Regulations Push Chinese Bitcoin Volumes to OTC and Neighboring Countries

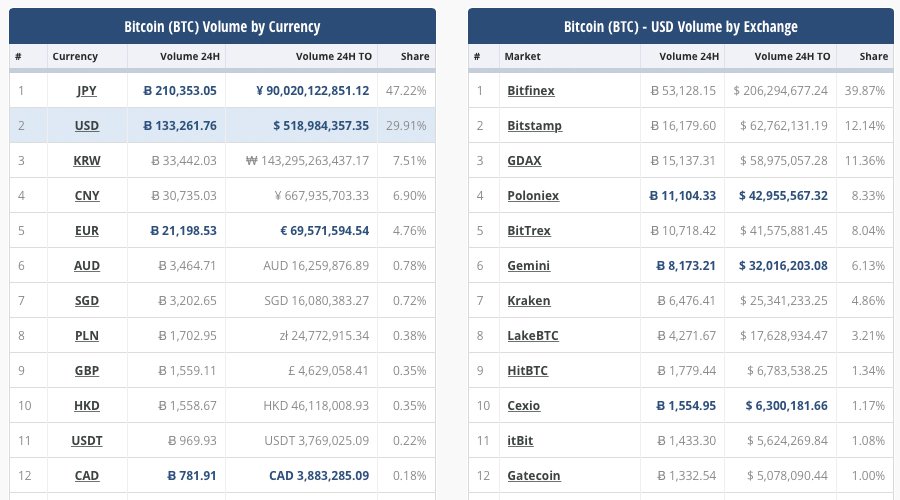

Following the regulatory crackdown in China, bitcoin’s price has climbed back up 30 percent over the $4K zone since the market’s nosedive last Friday. Now China’s bitcoin trade volume has dropped to the fourth position globally as Japan has taken the reigns over the past two days. Chinese traders have once again taken trading to the ‘streets’ and have also migrated business to Hong Kong and Korean exchanges.

Japan Captures the Lead in Global Bitcoin Trade Volume

Japan captures 47 percent of the global bitcoin trade volume at press time.

China’s Traders Move to OTC Markets and Local bitcoins

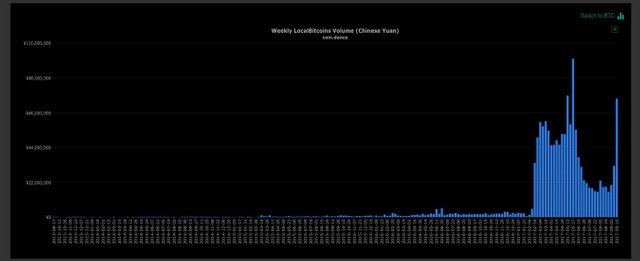

After BTCC, Huobi, Yobit, Yunbi, Okcoin, and others announced they were closing shortly, Chinese domestic exchange volumes dropped significantly. However, Over the Counter (OTC) trading has once again taken over in the region as traders are now swapping bitcoins over Telegram and other avenues. Further, Localbitcoins volumes in China has spiked exponentially, just as it did when Chinese exchanges paused deposits and withdrawals this past January. In fact, since governments all around the world have been making things a bit more difficult lately, Localbitcoins volumes have skyrocketed worldwide to the highest point ever with over $71M traded in the first week of September.

China’s weekly Localbitcoins volumes spike after domestic exchanges announced closing trading operations.

There’s also a relatively unknown OTC player in the Asian region who handles quite a bit of trading called Richfund.pe. Many insiders believe liquidity providers like Richfund are doing far more business since the Chinese exchange closure announcements. The business claims to command a significant portion of China’s large-scale OTC bitcoin trading, alongside other countries in the area.

“We provide 1000-5000 BTC large OTC services in China, Korea, Cambodia, Hong Kong and Taiwan,” explains the bitcoin liquidity provider and hedge fund management company Richfund.

Hong Kong and South Korean Exchanges Reap the Benefits from China’s Regulatory Crackdown

Not only did Chinese traders move to alternative solutions like OTC trading and Localbitcoins, many of them seemingly migrated to the Hong Kong-based exchange Gatecoin. Since the first wave of announcements, Gatecoin’s volumes have coincidently spiked over 24 percent. Other exchanges like BTCex, and ANX have also seen similar volume lifts since the September 15th exchange announcements. Speculators believe that not only has Chinese trading platforms pushed customers to Japan but traders are migrating to Hong Kong and South Korean exchanges as well. All three countries have seen bitcoin trade volumes increase over the past three days.

It’s safe to say Chinese traders have found other avenues to trade bitcoin and alongside OTC alternatives; many neighboring countries are reaping the benefits.

What do you think about other countries reaping the benefits from China’s recent bitcoin exchange shutdowns? Let us know what you think in the comments below.

Source : https://news.bitcoin.com

Congratulations @pineungmabok! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPthank you

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/regulations-push-chinese-bitcoin-volumes-to-otc-and-neighboring-countries/

Congratulations @pineungmabok! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!