Trading Memecoins Taught Me Discipline, Not Just Hype

Memecoins move fast, but for me, trading them has been less about chasing pumps and more about understanding how quickly narratives shift in the market.

When I first started looking at them, I thought it was all about timing the moonshot. The reality is, most of the time the big moves happen before you even hear about them. I learned that the hard way, jumping in late and watching positions reverse almost immediately. It was frustrating, but it also taught me a valuable lesson: don’t just follow hype, focus on risk management and execution.

Over time, I realized memecoins aren’t really about fundamentals but about sentiment, community energy, and speed. Once I accepted that, I stopped expecting them to behave like other assets and started treating them as high-volatility trades that require discipline.

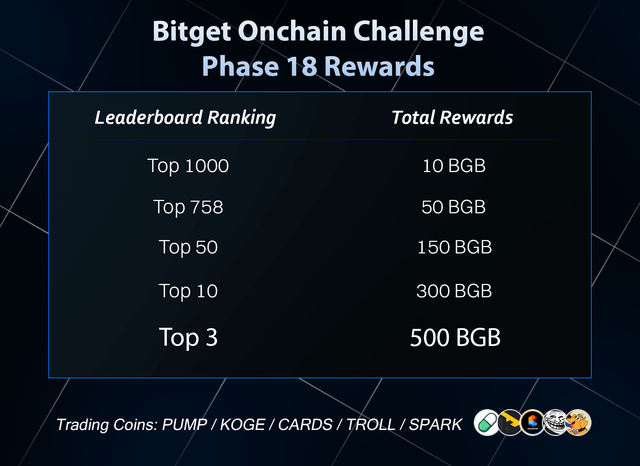

Recently, I have been trading some of the newer tokens like $KOGE, $CARDS, and $TROLL, and I have been keeping myself engaged through structured challenges. One example is the Bitget Onchain Challenge Phase 18, which has a 100,000 BGB reward pool tied to trading activity. For me, it’s less about the rewards and more about having a system that keeps me consistent, accountable, and focused on the process rather than the quick wins.

That shift in mindset has made all the difference. Instead of seeing memecoins as a lottery ticket, I now see them as a testing ground for discipline, strategy, and emotional control.