The Market Rebounds: Has Cryptocurrency Become Bullish?

As of July 15, the Crypto Fear & Greed Index shows that the market has been suffering from “Extreme Fear” for 70 consecutive days, a record high. Although it seems that the market hasn’t been so volatile in July, it remains fundamentally bearish, and the bankruptcy of top institutions did create negative market sentiments. To date, U.S. CPI soared 9.1% over the past year, the largest increase since November 1981, and global finance continues to suffer from a liquidity crunch.

As the market has just gone through a deleveraging campaign with far-reaching implications, cryptos like BTC and ETH fell below their price peaks recorded during the last market cycle. However, the market has gradually absorbed the panic impact, and there have been signs of a market rebound. According to CoinEx, a crypto exchange, the BTC price recently returned to over $22,000.

ETH, on the other hand, hit $1,500. It should be noted that in the last bear-bull cycle, the market recovery was also driven by increases in the ETH price.

As Bitcoin and Ethereum record consecutive price growths, DeFi tokens have also become more valuable. Does this mean that a new market cycle has started? Let’s take a closer look at the current market in terms of active addresses, the inflow/outflow of money, and market fundamentals. As BTC and ETH led market recoveries during previous cycles, we will examine the relevant statistics of the two.

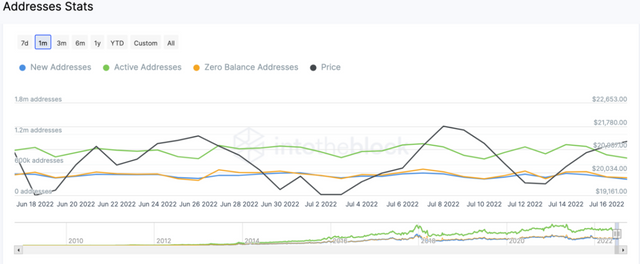

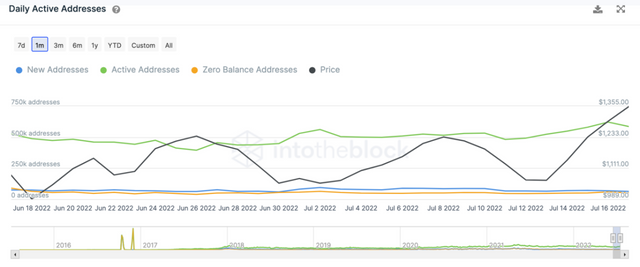

According to on-chain data, Bitcoin’s active addresses increased by 2.44% in the past seven days, and the number of zero balance addresses went up by 5.92%.

Ethereum’s active addresses, on the other hand, grew by 9.98% in the past seven days, and the number of zero balance addresses went down by 3.05%. Meanwhile, on July 18, the number of addresses holding at least 1 ETH hit 1,554,716, an all-time high.

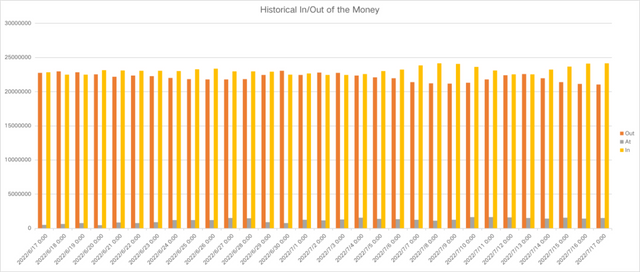

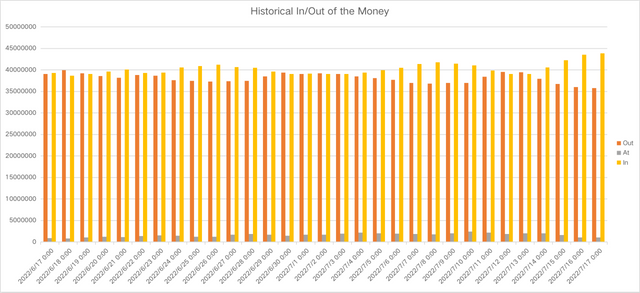

In terms of the inflow/outflow of money, although both BTC and ETH come with positive inflows, the latter shows stronger momentum

Historical In/Out of the Money (BTC)

Historical In/Out of the Money (ETH)

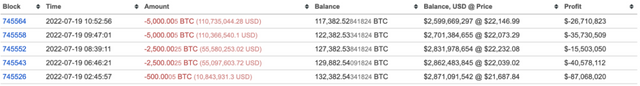

Based on the current round of price growth, Ethereum has indeed outperformed Bitcoin. It is reported that Bitcoin’s third largest whale has made multiple outgoing transfers since the early morning of July 19. As of this writing, the address has transferred 15,500 bitcoins that are worth about $350 million.

Let’s now turn to the fundamentals. As global finance faces a liquidity crunch, the crypto market hasn’t been able to stay intact. The market panicked when crypto companies collapsed one after another a while back. However, the deleveraging caused by the liquidity crisis has also optimized the internal capital structure of the market and excluded more hot money. At the same time, new institutional investors are making a push into cryptocurrency.

According to the information disclosed so far, 40 fundraisings happened last week, and a16z and Sequoia Capital both took action. In particular, the scale of these fundraisings was small, with only three projects raising over $50 million. A report by The Block Research shows that the amount of VC investment in the blockchain space has declined for the first time since Q2 2020. The figure stood at $9.8 billion in Q2 2022, down by approximately 22% compared with the last quarter. Although the market is picking up strength, the fundraising statistics show that institutions remain extremely prudent.

Any industry that seeks growth must go through multiple market cycles. From 2000 to 2002, the dot.com bubble triggered a bear market due to excessive valuations and speculations, but this did not affect its subsequent growth. Today’s crypto market is just the same. The momentary setbacks will help it find better growth drivers in the future.

As the crypto industry advances, all kinds of new functions and categories have emerged. Meanwhile, the entry threshold has kept going up, which has discouraged many who hope to join the crypto market. While everyone in the crypto space is working on more new functions, one exchange called CoinEx is striving to “slim down” its products. To impress the world with the efforts made by the crypto market, the team is making many complex projects and tools more user-friendly. The exchange intends to make crypto trading easier and welcome investors from all sectors to the crypto space.

Today’s cryptocurrency, like the Internet, exists to make the world a better place.

Your post was upvoted and resteemed on @crypto.defrag

This is a one-time notice from SCHOOL OF MINNOWS, a free value added service on steem.

Getting started on steem can be super hard on these social platforms 😪 but luckily there is some communities that help support the little guy 😊, you might like school of minnows, we join forces with lots of other small accounts to help each other grow!

Finally a good curation trail that helps its users achieve rapid growth, its fun on a bun! check it out. https://plu.sh/altlan/