Below the haircut threshold - SBD Supply does not affect inflation

Bottom line up front: When STEEM's price is below the haircut threshold, printing or burning SBDs doesn't affect the blockchain's overall inflation rate - at all.

Inflation is controlled by the virtual supply. For a fixed STEEM supply, haircut pricing holds the virtual supply constant, regardless of how many SBDs are created or destroyed.

Overview

We already knew this from @moecki's post, here, and even just from the definition of the haircut pricing, which was implemented to cap the debt at 10% of the STEEM + SBD market caps. In a sense, it's obvious, but it's also counterintuitive - and discussions of the topic tend to get wordy and confusing.

So, I wanted to introduce a practical demonstration. Here's a table that shows the virtual supply size if we hold the STEEM supply constant and adjust the SBD supply up or down in increments of 10% (Centered at 100%: multiply 1.1 going up or 0.9 going down). Please draw your attention to the right-hand column: "Virtual Supply".

| SBD Adjustment | Steem Supply | SBD Supply | Haircut Price | SBD Conv. Value (STEEM) | Virtual Supply |

|---|---|---|---|---|---|

| 34.87% | 515,243,318 | 3,288,875 | 0.057 | 17.407 | 572,492,576 |

| 38.74% | 515,243,318 | 3,654,306 | 0.064 | 15.666 | 572,492,576 |

| 43.05% | 515,243,318 | 4,060,340 | 0.071 | 14.100 | 572,492,576 |

| 47.83% | 515,243,318 | 4,511,489 | 0.079 | 12.690 | 572,492,576 |

| 53.14% | 515,243,318 | 5,012,766 | 0.088 | 11.421 | 572,492,576 |

| 59.05% | 515,243,318 | 5,569,740 | 0.097 | 10.279 | 572,492,576 |

| 65.61% | 515,243,318 | 6,188,600 | 0.108 | 9.251 | 572,492,576 |

| 72.90% | 515,243,318 | 6,876,222 | 0.120 | 8.326 | 572,492,576 |

| 81.00% | 515,243,318 | 7,640,247 | 0.133 | 7.493 | 572,492,576 |

| 90.00% | 515,243,318 | 8,489,163 | 0.148 | 6.744 | 572,492,576 |

| 100.00% | 515,243,318 | 9,432,404 | 0.165 | 6.069 | 572,492,576 |

| 110.00% | 515,243,318 | 10,375,644 | 0.181 | 5.518 | 572,492,576 |

| 121.00% | 515,243,318 | 11,413,208 | 0.199 | 5.016 | 572,492,576 |

| 133.10% | 515,243,318 | 12,554,529 | 0.219 | 4.560 | 572,492,576 |

| 146.41% | 515,243,318 | 13,809,982 | 0.241 | 4.145 | 572,492,576 |

| 161.05% | 515,243,318 | 15,190,980 | 0.265 | 3.769 | 572,492,576 |

| 177.16% | 515,243,318 | 16,710,078 | 0.292 | 3.426 | 572,492,576 |

| 194.87% | 515,243,318 | 18,381,086 | 0.321 | 3.115 | 572,492,576 |

| 214.36% | 515,243,318 | 20,219,195 | 0.353 | 2.831 | 572,492,576 |

| 235.79% | 515,243,318 | 22,241,115 | 0.388 | 2.574 | 572,492,576 |

| 259.37% | 515,243,318 | 24,465,227 | 0.427 | 2.340 | 572,492,576 |

(The table was converted from spreadsheet to Markdown by Claude. Hopefully the conversion didn't introduce any errors.)

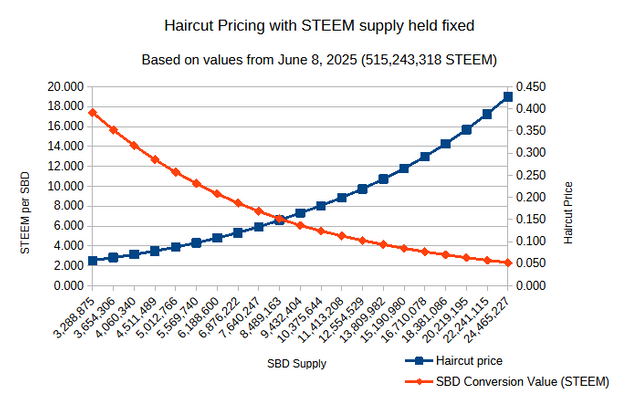

And here's a chart of how the SBD supply drives the haircut price and the number of STEEM per SBD. Changes to these values cancel each other out in the virtual supply calculation:

