Lombard is Making Bitcoin DeFi the Next Big Yield

I've been stacking BTC since the last bull run, mostly just HODLing through the dips. But lately, I've been checking out ways to make it work harder without selling like Liquid staking concept for BTC, get a yield-bearing token in return that's still usable for lending or trading in DeFi.

One that's standing out has been Lombard Finance with LBTC. It recently hit $1 billion TVL in about three months, grabbing a huge chunk of the Bitcoin staking market.

They just expanded to Solana for better yields, and it's integrated with protocols like Aave for borrowing. Backed 1:1 by BTC, staked through Babylon, it turns your holdings dynamic instead of static.

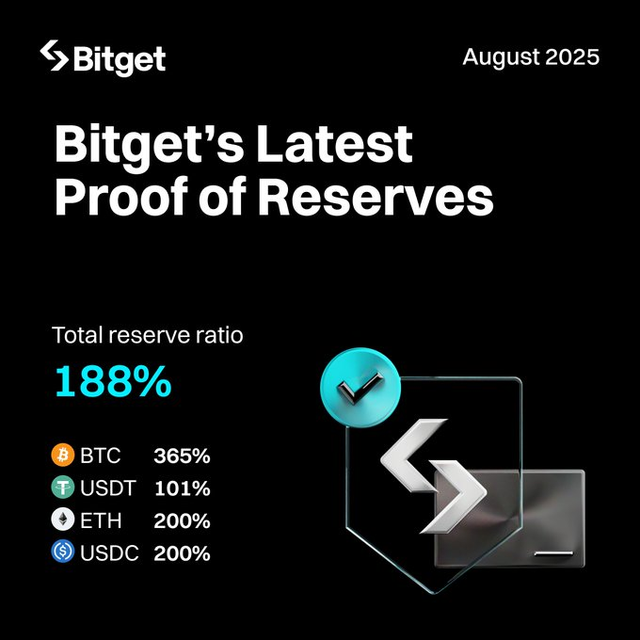

they also hit another milestone getting their native token listed on top CEXs like Bitget and others in the coming days... Their BARD token on ETH could be a governance play too.

Has anyone here dipped into LBTC? What's the real-world APY been like?

Curious if this shifts BTC from pure store-of-value to everyday finance tool. Thoughts?