How_Beginners_Can_Start_with_Bitcoin_Options

How Beginners Can Get Started with Bitcoin (BTC) Options

For many newcomers, the initial encounter with the term options often triggers thoughts like:

“Seems complex,” or “Is this just for expert traders?”

However, grasping the fundamental principles reveals it to be a surprisingly straightforward instrument.

Options function as derivative products.

Their uniqueness lies in enabling you to predefine your profit and loss profile.

Allow me to outline the primary benefits of options using concise key terms.

Flexibility

The first term is flexibility.

Spot and futures are both linear instruments: you either take a long or short position.

But options are non-linear. They serve not only for directional bets but also for risk mitigation.

At their core, options involve trading rights and obligations, while incorporating time as a factor.

For instance, desiring the right to purchase BTC at $115,000 in one month can be priced—this constitutes a call option.

Conversely, the right to sell BTC at a specific price is a put option.

This creates four participant roles (buyers and sellers for both calls and puts), facilitating highly adaptable strategies.

As an example: owning 1 BTC while acquiring a put effectively secures insurance for your holdings.

Asymmetry

The second trait is asymmetry.

Spot and 1x futures are linear: a 10% price rise yields a 10% return.

But options provide floating leverage.

During one Ethereum surge, I observed clients achieving 30x gains (equivalent to 3000%).

Purchasing an out-of-the-money option resembles buying a lottery ticket: the expense is minimal,

yet if the market shifts significantly to hit your strike price,

the reward might be 10x, 20x, or higher.

Controlled Risk

The third benefit is risk control.

High-leverage futures can disrupt sleep—waking to a fully liquidated position is possible.

However, as an option buyer, your maximum loss is confined to the premium paid.

It’s akin to a deposit: losses are capped.

As a seller, avoiding excessive naked sales and hedging with spot holdings,

options can act as a hedging mechanism, generating consistent income.

P&L Plasticity

The fourth, and perhaps most appealing feature, is profit-and-loss plasticity.

Linear products demand precise market direction forecasts.

But markets fluctuate in waves amid uncertainty—so how to profit from this?

Option traders operate as the market’s “slick operators.”

In options trading, “roughly accurate” can yield profits.

Exact price levels aren’t necessary.

Predicting a broad range or trend—

such as “the price will remain within these bounds” or “it won’t exceed that peak”—

allows for constructing profitable option strategies.

Summary of Key Traits

To recap, I consider the four essential attributes of options to be:

- Flexibility

- Asymmetry

- Controlled Risk

- P&L Plasticity

My Experience in 2024

In 2024, my primary focus was Bitcoin (BTC).

With altcoins, consistently outperforming BTC proves challenging.

But by concentrating on BTC and employing diverse techniques,

I attained 4x returns denominated in BTC.

Here are the three core strategies I utilized:

- Large-scale spot swing trades, yielding roughly 60% annualized returns.

- Futures grid trading in sideways markets, achieving about 15% monthly returns.

- Options strategies across market phases:

- Selling options to collect premiums during ranging periods

- Using combinations to hedge against unpredictability

- Generating returns in both bullish and bearish conditions

Integrating these three methods substantially enhanced my BTC-based profits.

🎁 Limited-Time Bonus — New Users Get a Bitcoin Mystery Box Worth 20+ USDT, Guaranteed!

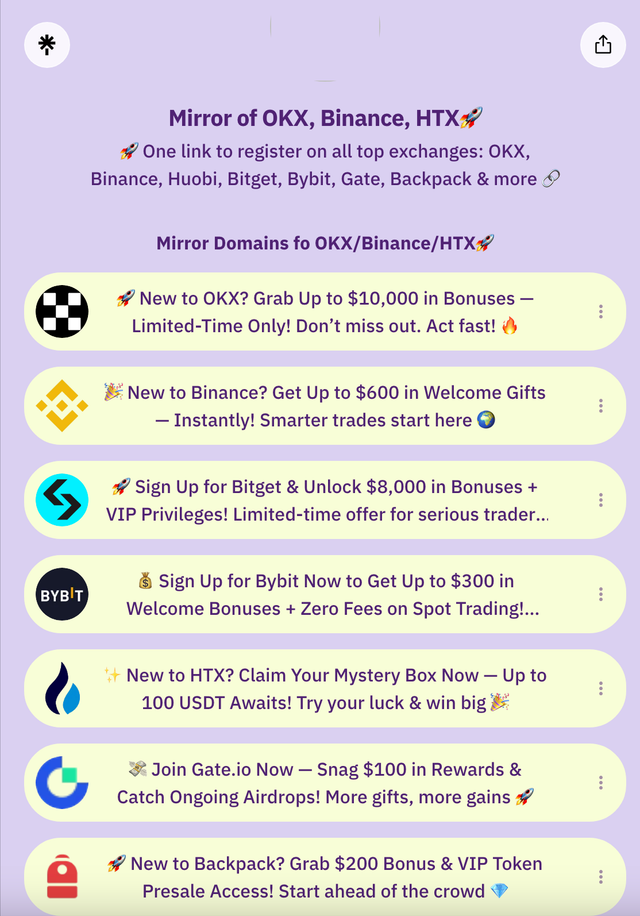

Sign up for leading crypto exchanges such as OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack & more—all accessible in one spot!

👉🏻 Bookmark the latest official backup domains to avoid missing out: https://linktr.ee

🔥 How to Access OKX Exchange from mirror domain

Many exchanges’ primary domains might face blocks or slow loading due to network restrictions or overseas servers. This frequently confuses users, leading them to suspect platform issues. Typically, it’s a network glitch—not the platform’s fault.

To address this, exchanges like OKX and Binance routinely update backup domains for smooth official site access.

- OKX Backup Domains: OKX Global or Alternative Link

- Binance Backup Domain: Binance

- Bitget Backup Domain: Bitget

- Bybit Backup Domain: Bybit/Bybitglobal

- Huobi HTX Backup Domain: Huobi (HTX)

- Gate.io Backup Domain: Gate.io

🔥 Related Reading

🔥 Alpha Dog Tools for Airdrop Hunting

1️⃣ Axiom Sniping Tool: https://axiom.trade

2️⃣ Gmgn Sniping Tool: https://gmgn.ai

3️⃣ Dbot Airdrop Tool: https://app.debot.ai

4️⃣ Morelogin Multi-Account Fingerprint Browser: www.morelogin.com

Trending Searches

btc options guide, best crypto exchange, okx best exchange, Buy Bitcoin, Web3 for Teens, High School Airdrops, CEX Rankings, OKX App Download, OKX RMB Deposit, Binance App Signup, Binance Buy Guide, Binance Airdrops, iPhone Binance Download, How to Buy President Token, How to Buy Dogecoin, Buy BTC with RMB, OKX Download, Web3 Airdrop, Zero-Cost Web3, Bitget China Access, OKX Passport Signup, Crypto Side Hustle, OKX Contracts, RMB Deposits OKX, NFT Wallet Guide, Huobi RMB Recharge, Crypto Beginner Guides, btc8848.com, Contract Trading Tips, Bitget Leverage, DeFi Mining, Crypto Airdrop Guide, Is Airdrop Still Worth It?, Contract Liquidation, Buying President Token ETH/BTC, DeFi Staking, NFT Trends, Zero-Cost Airdrop Web3, Inscriptions & Runes, Beginner Crypto Guide, How to Trade Crypto, Can You Make Money Trading?, Leverage Explained, DeFi Basics, OKX Airdrops, Node Staking, Liquidation, Financial Freedom, heiyetouzi.xyz, Overseas Apple IDs