Tether's competitors are growing larger, and it's not just Circle.

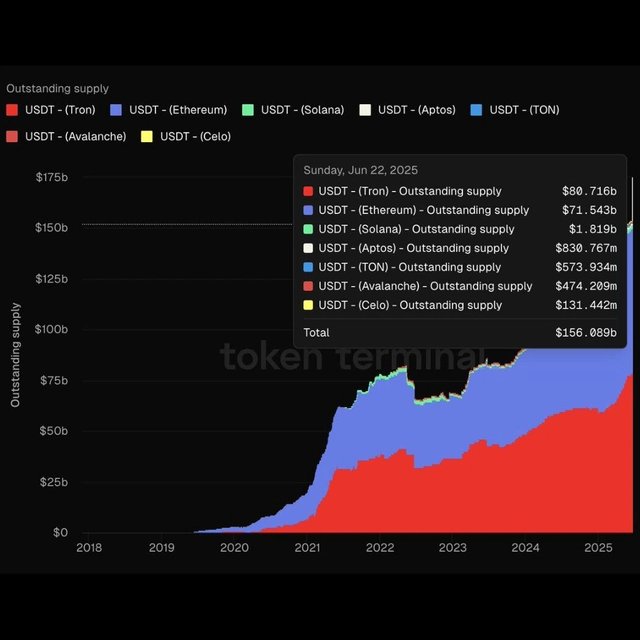

As reported by Token Terminal on X, Tether's USDT stablecoin has re-established its dominance in the crypto ecosystem, with its circulating supply surging to over $156 billion, hitting a new all-time high.

While USDT's supply is increasingly distributed across multiple blockchain networks, EVM (Ethereum Virtual Machine) powerhouses still command the largest share. Tron leads the pack with over $80 billion in USDT circulation, with funds on the Sun Yuchen-associated network growing by approximately $20 billion year to date.

Ethereum ranks second, holding over $71.54 billion in USDT circulation. Tron and Ethereum collectively account for more than 90% of USDT's total issuance.

Tether's USDT Network Supply Distribution (Source: Token Terminal)

Other fast-growing networks include Solana, Aptos, and TON, which leverage USDT liquidity outside EVM chains.

The Battle for Stablecoin Hegemony

USDT's extensive reach reflects its long-standing appeal as a reliable on-ramp for traders and institutions. Behind the scenes, however, a fierce competition is unfolding between USDT and Circle's USDC, the second-largest stablecoin by market share.

As USDT solidifies its lead, Circle's USDC supply recently exceeded $61 billion, capturing about 24% of the stablecoin market.

Circle's rise extends beyond blockchain data—it has also made waves on Wall Street. Since its IPO on June 5, Circle stock (CRCL) has surged over 700%, with a market capitalization of approximately $68 billion, demonstrating strong investor confidence. However, one of its major investors, Cathie Wood's ARK Investment, has started reducing its position, becoming among the first large investors to take profits from the valuation frenzy.

Circle Fills the Void Left by Tether's EU Exit

Due to the EU's strict Markets in Crypto-Assets (MiCA) regulations, Tether ceased issuing its euro-backed stablecoin EURT in November 2024, halting new minting and revoking EU user support. Tether publicly criticized MiCA's rigorous compliance and reserve requirements as overly "stringent."

Several exchanges in the European Economic Area have delisted USDT spot pairs to comply with MiCA, though custody and futures supplies remain available in many cases. To maintain a foothold in the European market, Tether is investing in MiCA-compliant alternatives—EURQ and USDQ—built in partnership with Quantoz through its Hadron platform.

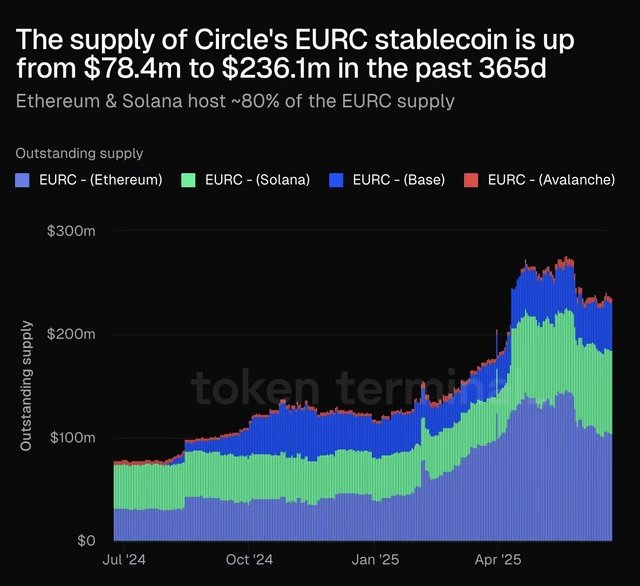

Circle's EURC Steps In as Tether's EURT Withdraws (Source: Token Terminal)

Meanwhile, Circle is expanding its euro stablecoin, EURC. Its supply has surged over the past year from $78.4 million to $236.1 million, with approximately 80% of circulation on Ethereum and Solana.

The showdown between USDT and USDC highlights the maturity of stablecoins in the global financial system. As of May 2025, Tether holds over $120 billion in US Treasury bonds, enough to moderately suppress short-term yields.

On the other hand, Circle is actively preparing for mainstream adoption through compliance, substantial capital, and high yields supported by reserve earnings.

However, this seemingly lopsided duopoly may soon face new contenders. Clarity on regulatory milestones like the Genius and Stability Act and other 立法 (legislation) at different stages in the House and Senate have piqued the interest of large enterprises. US banks and corporations are exploring issuing their own stablecoins to potentially challenge Tether-Circle hegemony.