When Bitcoin Surges to $95k Against the Trend: Unmasking the Institutional Harvesting Logic Behind the 'Safe-Haven Asset' Narrative

I. Bitcoin's "Safe-Haven" Attribute: The Digital Gold Narrative vs. Market Reality

In April 2025, Bitcoin surged to $95k against the trend. But it diverged more from traditional "safe-haven" gold

- Contradictory Correlations: Bitcoin's correlation with the Nasdaq rose to 0.5, while it dropped to -0.3 with gold.

- Intensified Institutional Control: Bitcoin ETFs like BlackRock IBIT held over 1.1 million BTC (5.2% of circulating supply). MicroStrategy's holdings accounted for 21.8% of Bitcoin's market cap, creating an "oligopoly pricing" landscape.

- Instrumentalized Safe-Haven Label: BlackRock CEO Larry Fink labeled Bitcoin a "safe-haven asset" for global pessimism. In reality, this aimed to attract sovereign funds (at 2%-5% allocations) to boost ETF capital inflows.

- Liquidity Siphoning Effect: A weekly net inflow of $1 billion into Bitcoin ETFs could lift prices by 7%-12%. Meanwhile, gold ETFs saw $2.3 billion outflows, showing capital shifting.

II. Institutional Harvesting

- Policy Rumors Driving Price Up: In March, Bitcoin rose 9% due to the "Trump Crypto Reserve Plan," then fell 9% on tariff panic. Whales used the volatility for high selling and low buying.

- Media Complicity in Dumping: After reports hyping Bitcoin as a "safe-haven" from institutions like JPMorgan, BlackRock IBIT holdings rose, forming a "research-report - capital - price" loop.

- Spoof Orders Manipulation: Whale "Spoofy" placed and canceled fake orders at $83k to create a false technical breakout, triggering retail leveraged followers.

- Volatility Harvesting: Institutions exploited peaks in options market implied volatility (IV), selling straddle combinations to arbitrage. Retail investors became the "fuel" for volatility premiums.

III. Market Structure Divergence: Institutions "Buying" vs. Retail "Liquidity Trap"

Institutional Stockpiling Strategy

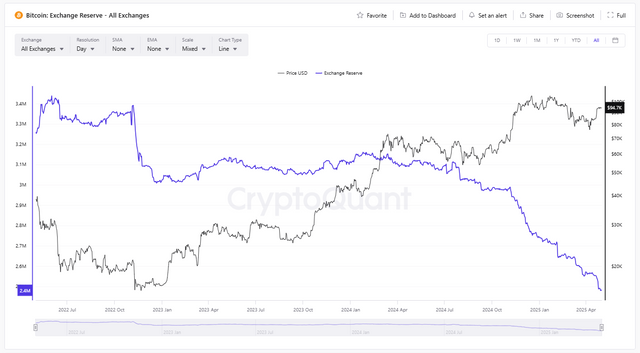

- ETF Siphoning Effect: Institutions bought 520k BTC via ETFs in 2025. Fidelity bought $253 million in one go. Exchange BTC reserves dropped by 500k year-on-year.

- Inflation Hedge Narrative Strengthened: Bitcoin's annual deflation rate of 2.5% vs. the US dollar M2 growth of 4.8% drew sovereign funds to hedge against currency devaluation.

Retail Dilemma: Altcoin Collapse and Leverage Dependency

- Altcoin Liquidity Drought: Total market cap shrank by 78% from the 2021 peak.

- High Leverage Suicide Rate: Retail leverage usage exceeded 80%, yet only 3% could profit consistently. Most became "nutrients" for exchange fees and liquidation.

IV. Retail Survival Guide: From FOMO to Rational Defense

- Reserve Risk Index: A reading below 0.012 (currently 0.008) suggests strong confidence among long-term holders.

- Coinbase Premium: When institutional buying exceeds retail selling, a positive premium signals a bounce. It's wise to use derivatives tools.

- Panic Bottom-Fishing Signal: When Bitcoin drops over 8% in a day and the Fear & Greed Index is below 30, consider building positions in batches.

- Narrative Counteraction: Beware of institutional interests behind labels like "safe-haven" and "digital gold." Verify on-chain data independently.

Bitcoin's breakthrough to $95k is both a victory for institutional narratives and a starting point for retail's cognitive revolution. As "safe-haven" becomes a tool of capital manipulation, only by seeing through the label fog, mastering on-chain language, and building a hedging system can retail investors capture excess returns amid institutional harvesting.