Historical_Bitcoin_Crashes_and_Opportunities

Analysis of Major Events in the Cryptocurrency Market (Dec 2017 – Nov 2022)

This article examines key events and their impacts on the cryptocurrency market from December 2017 to November 2022, covering the ICO boom, COVID-19 pandemic, Terra ecosystem collapse, and FTX bankruptcy. Each event significantly affected price volatility and market sentiment. A detailed review and data analysis of each incident follows.

December 2017 – ICO Boom & Bitcoin Surge

Event Overview

In December 2017, the crypto market saw a surge in Initial Coin Offerings (ICOs), with numerous startups raising capital through token issuances that attracted global investors. Simultaneously, Bitcoin's price soared from around $1,000 at the start of the year to nearly $20,000, marking an approximate 1800% increase.

Market Impact

- ICO Frenzy: Projects raised substantial funds via ICOs, fueling speculative demand and boosting token prices.

- Bitcoin Surge: Bitcoin's breakthrough to $20,000 captured widespread attention from institutional and retail investors.

- Data Point: Bitcoin rose from $1,000 to $20,000, representing a gain of ~1800%.

Aftermath

This period of exuberance planted seeds for future corrections, as many ICOs lacked real value and ultimately failed, eroding investor confidence.

March 2020 – Global COVID-19 Pandemic

Event Overview

March 2020 witnessed the rapid global spread of COVID-19, leading to lockdowns and a recession. The crypto market suffered heavily, with Bitcoin's price plunging over 50% from its peak.

Market Impact

- Pandemic Panic: Global financial markets crashed, disproportionately impacting high-risk assets like cryptocurrencies.

- Bitcoin Crash: Prices fell from over $10,000 to about $4,000, a drop of approximately 60%.

- Data Point: Bitcoin declined from $10,000 to $4,000, resulting in a ~60% loss.

Aftermath

Despite short-term pressure, some investors began viewing crypto as a hedge during the pandemic, contributing to a gradual long-term demand recovery.

May 2021 – Bitcoin All-Time High & Rise of Mid-Tier Blockchains/Stablecoins

Event Overview

In May 2021, Bitcoin reached a new all-time high above $64,000. Concurrently, mid-tier blockchain projects and stablecoins like USDT and USDC gained prominence, significantly boosting market trading volume.

Market Impact

- Bitcoin ATH: Institutional adoption drove Bitcoin to record highs, enhancing market confidence.

- Stablecoin Growth: Explosive trading in USDT and USDC increased market liquidity.

- Data Point: Bitcoin hit $64,000, reflecting a ~2800% rise from the 2020 low.

Aftermath

The popularity of stablecoins laid the groundwork for the DeFi boom but also attracted regulatory scrutiny.

May 2022 – Terra Ecosystem Collapse

Event Overview

May 2022 saw the collapse of Terra’s stablecoin UST and its sister token LUNA. UST lost its 1:1 peg to the USD, and LUNA’s price plummeted, erasing over 90% of its market cap.

Market Impact

- UST Depeg: UST fell from $1 to near zero, a decline of approximately 99%.

- LUNA Crash: LUNA crashed from ~$100 to below $0.01, a drop of ~99.99%.

- Data Point: UST fell ~61%; LUNA dropped ~99%.

Aftermath

The collapse shattered trust in algorithmic stablecoins and disrupted the broader DeFi ecosystem, severely damaging investor confidence.

November 2022 – FTX Bankruptcy

Event Overview

In November 2022, crypto exchange FTX abruptly filed for bankruptcy. Its parent company, led by Sam Bankman-Fried (SBF), faced a financial scandal, triggering market panic and sharp declines in Bitcoin, Ethereum, and other major tokens.

Market Impact

- FTX Collapse: User funds were lost, and market liquidity dried up.

- Bitcoin Drop: Bitcoin fell from over $20,000 to around $15,000, a decrease of ~26%.

- Data Point: Bitcoin declined from $21,000 to $15,000, a ~26% loss.

