Bitcoin Closes First Week in the Red After a Long Rally

After seven unstoppable weeks, the leading cryptocurrency is retreating, facing key resistance and showing signs of exhaustion that could define its next big move.

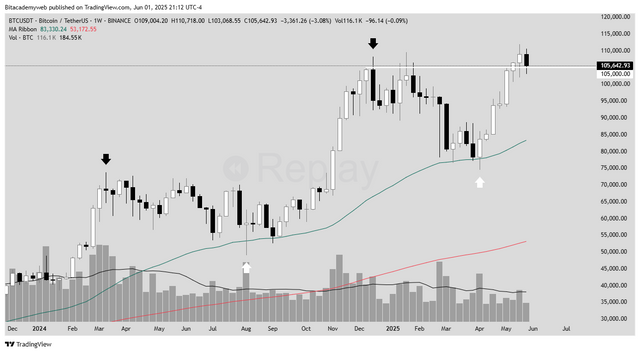

The price of Bitcoin (BTC) broke its impressive bullish streak, closing the week with significant losses of -3.08% to settle at $105,642. This is the first weekly decline recorded by the world's leading cryptocurrency after a spectacular seven-week rally, a move that has tested investor conviction and the underlying strength of the uptrend.

Its price continues to trade above the 50 and 200 EMAs on the daily chart, and both averages are well aligned upwards, reinforcing the positive long-term outlook / Tradingview

The "Expansion Zone": Opportunity or Sign of Caution?

Currently, Bitcoin is in what professional traders call an "expansion zone." Historically, these periods of strong growth are often followed by significant corrections, which experienced investors view as opportunities to "buy the dip" for new market entries, anticipating a continuation of the main trend.

Crucial Resistance and the Volume Alert

The cryptocurrency is testing and attempting to consolidate above the $105,000 resistance zone on the medium-term or weekly chart. However, the recent surge preceding this drop occurred with a notable decline in trading volume. While the price was climbing, the 25-week average of trading volume was retreating, generating a clear price-volume divergence. This divergence is a classic technical signal interpreted as underlying weakness in the uptrend or a lack of conviction on the part of buyers.

If BTC manages to hold and consolidate above $105,000, this level could act as crucial support. However, should a more significant pullback occur, the next major support lies at $84,200, where it meets the 50-period Exponential Moving Average (EMA50) on the weekly chart.

Medium-Term Bullish Sentiment, but Signs of Exhaustion

Despite the recent correction, Bitcoin is still in a medium-term bullish sentiment market. Its price continues to trade above the EMA50 and EMA200 on the daily chart, and both averages are well aligned to the upside, reinforcing the positive long-term outlook.

However, the inability to make a strong push above $105,000, combined with declining trading volume during the rally, shows clear signs of exhaustion in the current bullish momentum. This correction could be a necessary technical pullback before a potential continuation of the uptrend, especially considering that sellers do not show overwhelming conviction in this downside move.

To date, Bitcoin has posted cumulative gains of 55.75% over the past 12 months, underscoring its strong performance despite recent volatility.

A Defining Moment

Bitcoin's first weekly decline in nearly two months marks a pivotal moment for investors. Current price dynamics, characterized by a test of key resistance and volume divergence, suggest the market is at an inflection point. While medium-term sentiment remains bullish, caution is essential. The next few days will be crucial to see whether BTC manages to consolidate above $105,000 and resume its upward trajectory, or whether the correction deepens in search of lower support.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risks. Always conduct your own research and consult a qualified financial professional before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.