Bitcoin's Big Break: Are the Fed and the Dollar Fueling the Crypto King's Rise?

The crypto market is buzzing with talk of a potential rate cut, weakening the dollar and giving a major boost to BTC. Get your wallets ready!

Bitcoin (BTC) is back in the spotlight, riding a new wave of momentum. The rally is being driven by a softer dollar and growing chatter that the Federal Reserve (Fed) might be getting ready to cut interest rates at its next meeting. This is a classic domino effect in action: global economic shifts are having a big impact on the crypto world, once again showing a clear link between old-school finance and the digital future.

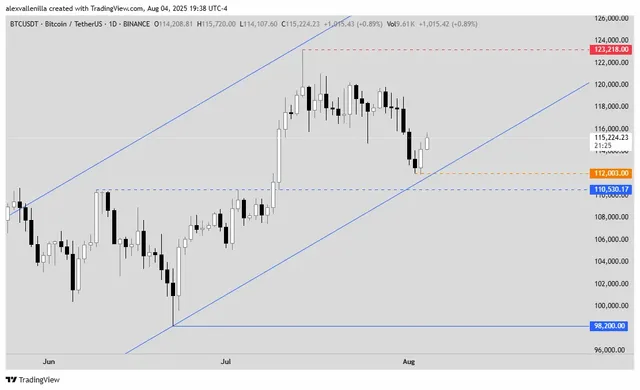

The digital asset has held above key support at 112.003 USDT, bouncing near the upward trend line that has been in place since last April. / TradingView

As of this report, BTC's price was up a solid 0.89%, trading on the Binance exchange at 115,224 USDT. This move happened as the dollar stumbled, with its index (DXY) dropping another 0.38% on Monday. That drop was a direct result of last week's weaker-than-expected US jobs and manufacturing reports. The news fueled speculation in the federal funds futures market, where the odds of a rate cut to 4.25% at the September 17 meeting have now shot up to 94.4%.

The Fed's Ripple Effect: From Washington to the Blockchain

The Fed's own credibility issues are also weighing on the dollar. The recent resignation of Governor Adriana Kugler has people wondering if the president will appoint someone with a more "dovish" (less aggressive) stance. If that happens, it could undercut Fed Chairman Jerome Powell's influence and put even more pressure on the dollar. Historically, a weak dollar is a great thing for cryptocurrencies, as investors look for alternative safe havens.

Technical Breakdown: BTC Takes Flight

From a technical standpoint, BTC is looking super strong. The digital asset has held firm above a key support level at 112,003 USDT, bouncing off an upward trend line that’s been in play since last April. This solid performance is boosting trader confidence and supporting the current growth narrative around Bitcoin. The mix of big-picture economic factors and market behavior suggests BTC's bullish run might be just getting started.

The Digital Future Syncs Up with Mainstream Finance

Bitcoin's latest surge is a big reminder that even with its decentralized nature, its value is closely tied to the ups and downs of the traditional economy. A weak dollar and speculation about the Fed's next move aren't just pushing up BTC's price—they're cementing its role as a major player in the global financial scene. The question isn't whether Bitcoin will keep growing, but how high it will ultimately go.

Disclaimer: This article is for informational purposes only and is not financial advice. Investing in cryptocurrencies comes with risks, and you should always do your own research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.