Should You Earn 1,800,000% APR On BlackHole DEX? 🛰☄

Today was a big day. I had gotten another laptop, tried the Brave Browser wallet for the first time in a long time, and experimented with the BlackHole exchange. I'm going to focus on the BlackHole exchange on Avalanche for this post. It has only been out for a couple of days and is a project by Alex Becker and Elio Trades.

Seems like they have decided to migrate their NeoTokyo assets over to AVAX which makes sense. If you haven't been on Avalanche for awhile the fees are generally under $0.01 which is helpful for these smaller tests I'm doing. I started out with $60 essentially on Solana and got that over to Avalanche in the Brave wallet.

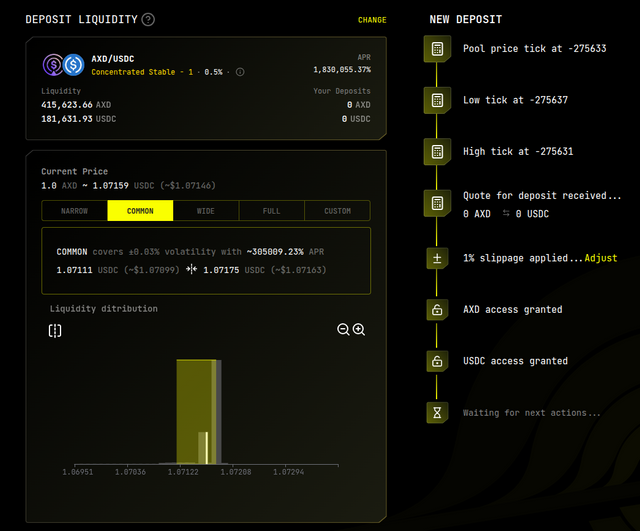

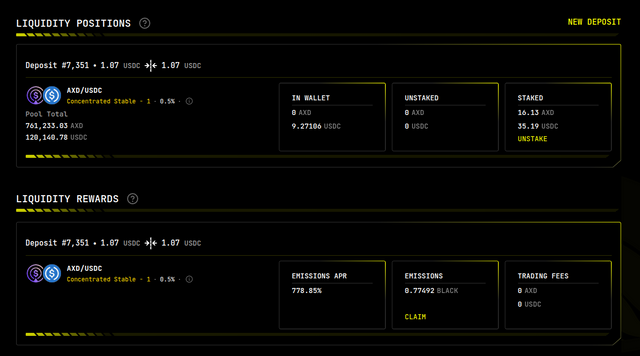

You are going to have to have a tiny amount of AVAX for gas fees so don't run your wallet dry. $1 worth of AVAX will go a long way. I got in the AXD / USDC pool and it was wild just trying to get in.

AXD got pulled away from the peg and was selling for $1.07 and that alone caused it to be very precarious to be in the pool.

At the huge APR you would double your money in 20 minutes. I was all excited and it was fun as hell. BLACK was cranking in and I was getting euphoric. That's when you know things are overheated.

Because of the 7% separation in that stable pairing and the amount of people getting in the APRs were changing rapidly and it drained the one side of the pair. I ended up with all USDC and no ADX.

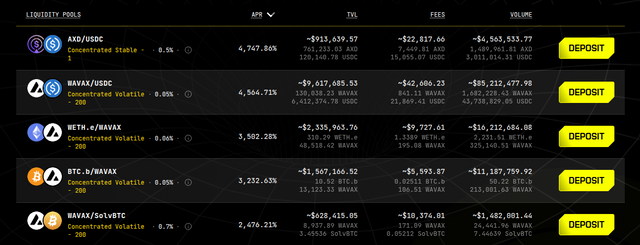

In the end the situation had changed and I decided to get in the WAVAX/USDC pool. That's wrapped AVAX which i don't get the purpose of wrapping the native asset on it's own chain for these pools. Maybe that keeps tweakers from draining their wallets of gas when they are trying to create pairs.

The WAVAX/USDC pairing I'm in is acting funny as well. It is sort of draining the AVAX side and stacking more USDC over time. Also the APR reported on the liquidity page is 3,648% APR but on the portfolio tab where my pair is it is reporting 615% APR. Quite a difference and the only thing I can think is there is an "Incentivize" page where you can essentially sacrifice BLACK to juice up the rewards for everyone so I don't know why that is why it doesn't correlate.

The APRs are going to thrash around wildly in these early days.

Now AXD is close to $1 again and that pool is paying 1,252% APR supposedly. I might go back in with a bit to see if it drains the one side or not.

CONCLUSION

The BlackHole UI is solid and if noting else this brings more attention to Avalanche and the fact thst the fees are so low now. Other ecosystem tokens like Arena are on there as well in liquidity pools.

The BlackHole DEX seems to be incentivizing people to lock up their BLACK in return for NFTs and rewards and has a voting power element as well with their game theory.

Ultimately I'm glad i didn't go in with a huge amount and am starting with small tests because it seems like these pools opperate with a different equation and are labelled "Concentrated Volatile - 200" and stuff like that. I haven't seen a breakdown and a lot of guys aren't getting into detail with their videos on what is working as a strategy.

BLACK is somewhat holding it's value and is listed on various other DEXs and has a decent amount of pairings and maybe they get a bunch of disciples to lock up a bunch of it. It's hard saying. Im going to assume it will get farmed and sold off so I'm going to stay liquid and try to rotate earnings to primary assets.