20 or 30 years ago, I probably could've summarized all this in a pretty-looking formula, but these days I think more in terms of spreadsheets and tables. 😉

Anyway, I hope this table and graph make it much easier to conceptualize haircut pricing. And the numbers should be simple enough for anyone with a spreadsheet to reproduce and verify.

Here's an explanation of the columns:

- SBD Adjustment: The percentage of today's actual SBD value.

- STEEM Supply: Today's STEEM supply (the same in all rows)

- SBD Supply: Today's SBD supply multiplied by the percentage in column 1.

- Haircut Price: 9 *

SBD Supply/STEEM Supply- this is what caps the value of all SBDs at 10% of STEEM's virtual value (wherevirtual value==virtual supply*haircut price). - SBD Conversion Value: 1 /

Haircut Price- How many STEEM will the blockchain pay for SBD conversions? - Virtual Supply:

STEEM Supply+ (SBD Supply*SBD Conversion Value)

Observation

- In the last 3 months, somewhere around 4.6 million SBDs were eliminated by SBD conversions. Ironically, in terms of value, those conversions didn't eliminate any debt at all. All they did was to create new STEEM and lower the haircut price.

Consequences

- When STEEM's price is below the haircut threshold

- Witnesses can do whatever they want with the SBD interest parameter without effecting the blockchain inflation rate.

- Creating SBDs raises the haircut price and destroying them lowers it.

- Creating SBDs by paying interest does tend to devalue the existing SBDs, so it still needs to be done with care.

- Witnesses can increase the haircut price, but they can't decrease it.

- As we've seen, SBD conversions do increase the virtual supply (and therefore blockchain inflation), because they increase the STEEM supply.

- The fewer SBDs there are in existence, the more each SBD conversion impacts the overall inflation rate (because each SBD gets more STEEM).

- This reinforces last week's post, suggesting that Steem's witnesses should experiment with SBD interest payments in order to minimize SBD conversions that happen below the haircut threshold and as a SPAM control mechanism. Inflation-risk from such an experiment appears to be little or none.

Final notes

- Remember that the points in this post only apply when the STEEM price is below the haircut threshold. Above that threshold, things are more in line with our intuitions.

- The math breaks down if the number of SBDs is 0, but that's not likely to be encountered in the real world.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

I'm not following this. Eliminating SBDs should count as eliminating long-term debt. Also, I have no intuition for what "raising" or "lowering" the "price" of a trade between SBDs and Steem tokens means, since either one could plausibly be the baseline, so that may be contributing to me having a hard time following the argument. Explicitly tacking Steem-per-SBD or SBDs-per-Steem donominations onto "prices" might be helpful (or maybe "the price" is a USD-equivalent?).

Brief reply 'cause I'm using a phone.

Example:

Because the value of SBD loses the peg, conversions can only reduce the debt when the STEEM price is above the haircut price. Otherwise, it's more like a debt transfer to the SBDs that remain. It's just the way it's designed.

¡Qué interesante es entender cómo funciona realmente la inflación en la blockchain de Steem cuando el precio cae bajo el umbral del recorte!

Muchos podrían pensar, de hecho, yo lo pensaba, que imprimir o destruir SBDs siempre afecta la economía del sistema, pero no es así en este caso. Lo que manda es el suministro virtual, y mientras este no cambie, la inflación permanece controlada.

Este tipo de mecanismos muestran lo sofisticado del diseño de Steem, pero también lo importante que es que los testigos tomen decisiones informadas, especialmente cuando se trata de los intereses de SBD. Si entendemos que ajustar intereses puede frenar conversiones innecesarias y evitar inflación, entonces hay margen para usar esta herramienta de forma estratégica y no reactiva.

Educar sobre estos temas es clave para evitar malas interpretaciones y reacciones emocionales ante decisiones técnicas.

La sostenibilidad de Steem depende, en parte, de cuánto comprendemos estos valiosos detalles.