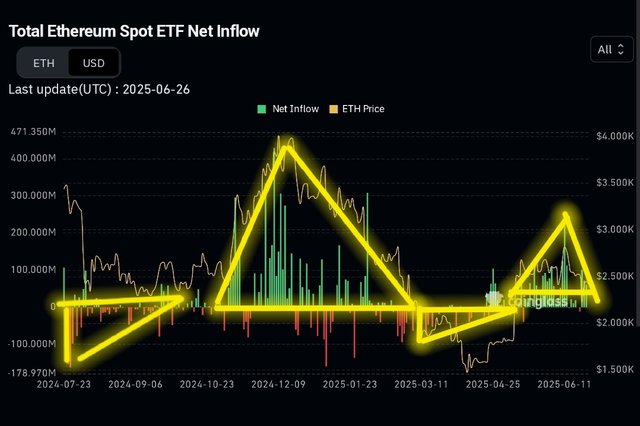

Since July 2024, net inflows of spot ETH ETFs have driven ETH price.

Do you remember that spot ETH ETFs were approved by the U.S. 🇺🇲 SEC(Securities and Exchange Commission) last July?

After the inception of spot ETH ETFs trading, when the net inflows were negative(Red), ETH price had price corrections or consolidations.

However, when the net inflows were positive(Green), ETH price was bullish.

Since this May, retail investors and institutions started buying spot ETH ETFs again. I'm not sure it will last more until later this year. But, if the Fed starts cutting rates again, global liquidity will likely flow into spot ETH ETFs.

Take a look at the total net inflows of spot ETH ETFs. It's around $4b, which means they're still holding around $4b worth of ETH as an ETF, and they endured three major price corrections and consolidations. They've not left this market! That's why I still presume this market isn't done.

@happycapital, great to see your analysis trending! This is exactly the kind of insightful, data-driven content the Steemit community needs. I appreciate how you've clearly illustrated the correlation between ETH ETF inflows and price action. The Coinglass charts really drive home the point!

Your forward-looking perspective, especially considering potential Fed rate cuts, is spot on. It's valuable to have someone connecting these macroeconomic factors to the crypto markets. I'm curious to see what the community thinks - do you see this trend continuing, and what other factors might influence ETH ETF performance? Let's discuss!

Congratulations, your post has been upvoted by @nixiee with a 43.177527822100224 % upvote Vote may not be displayed on Steemit due to the current Steemit API issue, but there is a normal upvote record in the blockchain data, so don't worry.