Dogecoin Adoption Is Growing — But Can Tech Save It from Retail Risk?

Dogecoin Payments Are Booming — But Are Retail Investors Getting Burned? Can Tech Save the Day?

Back in 2013, a cryptocurrency called Dogecoin was born as a joke — literally, a meme based on a Shiba Inu dog. Nobody expected it to one day become a real form of payment. With fast transactions and low fees (thanks to tech similar to Litecoin), it has even shifted toward more energy-efficient models. Today, over 100,000 merchants worldwide accept Dogecoin for things like flights and event tickets. But behind this popularity lies some serious risk.

Elon Musk has been a vocal promoter of Dogecoin on Twitter. When he once joked about using it to buy a rocket, the price jumped 30% in three days. But when he called it “a hustle,” it dropped 15% overnight. Many retail investors jumped in just chasing his tweets — not because they believed in the tech, but because they were gambling on his next post.

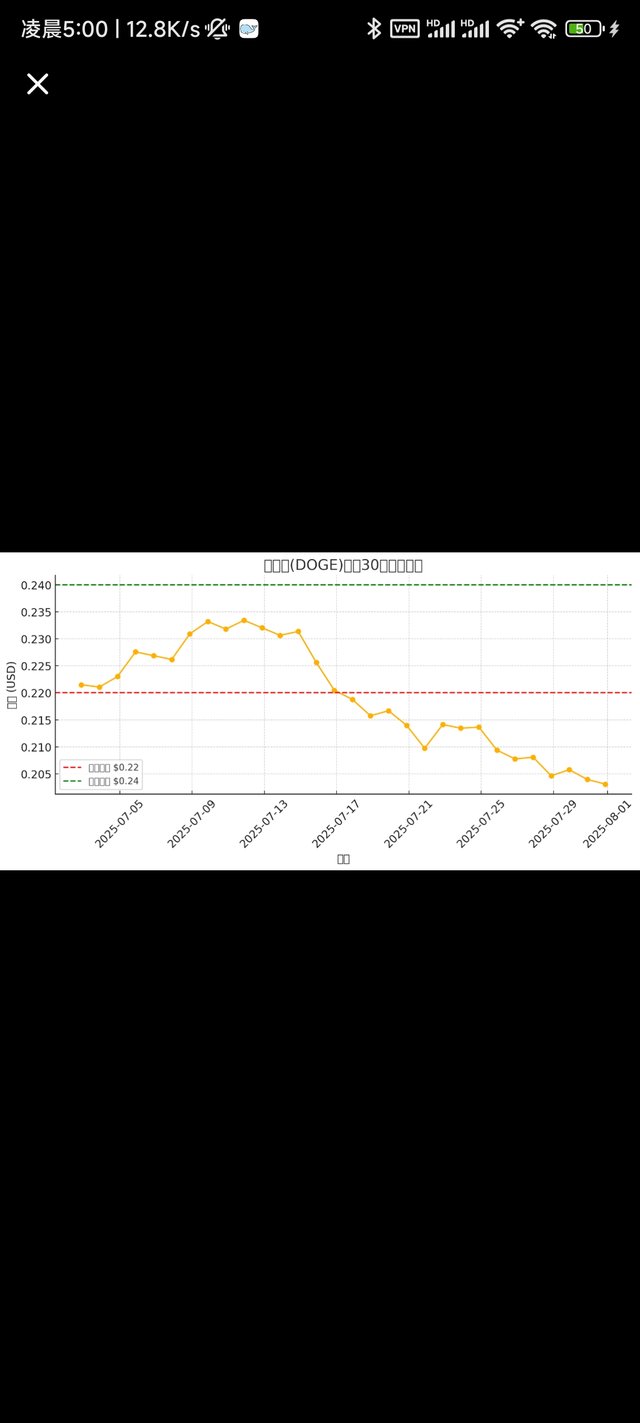

Dogecoin now has a market cap of around $8 billion, but its price is extremely volatile — bouncing between $0.20 and $0.25 over the past month. Data shows that the top 100 wallets control about one-third of all DOGE in circulation. If those whales sold off at once, the price could crash instantly. One whale recently bought 310 million DOGE, suggesting they believe the price is low enough — but for everyday users, it’s hard to tell if this is really the bottom.

On the tech side, the Dogecoin team is working on upgrades like more energy-efficient consensus mechanisms and scaling the network to handle up to 2,000 transactions per second. If these efforts succeed, maybe you’ll be able to buy a Starbucks coffee with DOGE someday. But so far, it’s still in testing. Once live, lower fees and faster speeds might boost adoption.

Regulators in the U.S. are watching closely. If Dogecoin gets classified as a security, exchanges could be forced to delist it, drying up trading volume overnight. Right now, there are two main user groups: students and expats using it for fast, cheap international transfers — and speculators riding the Elon Musk hype train. The latter group faces much higher risk.

Currently, the price is hovering around $0.22. If that support level holds, DOGE could bounce back to $0.24 or even $0.30. If momentum builds, $0.45 or even $1 isn’t off the table. But if it dips below $0.22, a fall to $0.20 or lower is entirely possible.

There’s also talk in the community about Layer 2 solutions like ZK-rollups to reduce fees and increase throughput. But for most users, the real concern isn’t technical jargon — it’s whether Dogecoin can become a reliable everyday currency. Meanwhile, debates rage in forums: some say Dogecoin survives purely off Musk’s tweets, others argue the tech lacks real innovation.

Right now, Dogecoin feels like Elon Musk’s personal ATM. Retail investors ride the rollercoaster, the tech upgrades are still incomplete, and regulatory action could strike at any time. Whether or not to use DOGE depends on how much risk you’re willing to take.