India Forklift Market: Driving Industrial Efficiency in Warehousing and Manufacturing

The India Forklift Market is experiencing robust growth as automation, warehousing, and infrastructure development take center stage in the country’s industrial transformation. With the boom in e-commerce, logistics, construction, and organized manufacturing, forklifts have become indispensable assets for improving operational efficiency and safety.

The push for “Make in India,” rapid warehouse expansion in Tier 1 and Tier 2 cities, and increased adoption of electric vehicles in intralogistics are reshaping the forklift landscape across sectors.

Market Dynamics and Demand Drivers

The India Forklift Market is evolving with the rising need for material handling equipment in warehousing, FMCG, retail, automotive, and manufacturing.

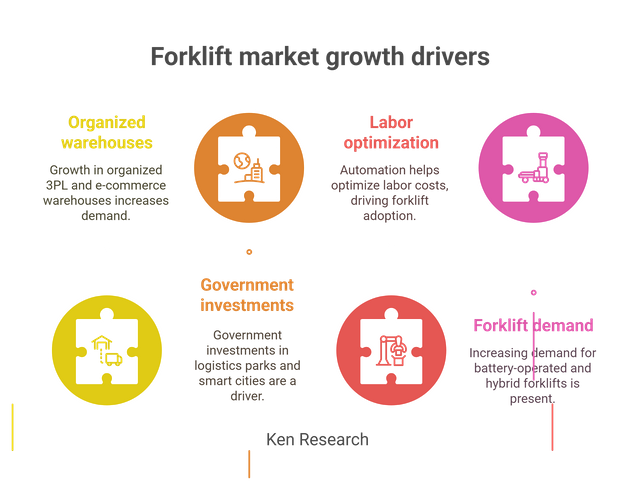

Key growth drivers include:

-

Growth of organized 3PL and e-commerce warehouses

-

Government investments in logistics parks and smart cities

-

Labor cost optimization through automation

-

Increasing demand for battery-operated and hybrid forklifts to meet ESG mandates

The India Forklift Market size is projected to grow steadily over the next five years, driven by demand for both counterbalance and warehouse forklifts.

Product Segmentation and Technology Shifts

Forklifts are categorized by:

-

Type: Electric, diesel, LPG

-

Application: Manufacturing plants, warehouses, ports, airports

-

Capacity: Below 5 tons, 5–10 tons, and above

A clear shift toward electric forklifts is underway due to rising fuel costs, stricter emission norms, and enhanced indoor air quality requirements in enclosed spaces like warehouses and factories.

Competitive Landscape: Global vs. Domestic Players

India’s forklift sector is dominated by both domestic manufacturers and international OEMs, including:

-

Godrej Material Handling

-

Toyota Material Handling India

-

KION India Pvt. Ltd.

-

Hyundai Construction Equipment India

These players are investing in telemetry, battery swapping, and IoT-integrated fleet tracking systems to deliver advanced capabilities in real-time forklift management.

Benchmarking with the USA: A Mature Market with Tech-Driven Trends

The USA Forklift Market offers valuable insights for India, particularly in terms of automation and smart logistics. The U.S. market is driven by early adoption of autonomous material handling systems, AGVs (Automated Guided Vehicles), and hydrogen fuel cell forklifts.

Current USA Forklift Market trends include:

-

Integration of advanced sensors and telematics

-

Use of predictive maintenance platforms

-

High penetration of rental and leasing models

-

Regulatory compliance driving demand for low-emission forklifts

India can replicate several of these innovations as it scales warehousing and builds smart logistics infrastructure under PM Gati Shakti.

Challenges and Opportunities

Challenges:

-

High upfront costs for electric and smart forklifts

-

Lack of trained operators and safety compliance awareness

-

Inconsistent service infrastructure in remote locations

Opportunities:

-

Increasing demand from Tier 2 and Tier 3 cities

-

Expansion of green logistics zones

-

Forklift-as-a-service (FaaS) business models

-

Customization for Indian terrain and use-cases

If you’d like to explore more of my trending blogs, this reflects the evolving dynamics and transformations currently shaping the market.

Conclusion

The India Forklift Market is set for a major transformation, fueled by a logistics-first policy approach, warehouse modernization, and the growing appeal of automation. By integrating digital technologies, eco-friendly powertrains, and learnings from the USA Forklift Market, Indian manufacturers and operators can unlock massive operational gains and global competitiveness.

As India’s supply chain backbone strengthens, forklifts will continue to play a central role in enhancing productivity, reducing downtime, and supporting the country’s ambitious industrial growth story.