Are you missing the simple steps that create real wealth?

The Myth of the “Secret” to Getting Rich

In the popular imagination, the road to riches is paved with whispered stock tips, obscure asset classes, and the kind of arcane strategies only insiders understand. But scroll through the sprawling financial discussions and a very different picture emerges.

Here, in the messy honesty of online forums, the most valuable opportunities aren’t locked behind hedge fund doors. They’re hiding in plain sight — simple, almost obvious principles that most people understand in theory but fail to execute in practice.

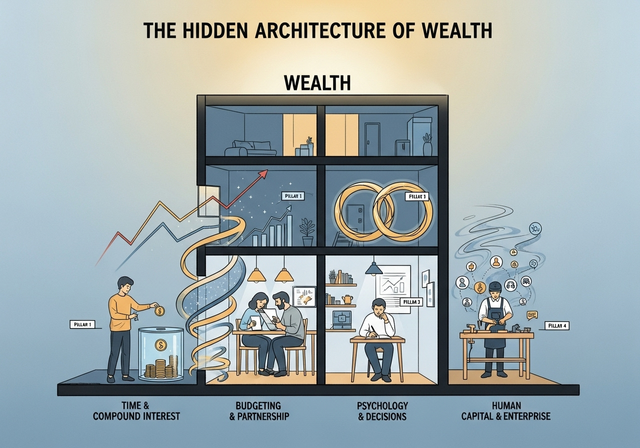

This isn’t a hunt for the magic investment. It’s a behavioral story — about human psychology, life choices, and the systems that nudge us toward (or away from) good decisions. After sifting through thousands of anecdotes, arguments, and confessions, four recurring “pillars” stand out as the quiet foundations of lasting wealth:

- Overcoming Financial Inertia – The costliest mistake? Never starting.

- The Partnership Multiplier – Why who you marry can be the biggest financial decision of your life.

- Winning the Inner Game – The battle against fear, greed, and regret.

- Redefining “Investment” – