Stablecoins_The_Money_Printing_Business_in_Crypto_and_Stocks

When newcomers encounter the term "stablecoin," it might seem complex.

In truth, it's simply a digital form of the dollar or RMB. Its value remains largely steady,

but the underlying industry is far more expansive than most realize.

1. Issuing a stablecoin is easy, getting people to use it is hard

The world's leading stablecoin, USDT, has weathered numerous waves of FUD

(Fear, Uncertainty, Doubt).

At one extreme, when the exchange rate hit 1 USD = 7 RMB,

USDT plunged to just over 5 RMB.

Despite this, USDT maintains its top position.

Ranked second is USDC, primarily used for earning yield on Coinbase.

The profit disparity is staggering:

- Tether (USDT issuer) generates $14 billion annually

- Circle (USDC issuer) earns $140 million annually

- Gap: 99%

Why such a vast difference?

USDT incurs no distribution costs—all treasury yields flow directly to Tether.

Circle, however, allocates 90% of its revenue to purchasing "listing slots" on

exchanges like Binance and Coinbase.

2. Public companies want to “print money” too

Many U.S.-listed firms aim to launch their own stablecoins—

and the motivation is clear.

For stock trading alone, licensing is inexpensive,

and share prices could surge 30% overnight.

3. Stablecoin + its own blockchain = double impact

Nearly every stablecoin project eventually develops its own chain.

Back in 2022, I proposed building a chain around USDT.

While praised as brilliant, it received no funding.

Now Tether and Circle are pursuing this path.

Why build a chain for a stablecoin?

My original blueprint outlined:

- Native DEX pairs use /USDT—enhancing price stability

- USDT holders can operate as nodes, earning gas fees

- USDT serves as the gas token, with approvals disabled—reducing theft risks (barring private key leaks)

4. The scary potential of big tech

Consider:

- Meituan Chain: Supports RMB stablecoins. Millions of delivery riders receive stablecoin payments, instantly granting Meituan a chain with tens of millions of active users.

- Apple Chain: Apple issues a USD stablecoin. Developers recharge via Apple Pay and spend it directly.

This isn't fantasy—it's plausible.

If realized, it could "rebuild" another Meituan or Apple from scratch.

5. Win them over before they wake up

For established players like Tether and Circle,

the smartest strategy is to partner with big tech before they grasp the opportunity.

Example:

If Apple entrusted Circle with its cash reserves to issue a stablecoin,

and Circle returned all U.S. treasury interest to Apple,

USDC's supply could eclipse USDT—sending Circle's stock soaring.

6. Opportunities for new players

New entrants must identify unique angles.

This could involve alliances with big tech, niche applications,

or even government collaborations.

7. The national-level play

If China issued a USD stablecoin

and controlled 90% of its supply,

it would effectively join America’s "money printing" business.

This might take time to consider—but it’s feasible.

8. The battle is only beginning

Stablecoins transcend commerce—they touch monetary sovereignty.

Once they surpass commercial boundaries,

they enter the arena of national power dynamics.

When an atomic bomb emerges in an era of swords and shields,

the game’s rules transform instantly.

9. If nothing “explosive” happens…

Under orderly development,

Tether could become the world’s top company.

Based on Circle’s peak P/E ratio,

Tether’s valuation might hit $6 trillion, exceeding Nvidia.

Growing from $150 billion to $1.5 trillion in USDT circulation is inevitable.

But can Apple realistically sell 10× more iPhones?

10. Failing to see it = losing the game

Major firms may one day find they did nothing wrong—

yet still lost dominance.

Because —

The ultimate business is printing money.

Better than printing money is digital issuance without paper.

Even better is using another’s credit to print your money—

where risk is theirs, and profit is yours.

Stablecoins represent one of crypto and stocks’ most lucrative future paths.

Recognizing this now means you’re still early.

