Will DEXs Finally Kill_CEXs? Why 2025 Is the Inflection - and Why Baumz.com Can Win the Next Cycle

Perps that only charge when you're up, on your net profits, not each trade.

TL;DR: DEXs are no longer "alternatives" - they're viable competitors closing the gap on speed, liquidity, UX, and safety. With the right architecture (CLOBs, omnichain routing, oracle integrity, and fair-fee economics), the next two years could tip majority share on-chain. Baumz is engineered for this moment with CEX-level performance, TPO (Tri-Proof Oracle) for price integrity, and Pop-Net+ Carry (fees only on 24-hour net profit).

- The Market Reality: DEXs Have Crossed the Line From Experimental to Competitive

The post-cycles story is clear:

2017–2018: Early DEXs proved decentralization but failed UX and speed (EtherDelta-era trade confirmations in minutes; thin liquidity).

2020–2021 (DeFi Summer): AMMs (Uniswap) unlocked permissionless trading and LP participation, then Uniswap v3 concentrated liquidity improved capital efficiency - but AMMs still struggled with majors, slippage, and IL.

2022 (Post-FTX): A trust shock pivoted attention to self-custody. DEX volumes spiked but UX and fiat rails still sent many users back to CEXs.

2025 (Turning Point): On-chain CLOBs, faster block times, better wallets/fiat rails, and liquidity aggregation push DEX UX near parity.

Spot market share: ~19% by Q3 2025 (up from 10.5% in Q4'24).

Perp market share: ~13% by Q3 2025 (up from 4.9% in Q4'24).

Volumes: DEX spot hit $1.43T in Q3 (+43.6% QoQ); Perp DEXs reached $2.1T cumulative by Q3 (+107% QoQ).

Trajectory: If current growth persists, the window for on-chain majority by 2027 is credible - especially for derivatives.

- Why Traders Are Migrating (For Real This Time)

Three structural shifts changed the calculus:

CEX-grade UX - without custody risk

On-chain CLOBs (e.g., Hyperliquid-class systems) deliver sub-second confirmations, deep books for majors, and precision for limits/derivatives that AMMs could not.

Fee Compression & New Economics

Zero/ultra-low visible fees and on-chain referral/reward schemes are disrupting the CEX rebate model. For active traders, tiny deltas in fees compound into real edge.

Fairness & Transparency

Open execution, visible liquidity, and auditable rules boost trust - especially in volatility. The October 2025 liquidation shock showed how transparent, resilient systems outlast opaque ones.

Bottom line: When DEXs match execution quality and make trading cheaper and fairer, the CEX advantage erodes fast.

- What's Still Missing - and How Baumz Fills the Gaps

Even in 2025, two gaps remain:

Oracle integrity under stress (false prints → unfair liquidations).

Aligned incentives (most venues still tax traders per trade, not per success).

Baumz addresses both with a technical + economic stack designed for this exact cycle.

(a) TPO (Tri-Proof Oracle): Integrity by Design

Freshness Proof: Sub-second data recency with time-commitment checks.

Deviation Proof: Rejects outliers using adaptive bands (|Pᵗ−μ| > k·σ).

Sanity Proof: Cross-oracle consensus (e.g., Chainlink + Pyth + Stork) with weighted median fallback.

Why it matters: The October 10–11, 2025 meltdown wasn't "market reality" - it was a data failure. TPO is built to prevent that class of error from triggering liquidations or funding distortions. In practical terms, TPO protects trader margin first, then updates positions - exactly how a professional venue should behave.

(b) Pop-Net+ Carry: Fees Only on Net Profit (24h)

You pay only when you win (and then just a small carry on your 24-hour average profit).

No per-trade tax; no "winning-trade tax" like some competitors.

Aligns venue revenue with trader success - a structural shift in DEX economics.

Why it matters: Fee compression is a trend; aligned monetization is the edge. Over time, this attracts serious order flow, because your costs scale with outcomes, not activity.

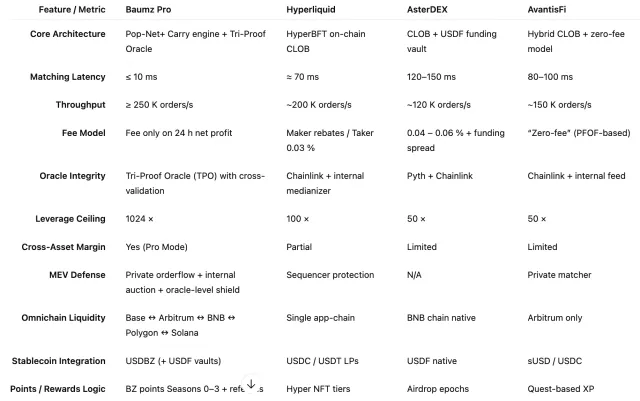

Benchmarking the Perpetual Landscape

- Architecture That Competes: CEX-Class Performance, On-Chain

Baumz is a dual-track exchange:

Baumz Basic: CLOB perps + spot + bridge on top EVMs and Solana connectivity.

