LEO Alpha for Your Immediate Attention

I have already taken action based on the information I have presented here. This is financial history regarding how I have managed my portfolio. If my analysis is correct, I will be rewarded by the growth of my portfolio (which is all in on cryptocurrency). I have my logic and facts; but not omniscience. I'm investing my own money and I am sharing what I do so more individuals can benefit from it.

The First Hint of Snowball

I do not know of a single person who could time the market accurately in a consistent manner. What can do is figure out if certain events are more likely to happen. If one could enter around the beginning of a major price pump, that is the most efficient entry point. Although I have believed in $LEO for a long time (CUB and POLYCUB was the biggest part of my portfolio during the DeFi boom), my accumulation of $LEO was of the more slow and steady variant. Rather than buying the Token directly, I delegated my HIVE Power to @leo.voter in order to earn my Tokens.

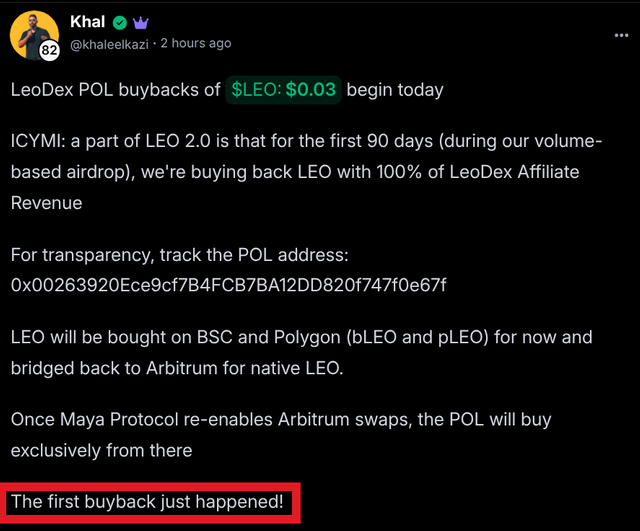

These buybacks are the main reason I started to actively purchase LEO from the market instead of waiting for the slow accumulation. $LEO is a deflationary Token. In regards to that it is better than $BTC and even $ETH because ETH is only deflationary when activity is high. Bridge revenue is burning what is left of 30 million LEO supply. The rewards I get for @leo.voter delegations are now coming from real earnings made through curation. Such a system is sustainable. Protocol keeps on acting as one of the biggest buyers of the Token. @leostrategy is only going to intensify the experience as the project is aimed at buying and locking up $LEO in order to earn more LEO.

What I Learned When Buying LEO

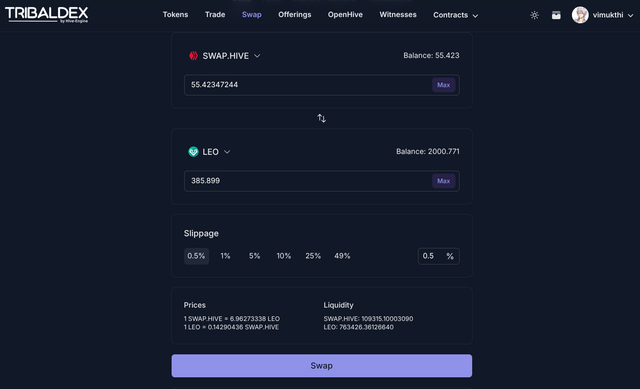

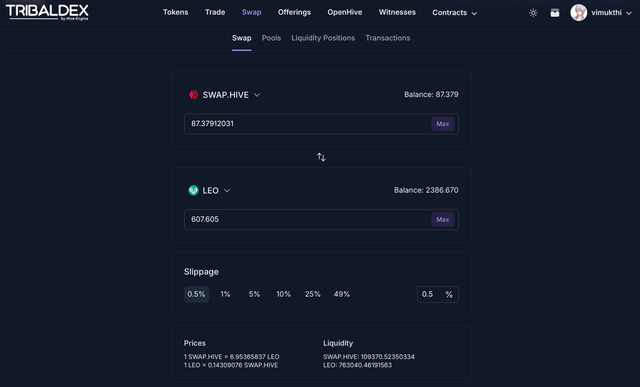

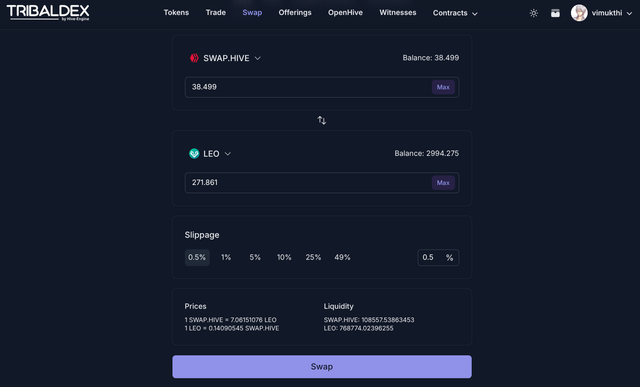

After deciding that this is a very good entry point to actively start buying, I checked the prices on DEXs. There are arbitrage opportunities; but I was merely looking for the cheapest place to buy LEO immediately.