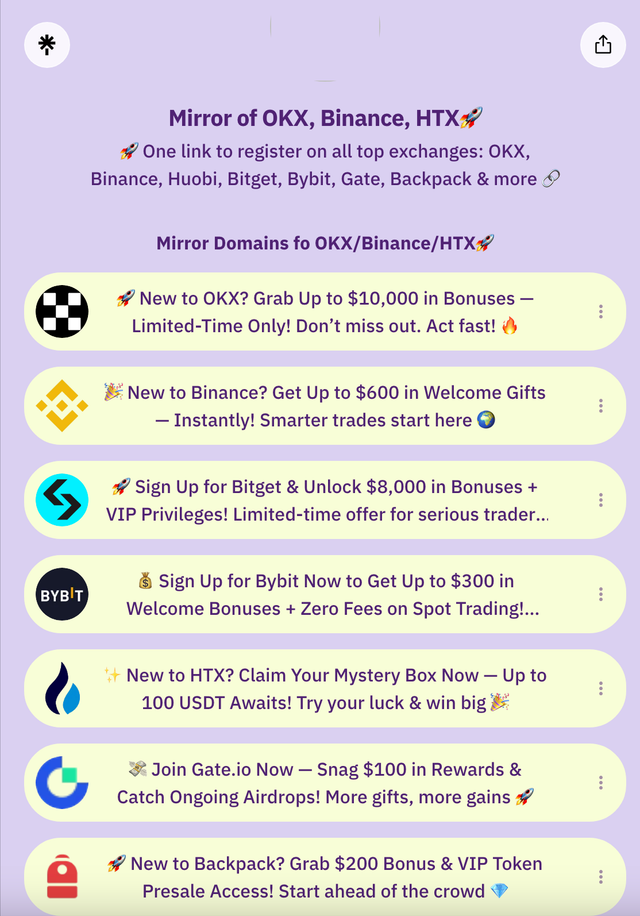

🎁 Limited-Time Bonus — New Users Get a Bitcoin Mystery Box Worth 20+ USDT, Guaranteed!

Sign up for premier crypto exchanges like OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack & more—all in one spot!

👉🏻 Bookmark the latest official backup domains to avoid missing out: https://linktr.ee

🔥 How to Access OKX Exchange from mirror domain

Exchange main domains often face blocks or slow loads due to network issues or overseas servers, misleading users into thinking platforms are faulty. Typically, it’s just connectivity problems—not the exchange’s error.

To counter this, exchanges like OKX and Binance frequently update backup domains for uninterrupted access.

- OKX Backup Domains: OKX Global or Alternative Link

- Binance Backup Domain: Binance

- Bitget Backup Domain: Bitget

- Bybit Backup Domain: Bybit/Bybitglobal

- Huobi HTX Backup Domain: Huobi (HTX)

- Gate.io Backup Domain: Gate.io

🔥 Related Reading

🔥 Alpha Dog Tools for Airdrop Hunting

1️⃣ Axiom Sniping Tool: https://axiom.trade

2️⃣ Gmgn Sniping Tool: https://gmgn.ai

3️⃣ Dbot Airdrop Tool: https://app.debot.ai

4️⃣ Morelogin Multi-Account Fingerprint Browser: www.morelogin.com

Trending Searches

best crypto exchange, okx best exchange, Buy Bitcoin, Web3 for Teens, High School Airdrops, CEX Rankings, OKX App Download, OKX RMB Deposit, Binance App Signup, Binance Buy Guide, Binance Airdrops, iPhone Binance Download, How to Buy President Token, How to Buy Dogecoin, Buy BTC with RMB, OKX Download, Web3 Airdrop, Zero-Cost Web3, Bitget China Access, OKX Passport Signup, Crypto Side Hustle, OKX Contracts, RMB Deposits OKX, NFT Wallet Guide, Huobi RMB Recharge, Crypto Beginner Guides, btc8848.com, Contract Trading Tips, Bitget Leverage, DeFi Mining, Crypto Airdrop Guide, Is Airdrop Still Worth It?, Contract Liquidation, Buying President Token ETH/BTC, DeFi Staking, NFT Trends, Zero-Cost Airdrop Web3, Inscriptions & Runes, Beginner Crypto Guide, How to Trade Crypto, Can You Make Money Trading?, Leverage Explained, DeFi Basics, OKX Airdrops, Node Staking, Liquidation, Financial Freedom, heiyetouzi.xyz, Overseas Apple IDs