Binance registration, Binance airdrop registration, Binance iPhone app download, how to buy Trump Coin, how to buy Dogecoin, buying Bitcoin with RMB, how to download OKX, web3 airdrop, web3 zero-cost farming, Bitget China download & registration, OKX passport registration, OKX download, Binance download, crypto side jobs, OKX contracts, how to deposit RMB on OKX, how to recharge OKX, NFT wallet setup, how to recharge Huobi with RMB, beginner’s guide to crypto, btc8848.com, contract trading Tony’s mindset, contract leverage bitlanglang, DeFi mining, crypto airdrops, contract liquidation solutions, how to buy Trump Coin on OKX and Binance, how to buy Ethereum on OKX and Binance, DeFi staking and mining, NFT trading, web3 zero-cost farming, how to play crypto web3, how to inscribe NFTs, how to craft runes, beginner’s guide to crypto, how to trade crypto, is crypto profitable, contract leverage explained, DeFi mining, crypto airdrops guide, OKX Binance airdrops, node staking, liquidation, financial freedom, heiyetouzi.xyz