Note the price of LEO at the bottom of the screenshot. Compare that against the price on the order book (where users can trade for free with limit/market orders). There is a considerable gap in price opening up arbitrage opportunities.

I did not want to miss out on long term gains by focusing on making a quick profit via arbitrage. There is even a chance of bots eating up a large part of the profits I was expecting to make. Instead, I merely doubled down on buying more through Tribaldex Dieselpools.

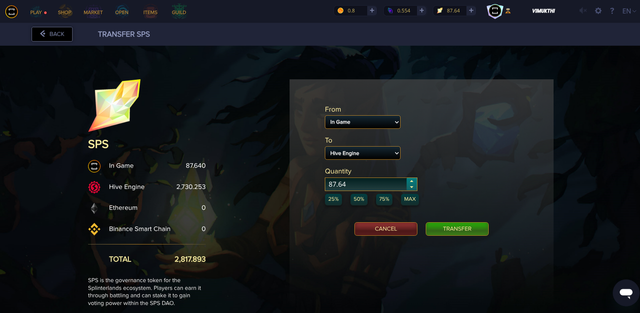

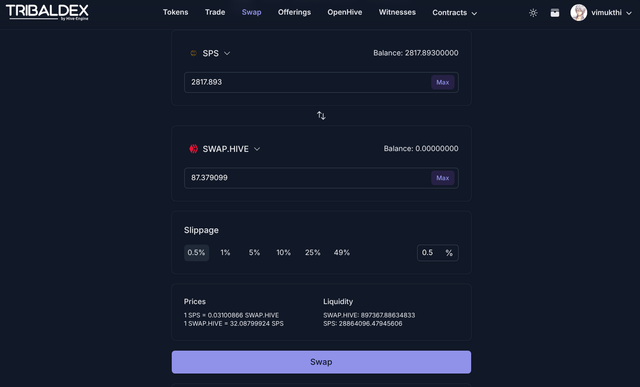

Sold Some $SPS for Now

This is not the best time to sell SPS based on my analysis. When I compare the short term potential of SPS vs LEO, I know that LEO is the stronger contender as @splinterlands needs to onboard more users to generate more revenue and higher asset prices.

I continue to earn SPS everyday through gameplay + staking + Node Licence. I believe greatly in the long term potential of Splinterlands as the best CCG in Web 3. I merely think the price increase for SPS will be more delayed compared to LEO. Thus I made my second purchase for the day.

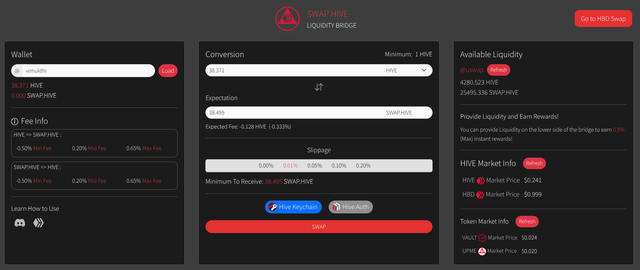

Use @uswap Whenever Available

There are many ways to go from HIVE to SWAP.HIVE and vice versa. There is the official bridge for HIVE-Engine Layer 2 and there are others that function similar to Hawala.

Hawala is an informal method of transferring money without physical money movement, relying heavily on trust and honor between hawala brokers. It originated in South Asia during the 8th century and is used today as an alternative remittance channel, particularly in the Islamic community. Hawala allows people to transfer money without formal banking relationships or access to established financial networks, making it beneficial for those in countries with strict capital controls or sanctions.

When one side of the liquidity is drying up, @uswap starts paying users to swap. This is functionally a way of getting paid for providing liquidity. @theguruasia and @ali-h have built the cheapest "bridge" between HIVE and HIVE-Engine. As you can see, I earned some extra $HIVE and used it to purchase more LEO.