Target: <200 ms match latency, ~65k TPS open-order throughput, up to 50× leverage.

Partner oracles: Stork + Chainlink.

Season 1 rewards integrated (trading points logic; referrals).

Baumz Pro: Intent-based matching with ≤10 ms targets, ≥250k TPS, 1024× leverage tiers, and synthetic perps (crypto, equities, RWAs, FX).

Pop-Net+ Carry (fees on 24h net profit).

TPO for price integrity.

MEV-neutralization: private orderflow layer, secure intent gateway, internal MEV auction, oracle-level defense.

Cross-asset margin: net PnL offsets, more efficient capital use.

Omnichain routing: Base ↔ Arbitrum ↔ BNB ↔ Polygon ↔ Solana bridge, with receipts and rewards sync.

Result: CEX-like trading with on-chain verifiability.

- The Business Flywheel: Rewards, Stable Vaults, and Liquidity

Seasoned Rewards: From Season 0 airdrops to Season 3 vault incentives, trading activity and referrals feed a predictable points system without encouraging wash behavior (metrics guardrails baked in).

USDBZ Stable & Vaults: Funding-aware vaults engineered for delta-neutral strategies; designed to share value back to users.

Partnership Mode: Proposals ready for L1/L2 ecosystems, oracles, lending, RWA, and analytics partners - because distribution wins.

This creates a compounding loop: better execution → more real volume → shared rewards → deeper liquidity → better execution.

- Why Baumz Stands Out vs. Emerging Perp DEXs

Many next-gen venues make one of these claims. Baumz commits to all:

CEX-class latency targets (≤10 ms Pro) and high throughput (≥250k orders/sec).

Pop-Net+ Carry (fair-fee model) instead of trade taxes or "win-only" trade fees.

TPO (multi-oracle, multi-proof integrity) to stop oracle-driven liquidations.

Omnichain liquidity routing so traders get best venue, not best island.

Cross-asset margin and 1024× tiers for professional strategy design.

MEV protections at the orderflow and oracle levels.

This is an integrated stack - performance, fairness, accuracy, and reach - not a single-feature pitch.

- What It Means for the "DEX vs CEX" Debate

CEXs still command brand trust for fiat ramps, regulated listings, and insurance. They'll remain part of the stack - especially as they quietly invest in on-chain rails.

DEXs now offer a compelling alternative for execution, product innovation, custody, and transparency. The data says adoption is accelerating - particularly in perps.

If DEXs win majority by 2027, the venues that win will:

Deliver CEX-class execution,

Protect users from data and MEV asymmetries, and

Align economics with trader outcomes - not extractive fees.

That is precisely the Baumz roadmap.

- What to Watch Next

Pop-Net+ Carry in the wild: As traders feel the difference (fees only on success), retention and word-of-mouth should compound.

TPO stress tests: In volatile windows, TPO's deviation/sanity guards should visibly reduce false liquidations.

Omnichain routing metrics: Cross-venue receipts, stable slippage on majors, and consistent fills even under load.

Why Baumz Leads

Economic Alignment: Only protocol charging after net profit.

Integrity by Design: TPO eliminates data lag liquidation risk.

Scale Readiness: 250 K TPS / 10 ms targets = CEX-level execution.

Omnichain Access: Trade across EVMs + Solana without bridging friction.

Community Flywheel: Seasonal rewards + referrals + vault yields keep liquidity sticky.

Conclusion: The Next Standard for On-Chain Trading

DEXs won mindshare after FTX. In 2025, they're winning market share on speed, cost, and fairness. The final mile is trust in data and alignment in fees.

Baumz brings both:

TPO to keep prices honest,

Pop-Net+ Carry to keep fees fair,

CEX-class performance to keep traders competitive.

If you believe the next era of markets will be transparent, omnichain, and user-aligned, Baumz is built for that world.

About Baumz

Baumz is a next-generation decentralized trading protocol that merges CEX-level performance with on-chain transparency.

Engineered for professional and retail traders alike, Baumz delivers ultra-fast execution, fair fee structures, and cross-asset flexibility through its dual architecture — Baumz Basic and Baumz Pro.

CEX-Class Speed: Executes up to 250,000 orders per second with ≤10 ms match latency, achieving true high-frequency trading on-chain.

Leverage Freedom: Supports up to 1024× leverage for advanced users under a robust risk engine and real-time margin monitoring.

Smart Fee Model: With Pop-Net+ Carry, traders pay fees only on 24-hour average net profit — no per-trade or losing-trade costs.

Price Integrity: Powered by Tri-Proof Oracle (TPO) — combining freshness, deviation, and sanity proofs across multiple oracle sources (Chainlink, Pyth, Stork) for ultra-accurate and tamper-resistant price data.

Omnichain Liquidity: Seamless routing across Base, Arbitrum, BNB, Polygon, and Solana — ensuring the best execution without manual bridging.

Baumz is redefining decentralized trading by delivering CEX-grade performance, zero-trust transparency, and trader-aligned incentives — all on-chain.

X/Twitter | Telegram | Perpetual Trading | Whitepaper

.png)