Beginners_Guide_to_Perpetual_Futures_Trading

You frequently hear seasoned traders in communities discussing their profits from futures contracts.

This article will clearly break down: How perpetual contracts operate + Their key characteristics + Associated risks + Essential considerations 👇

What is a Perpetual Contract?

Let’s begin with traditional futures:

A futures contract = an agreement between two parties to buy or sell an asset at a predetermined price on a future date.

👉 The underlying asset could be oil, gold, Bitcoin, or Ethereum.

Perpetual contracts (Perpetual Futures) represent an enhanced version:

✅ No expiry date: Positions can be held indefinitely

✅ Funding rate mechanism: Ensures contract prices stay close to spot prices most of the time

✅ Margin system: Only partial funds are needed to open a position

For example: If you purchase a BTC perpetual contract at 30,000 USDT, your position has no time constraint.

You can close it at any time to realize profits or losses.

It’s no surprise that nearly 75% of global crypto trading occurs in the perpetual futures market.

Core Features of Perpetual Contracts

1️⃣ Linear contracts: Settled in stablecoins like USDT, simplifying trading.

2️⃣ No settlement date: Flexible trading without forced expiry liquidation.

3️⃣ Spot-pegged: Funding rate keeps prices aligned with spot markets.

4️⃣ T+0, 24/7: Trade anytime, year-round.

5️⃣ Adjustable leverage: Typically 10–125x, amplifying both risks and returns.

6️⃣ Margin system:

- Initial margin: Low entry barrier

- Maintenance margin: Falling below triggers margin calls or forced liquidation

7️⃣ PnL (Profit & Loss): Calculated from entry vs exit prices, including fees and funding rates.

8️⃣ Mark price: Prevents manipulation by using an index from multiple exchanges.

9️⃣ Insurance fund: Acts as a buffer during extreme volatility to prevent widespread defaults.

🔟 Auto-Deleveraging (ADL): Automatically reduces leverage when liquidated positions lack sufficient margin, protecting market stability.

Common Perpetual Contract Strategies

- Trend trading: Long/short based on market trends, using technical analysis, Elliott waves, or macro factors.

- Hedging arbitrage: Hold opposing positions in spot and futures to lock in risk or profit from spreads.

- Funding rate strategy:

- High funding rates: Short positions to collect fees

- Negative funding rates: Long positions become more cost-effective

Risks & Key Notes ⚠️

- Leverage control: Beginners should use ≤5x leverage; even minor price moves can cause liquidation.

- Position sizing: Avoid all-in bets; always reserve funds for stop-losses and margin.

- Funding rate: Long-term holds incur costs, especially in sideways markets.

- Extreme market moves: Flash crashes or spikes can trigger liquidation.

- Exchange rules: Margin ratios, liquidation systems, and ADL vary by platform—research them beforehand.

- Mindset: Perpetuals are zero-sum; emotional over-leveraging often leads to liquidation.

Summary & Suggestions

Perpetual futures are a double-edged sword (resembling a journey of discipline, particularly over emotions).

✅ Use wisely: Amplify gains or hedge flexibly

❌ Misuse: Fastest route to losses

Suggestions:

- Beginners → Small positions + Low leverage; prioritize loss-cutting.

- Intermediate traders → Blend technical and macro analysis.

- Long-term traders → Develop a system, review it regularly, and maintain discipline.

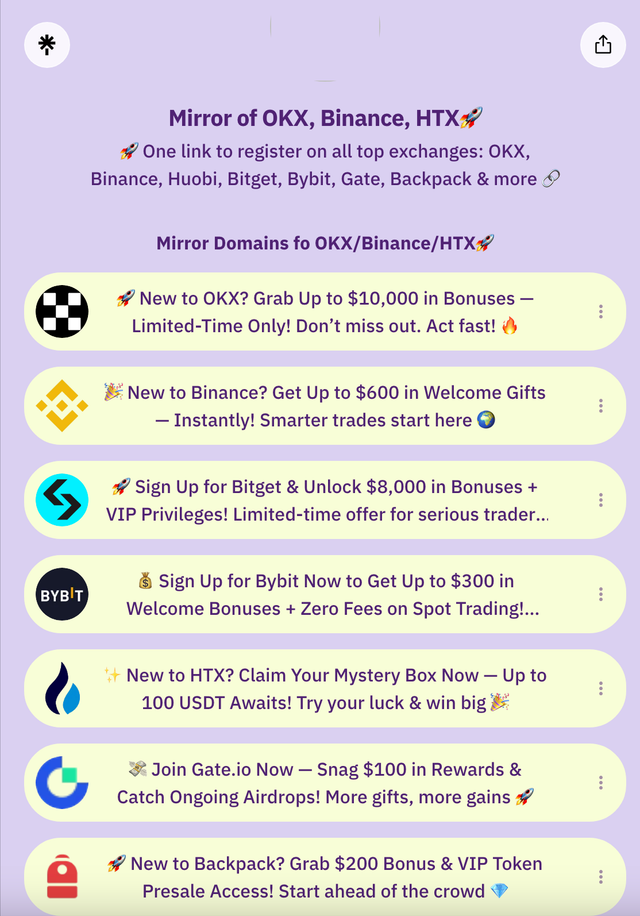

🔥 How to Access OKX Exchange from mirror domain

Network restrictions or overseas servers can block or slow main exchange domains, confusing users who may think the platform is faulty. Often, it’s just a connectivity issue—not the exchange’s fault.

To address this, exchanges like OKX and Binance frequently update backup domains for seamless access.

- OKX Backup Domains: OKX Global or Alternative Link

- Binance Backup Domain: Binance

- Bitget Backup Domain: Bitget

- Bybit Backup Domain: Bybit/Bybitglobal

- Huobi HTX Backup Domain: Huobi (HTX)

- Gate.io Backup Domain: Gate.io

🔥 Related Reading

🔥 Alpha Dog Tools for Airdrop Hunting

1️⃣ Axiom Sniping Tool: https://axiom.trade

2️⃣ Gmgn Sniping Tool: https://gmgn.ai

3️⃣ Dbot Airdrop Tool: https://app.debot.ai

4️⃣ Morelogin Multi-Account Fingerprint Browser: www.morelogin.com

Trending Searches

perp future trading, best crypto exchange, okx best exchange, Buy Bitcoin, Web3 for Teens, High School Airdrops, CEX Rankings, OKX App Download, OKX RMB Deposit, Binance App Signup, Binance Buy Guide, Binance Airdrops, iPhone Binance Download, How to Buy President Token, How to Buy Dogecoin, Buy BTC with RMB, OKX Download, Web3 Airdrop, Zero-Cost Web3, Bitget China Access, OKX Passport Signup, Crypto Side Hustle, OKX Contracts, RMB Deposits OKX, NFT Wallet Guide, Huobi RMB Recharge, Crypto Beginner Guides, btc8848.com, Contract Trading Tips, Bitget Leverage, DeFi Mining, Crypto Airdrop Guide, Is Airdrop Still Worth It?, Contract Liquidation, Buying President Token ETH/BTC, DeFi Staking, NFT Trends, Zero-Cost Airdrop Web3, Inscriptions & Runes, Beginner Crypto Guide, How to Trade Crypto, Can You Make Money Trading?, Leverage Explained, DeFi Basics, OKX Airdrops, Node Staking, Liquidation, Financial Freedom, heiyetouzi.xyz, Overseas Apple IDs