TTS Development Spotlight: The Metrics and Analytics Behind the EAG

It is hard to believe that climate change is still a topic under debate as one industry, the insurance industry, is facing seismic shifts as increasing severe weather events create more losses in the residential and commercial property spheres. As the season’s first hurricane, Erin, spins up to a Category 5 in a matter of days, insurance businesses are not arguing whether or not climate change exists but are focusing resources on managing the current environmental landscape. Mitigating actual losses is a challenge but technology can help insurance carriers in 2 distinct areas of the operation:

Premium revenue management

Client transparency, confidence and loyalty

A new tool from TTS aims to offer relevant strategy and data based environmental assessments that can help carriers with those distinct and valuable operational facets.

Data Driven Climate Assessments

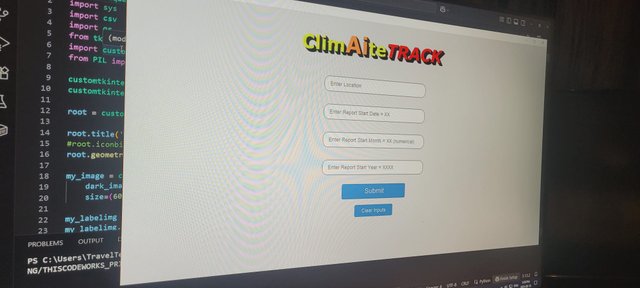

Insurance companies are turning to technology to help mitigate and manage the impacts of increasingly severe weather events. Predicting future weather events and their severity is not an exact science but past and present weather data metrics applied within a relevant algorithm can yield a definitive ‘environmental picture’ of a specific region. ClimAIteTRACK is a new insurance management tool from TTS that delivers climate assessments for a specific region. With advanced data capturing functionality and proprietary algorithms, ClimAIteTRACK can create relevant and easy to understand environmental assessments for any city, country, region, state or province around the globe. ClimAIteTRACK is designed and purpose-built for the insurance industry, delivering 2 key benefits to businesses.

Consistent positive yield adjustment on premium revenue

Increase in client brand confidence and loyalty

ClimAIteTRACK is preset with a series of weather metrics but the modular nature of the technology enables expansion of metrics and optimization of the algorithms and analytical processes.

The Environmental Assessment Grade

The Environmental Assessment Grade (EAG) is the end result of ClimAIteTRACK’s data analytics functionality. The EAG is an easy to understand ‘report card’ of a specific area’s past and present environmental scenario. Using historical and recent data across 7 key weather metrics, the EAG delivers analysis and results within an organized layout and provides a clear letter grade and assessment comment. The EAG is derived from a proprietary algorithm that utilizes comparative and direct analysis of values to visualize historical and current exposure to elements. Increasing values can also suggest increasing weather risk to commercial and residential property and assets. The completed EAG can provide detailed and significant insight to the specific location’s present climate situation which insurance businesses can use to better manage operations. The EAG can be delivered through back end interfaces or consumer facing graphical elements.

Premium Guidance and Transparency

ClimAIteTRACK was designed for the insurance industry and its core functionality delivers 2 significant benefits to insurance businesses:

Premium management and adjustment strategies that are region specific

Client facing elements that offer full transparency and build brand and business confidence

Through its historical and current weather metrics analysis, ClimAIteTRACK can help insurance companies make better premium adjustment decisions, mitigating the potential of increasing losses and protecting revenue and profitability. ClimAIteTRACK generates the client friendly EAG report that carriers can use to educate and inform clients on decision reasoning, with the goal of building stronger and more loyal relationships between the insurer and the client. ClimAIteTRACK is scripted in the Python language, enabling expansion of weather metrics and analytic methods to suit the individual insurance company and the clients they serve. EAG results can be vertically integrated into existing insurance management systems, ensuring seamless automation and implementation of ClimAIteTRACK’s analytical and reporting functionality.

ClimAIteTRACK: Meaningful Analytics for the Insurance Industry

The climate is indeed changing and while the debate lingers on the impacts and causes of climate change, the effects on insurance companies are very real. The negative impacts have been felt by the industry over the last 10 years with increasing claims and losses in both the residential and commercial property areas, driven by increasing frequency and severity of weather events. ClimAIteTRACK is a new tool for the insurance industry that provides environmental assessments by region and delivers 2 significant benefits to insurance businesses and their clients. Proprietary algorithms and historic and real time weather metrics create meaningful and relevant analytics for greater insight on future potential environmental risk and past region exposure to damage causing elements. Climate change is an ongoing challenge for the insurance industry but technologies such as ClimAIteTRACK can offer valuable data analytics to help insurance businesses manage premium revenue and client facing transparency.