Trading Stocks in Crypto World... The Barriers and the Breakthroughs

As a crypto trader, I've always eyed those big Web2 stocks like Tesla or Nvidia alongside my BTC and ETH holds. But jumping into traditional stock trading? Man, it's a hassle. The endless KYC checks feel invasive, tax forms are a nightmare to navigate, and if you're not in the right country, you're often locked out entirely. Plus, starting small isn't easy with minimum investments that eat into your capital. It's like two separate worlds that don't play nice together, forcing you to juggle apps and accounts just to diversify a bit.

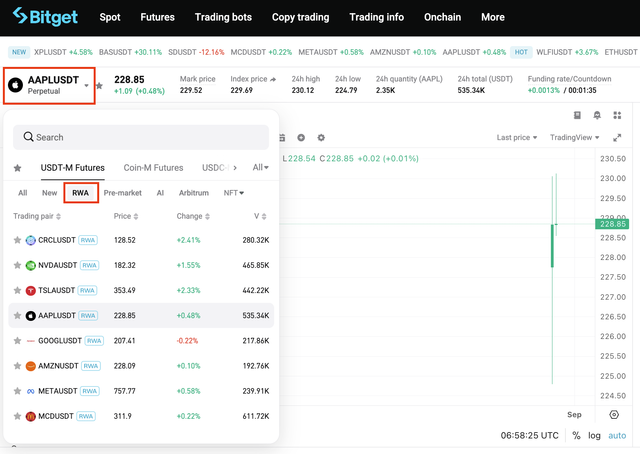

Lately, though, crypto exchanges are stepping up and blending these markets in smart ways. Take how some platforms now let you trade tokenized versions of those stocks right in your crypto wallet – no brokerage signup needed. You can go long or short on stuff like AAPL or META with USDT, crank up to 10x leverage if you're feeling bold, and start with pocket change like $5. It's all settled fast, globally accessible, and pulls prices from multiple sources for fairness. This setup cuts the red tape and lets you build a mixed portfolio without the headaches.

For me, it's made dipping into stocks way less stressful while keeping everything in one spot. Anyone else frustrated with old-school brokers and trying these new tools? What's your take on mixing crypto with traditional assets?