Aftermath

The FTX crisis exposed regulatory gaps in crypto, prompting global governments to strengthen oversight of digital assets.

From 2017 to 2022, the crypto market evolved from hype to collapse and toward maturity. The ICO boom drove early growth, the pandemic tested resilience, and Terra and FTX revealed systemic risks. These events influenced prices and shaped regulations and industry structure. Moving forward, the crypto industry must balance innovation with compliance for sustainable growth.

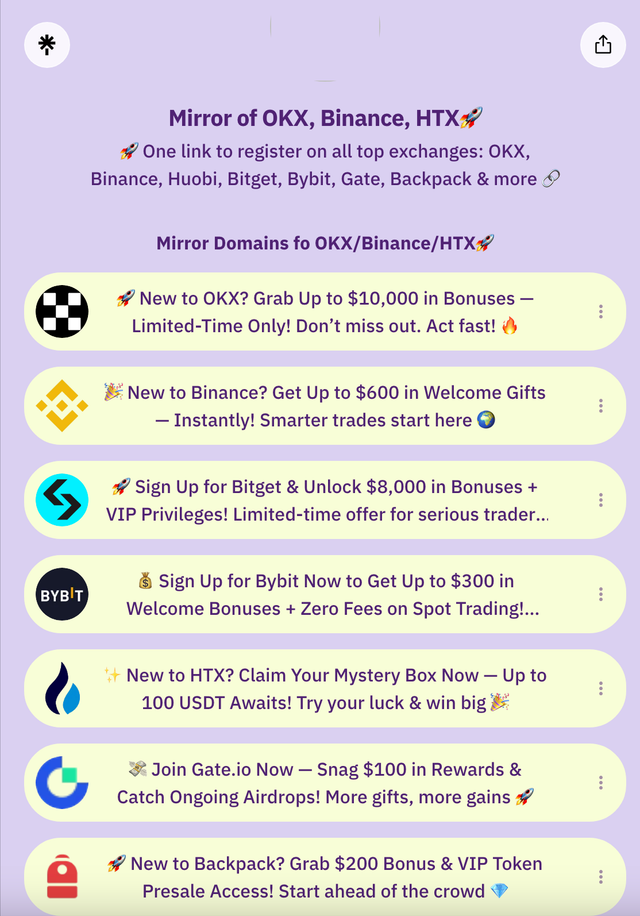

🎁 Limited-Time Bonus — New Users Get a Bitcoin Mystery Box Worth 20+ USDT, Guaranteed!

Sign up for leading crypto exchanges like OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack, and more — all in one place!

👉🏻 Bookmark the latest official backup domains to avoid missing out: https://linktr.ee

🔥 Recommended Reading

🔥How to Access OKX Exchange from mirror domain

Many exchange domains face restrictions or slow speeds due to overseas hosting. To maintain access, exchanges like OKX and Binance frequently update backup domains. Here's the latest:

- OKX backup domain: OKX Overseas (VPN Required) or Alternative Domain

- Binance backup domain: Binance

- Bitget backup domain: Bitget

- Bybit backup domain: Bybit/Bybitglobal

- HTX backup domain: Huobi (HTX)

- Gate.io backup domain: Gate.io

🔥 Alpha “Meme Hunting” Tools

1️⃣ Axiom: https://axiom.trade

2️⃣ Gmgn: https://gmgn.ai

3️⃣ dbot: https://app.debot.ai

4️⃣ Morelogin Fingerprint Browser: www.morelogin.com

Popular Search Keywords

Bitcoin buy, Bitcoin crash, crypto trading, crypto leverage, TrumpCoin, Dogecoin, how to buy crypto, OKX download, OKX registration, Binance airdrop, Binance registration, Binance tutorial, OKX CNY deposit, NFT wallet guide, DeFi mining, leverage trading strategy, crypto moonshots, BTC airdrops, NFT play, Web3 farming, inscription minting, rune minting, how to start in crypto, how to earn in crypto, DeFi yield farming, node staking, liquidation, financial freedom, heiyetouzi.xyz