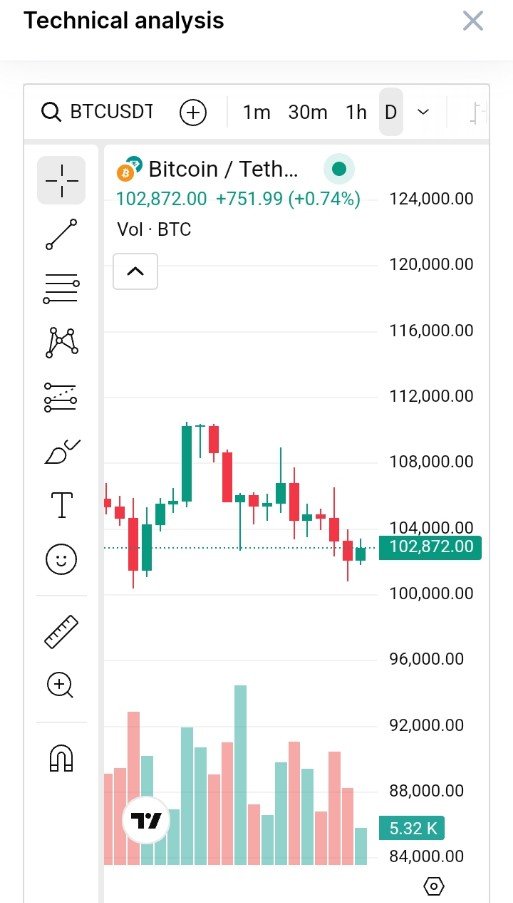

Latest snapshot of Bitcoin (BTC) price and key technical levels

Here’s the latest snapshot of Bitcoin (BTC) price and key technical levels:

📊 Bitcoin Price Summary

Current price: ≈ $102,860 USD

Day’s range: $101,183 – $103,983

Year-to-date: Up ~13.5% for 2025

🔑 Support & Resistance Levels

- Immediate Support

$100,000 — A critical psychological floor: multiple analysts (e.g., Mihir/RhythmicAnalyst) see this as key support—breaking below could lead to $95K

$101,957 — Barchart’s 1st support level

$100,170 — Barchart’s 2nd support level

$97,912 — Barchart’s 3rd support level

- Immediate Resistance

$106,000 – $106,002 — Barchart’s 1st resistance

$108,260 — Barchart’s 2nd resistance

$110,046 — Barchart’s 3rd resistance

$110,400 – $112,000 — Noted as a supply zone and psychological ceiling by multiple sources

$112,000 — Historical all-time high from May 22, 2025

📈 Technical Context & Implications

Consolidation phase around $100K–$105K:

BTC has been range-bound between $100K (support) and $105K (resistance), with tight Bollinger Bands and neutral RSI (~48), indicating a buildup before a big move .

Macro and geopolitical dynamics:

Support holds as long as Middle Eastern tensions don’t escalate—a deterioration could push BTC below $100K .

On-chain supply zone:

A high-volume supply cluster lies in the $95.5K–$97K range, a strong support zone, as short-term holders break even around $98K .

Potential downside trigger:

A break below $100K could lead to a test of next support around $95K .

Upside scenarios:

A break above $106K unlocks the path to $108K–$110K, with $112K serving as the critical ceiling—surpassing it could open a rally toward $120K+ .

Moving average signals:

Some fear of a "death cross" (50‑DMA crossing below 200‑DMA) looms, which could drag BTC back to $73.8K—but this is still being watched closely .

🧭 Levels at a Glance

Level Price ($) Role

Resistance 106,000 Short-term ceiling

108,260 Mid-range resistance

110,400–112,000 High supply zone, ATH level

Support 101,957 Short-term support

100,000 Key psychological & technical floor

100,170 Secondary support

~97,900 Strong bottom support

🎯 Strategy Implications

Bullish scenario:

Break above $106K → $110K → $112K could open momentum toward $120K+ .

Bearish scenario:

Drop below $100K → $95K → potential revisit of supply cluster at $95K–$97K .

Monitoring tools:

Pay attention to volume breakouts, RSI momentum, MACD crossovers, and on‑chain holder activity for confirmation of moves.

✅ Summary

Bitcoin remains range-bound in a tight zone between $100K and $106K. A breakout above could unlock a rally to $110K–$112K and beyond, while a breakdown risks revisiting $95K–$97K. Traders and holders should watch volume, macro events, and technical indicators for next triggers.

Let me know if you'd like intraday pivot point levels or deeper breakdowns on any timeframe!