Where The Money Comes From

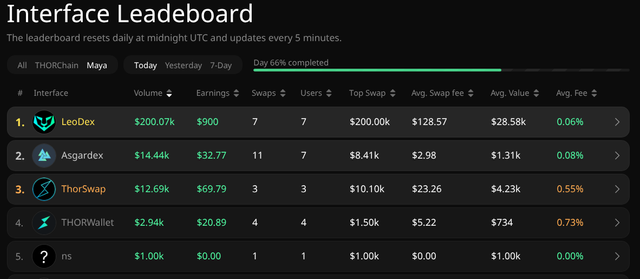

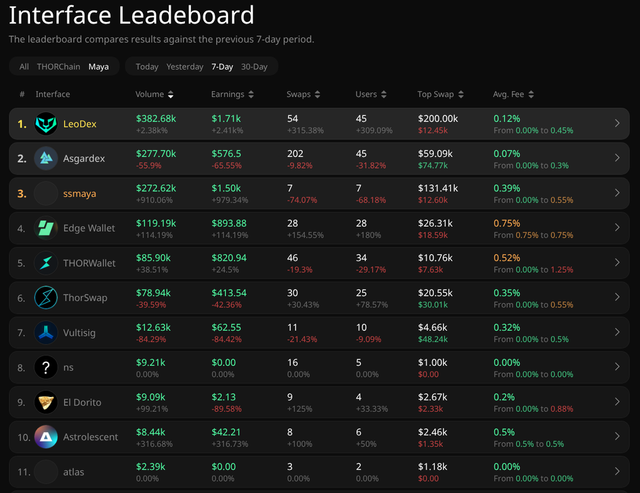

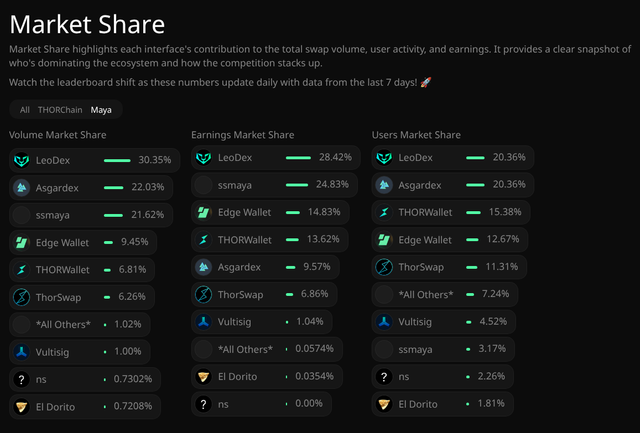

LeoDEX is the biggest Interface on @mayaprotocol. We started out as a tiny newcomer and grew into one of the most feature rich projects. LeoDEX was the first Interface to support ZCash swaps and there are some extra innovative features such as being able to swap cryptocurrency without even connecting a wallet. This is a fully non custodial system using QR codes and temporary Keystore wallets that live in the browser.

Above are few screenshots I used to how far LeoDEX has come. One or two events could be considered "luck". That is why weekly statistics can be more useful when it comes making long term projections.

We have a considerable lead as we maintain the #1 spot. It is only recently that we made it to the top. Before that we used to in Top 5 consistently. Progress is not magic. It is real building and usually come in a million small steps.

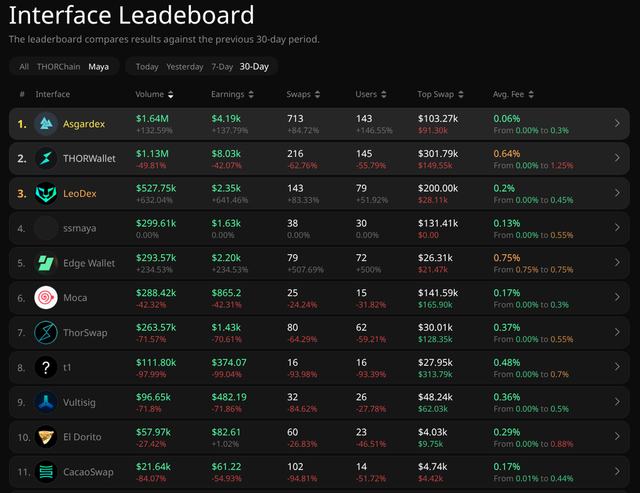

The new 30 Day statistics on xScanner paints an image closer to how things used to be. Even among the combined trading volume of THORChain + @mayaprotocol, LeoDEX is consistently in Top 20 and often makes it to Top 15.

LEO Leading on Every Metric

We have developed and marketed enough to the point it is realistic to consider LeoDEX being on top of most days. At the very least we should expect us to be on Top 3. We might be able to do exactly this with THORChain. The competition will be tougher. There is no 100% guaranteed victory for us. All I'm saying is that it is realistic to target the crown for LEO.

Other Revenue Sources

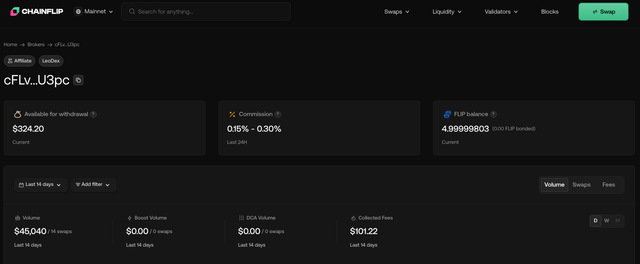

There is Chainflip, Rango and Relay connected to LeoDEX and we have Premium + subscriber only content on INLEO. There are other revenue sources in the R&D phase in the form of LeoMerchants. The revenue is real. The buybacks are happening. I have given you tips to acquire $LEO at the best prices.