Stop Worrying About Gun Control and Get Financial Control

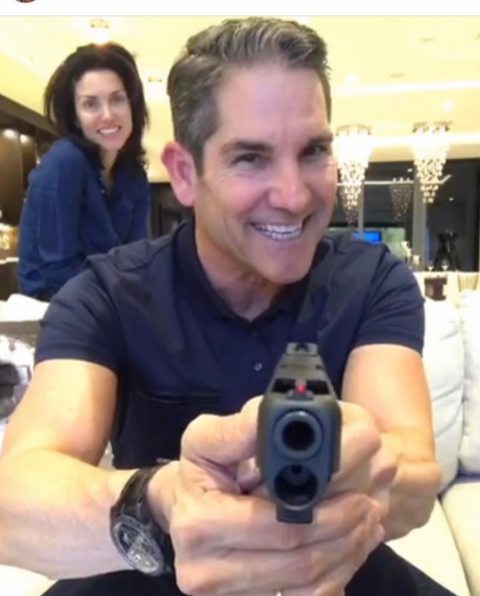

Years ago when I was trying to get a first date with the woman who would later become my wife, I found out that she was into shooting guns. I then pursued this information regarding shooting and found out that Elena was one of the top ten women clay shooters in the state of California. I called the L.A. Gun Club, rented the shooting range, and hired the best coach in Los Angeles for the following Saturday. I got the date and took her out for a day of shooting.

Since that day my wife has become even more proficient with handguns.

My job is to take care of my family, my business, and myself. That requires me to be unreasonable. If someone attacked you with a gun, would you be unreasonable or would you make sense of that gun? If a bomb went off in your building, you would be unreasonable and do whatever it takes to protect yourself, your business and your family?

There are 300 million guns in the US but over 4 billion prescription meds subscribed annually. Are guns the problem or drugs? Let’s face it, more people die from prescription drugs.

Instead of worrying about gun control, you need to get a handle on money control. If your finances are out of control, how can you take care of your family, your business and yourself?

Money control starts with putting an end to saying things like, “Money won’t make me happy” because that’s false. People who are just getting by talk about money as though it’s a bad thing—but I promise you having massive amounts of money isn’t going to be a reason you’ll ever be unhappy.

Here are two mistakes that most “normal” people make that the wealthy don’t.

#1 Not Using Debt—

You’ve been told don’t use it, never use it, it’s evil. My boy Dave Ramsey says all debt is bad debt. If you do your homework and don’t just listen to the popular thinking that debt is somehow killing everyone, you’ll understand there are different kinds of debt. There’s time to use debt and there’s time not to. When do you use debt? There’s no always in anything.

All big companies use debt. Debt can be used to expand a business. Debt is my ability to go into the marketplace and produce more income, not buy more things. I never use debt for consumption. Consumption is things like groceries or cars. Not all debt is created equal. I use debt to build income. Debt is me going to the bank to borrow money to build my business. Look at Apple, they have $270 billion in cash. They borrow money from Japan. Why? Because they can use debt cheaper to explode income, to invest in equipment, and to do research to blow up their top line.

I have hundreds of millions in debt. I’m not paying it—the tenants who live in my apartment buildings are paying down my debt while I get the write-off from the interest they are paying. So when do you use debt? When it makes you more money, when you get a write-off, and when you can expand your business. Don’t believe that all debt is bad—get wealthy by using debt smartly.

#2 Looking at Prices—

You know the old saying that if you have to know the price you can’t afford it? That’s actually not true. Why are you looking at prices? If you’re looking at price you already have deceived yourself. Price is not your problem. The price is not what you are buying. I did this for years—I’d go to a restaurant and look at the prices on the menu. Do you think the super wealthy worry about the price of a steak or a cup of coffee?

Wealthy people don’t worry over price. They aren’t worried over a $30 book or a $1000 program. Their attention is focused on success. Be focused on your income. The average American makes $52,000 a year where the average cost of living is higher than $52,000 a year. 76% of all Americans live paycheck to paycheck in the wealthiest country in the world.

It’s no different for a person in America than it is for a guy in India making $2 a day. Neither has enough income. It’s no different. All the attention is on what things costs. Shift your attention away from price because price is not your problem. The problem is you don’t make enough income. Looking at prices is an indication that you’ve contracted financially. Get wealthy by focusing on your income, not prices.

If you’re not using debt and if you’re looking at prices, you are not in control financially. Better start worrying about that instead of blaming guns for all the worlds woes. Be sure to share this with someone you know who keeps complaining about guns but never has a word to say about their lack of control in money matters.

The truth is more people turn to crime because of a lack of money. Poverty is a problem. Prescription drugs are a problem. Me having a right to have a concealed carry and protect my family is not the problem.

Be great,

GC

Grant Cardone is a New York Times bestselling author, the #1 sales trainer in the world, and an internationally renowned speaker on leadership, real estate investing, entrepreneurship, social media, and finance. His 5 privately held companies have annual revenues exceeding $100 million. Forbes named Mr. Cardone #1 of the "25 Marketing Influencers to Watch in 2017". Grant’s straight-shooting viewpoints on the economy, the middle class, and business have made him a valuable resource for media seeking commentary and insights on real topics that matter. He regularly appears on Fox News, Fox Business, CNBC, and MSNBC, and writes for Forbes, Success Magazine, Business Insider, Entrepreneur.com, and the Huffington Post. He urges his followers and clients to make success their duty, responsibility, and obligation. He currently resides in South Florida with his wife and two daughters.

.jpg)

How fun!! Your wife is awesome. My man @amvanaken is teaching me how to shoot:) I agree we need to be protected and protect ourselves in many ways. Financial protection is huge too! Great info thanks for sharing :)

Financial control will help to make gun control.

When Steem goes to $100 and couple more investments go well, i'd stop looking at the price too lol..Gotcha hustle mate, been slacking lately. Thanks for the kick & you guys look really cool :)

Both are great things to keep in mind. I have yet to efficiently use debt, but I also do not owe much either. I get what your saying though, like the rich dad in rich dad,poor dad..? And I also agree that prescription pills are worse than guns currently! Thanks for the thoughts, you are appreciated!

Blastin dem Haters 😂😂😂

People are curious about the unknown. I am so

But I do not think so much about guns can hurt.

Thank you.

That's my mentor giving me a new lesson today on using debt. I especially hate to owe debts. It gets me depressed thinking all day what the person will think of me. And again you've confirmed the thought I shared this morning https://steemit.com/curation/@desmonddesk/the-choice-factor-why-you-should-become-wealthy-daily-dose-day-3 I had referenced you @grantcardone while emphasizing the need to be wealthy and invest in real estate. Smiles....

Like I mentioned in my post which you have confirmed, if we put our families as our priority, we will need money to keep them protected. Then if so, why do some think making more money or being wealthy too is evil?

Thanks for sharing sir. My Real Estate mentor.

Meanwhile sir, your wife is beautiful. Your twin. Has anyone told you that?

I am @desmonddesk

Your #1 Fan on steemit

Debt is an amazing tool. I know that Dave Ramsey helps a lot of people. But I do not agree on his stance on debt or real estate. Real estate can be an amazing investment paired with debt used the right way. I also don't agree with good and bad debt argmuments. I think there is good and bad debt, but it does not matter what the debt is against, but what the terms of the debt are and what it is used for. I have a loan on my Lambo, which seems like bad debt to many. But I make so much more money with that debt than the 4 percent interest rate on the loan.

"So when do you use debt? When it makes you more money, when you get a write-off, and when you can expand your business. Don’t believe that all debt is bad—get wealthy by using debt smartly." That is my quote of the day. Thank you.