Three reasons why Ethereum rally to $10K dream is alive in 2025

Ethereum rally to $10,000 is a narrative driving speculation among traders in H2 2025. The largest altcoin has outperformed Bitcoin and Solana in the past month. ETH purchases by public companies is driving demand for Ether, and analysts at Standard Chartered believe that this won’t stop anytime soon.

While Bitget Wallet experts set a $10,000 target for Ethereum Ethereum, UK Bank Standard Chartered says that companies could end up owning 10% of all Ether, a 10% increase from the current level.

In this deep dive we explore the reasons why Ethereum’s dream rally to $10,000 is likely closer than anticipated.

Ethereum demand among companies explodes

Bitcoin Bitcoin

btc

-0.43%

Bitcoin rally’s biggest driver in the 2025 bull run is institutional adoption, purchase of BTC for company treasuries and nations, states adding BTC to their balance sheet. A similar phenomenon could trigger a bull run in Ether.

One percent of Ethereum’s circulating supply is currently held by 11 firms, identified by UK Bank Standard Chartered. The banks hold millions of crypto on their balance sheet and the demand for ETH remains high.

Experts at the bank predict a tenfold increase in Ethereum holdings of the companies, meaning that 10% of Ethereum’s circulating supply could be held and controlled by the firms.

Geoffrey Kendrick, Standard Chartered’s head of digital assets is quoted in a note that the bank sent out to its investors on Tuesday:

Ethereum purchases by BitMine, GameSquare, and SharpLink exceed $3.5 billion according to CoinGecko data, acting as a catalyst for the ETH price rally.

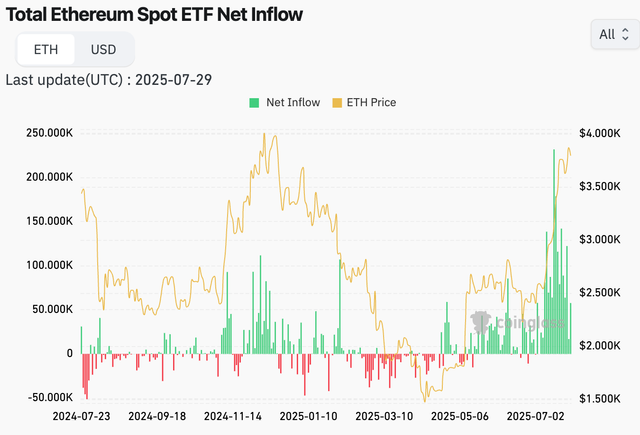

Spot Ethereum ETFs have recorded net positive flows since July 7 as institutional investors gobble Ether faster than they did Bitcoin. The data support a bullish thesis for Ether. Coinglass data shows the Ethereum ETF flows.

ETF inflows crossed $2.3 billion within a week, supporting demand for the largest altcoin.

The institutional demand for Ethereum is expected to keep rising with the largest ETH treasury firm, BitMine Immersion Technologies, signaling a $1 billion stock repurchase program for Ethereum purchase.

As Wall Street giants warm up to Ethereum as a treasury reserve asset, demand is likely to drive the altcoin’s price higher.

BTCS and Ethereum treasuries explained

BTCS made the strategic pivot from mining Bitcoin to buying Ethereum for their treasury. The US based publicly traded digital asset firm has observed over 130% increase in its stock price year-to-date and a 600% increase in the last three years.

The pivot to Ethereum treasury has had a positive impact on the company, as it evolved from an online Bitcoin marketplace to a key infrastructure developer on the ETH blockchain, and a strategic ETH holder.

BTCS owns approximately $270 million worth of Ethereum, at an average price of over $3,800.

Charles Allen, CEO of BTCS Inc told MilkRoad co-founder Kyle Reidhead that he loves Bitcoin but it doesn’t do anything. BTC is a treasury asset, while Ethereum has the power to change how assets move around the world.

The first step for most Ethereum treasury companies is to buy Ethereum and stake it, use AAVE to lend Ether, and generate an income from lending. Commenting on what’s next after these two steps, Allen says, there are more projects in the pipeline and the firm plans on buying more Ethereum.

BTCS is focused on making the Ethereum blockchain faster and better, with several projects on the roadmap. The ETH treasury company is focused on making Ethereum more valuable and says it is a responsibility of public companies to buy ETH tokens.

Congratulations, your post has been manually

upvoted from @steem-bingo trail

Thank you for joining us to play bingo.

STEEM-BINGO, a new game on Steem that rewards the player! 💰

How to join, read here

DEVELOPED BY XPILAR TEAM - @xpilar.witness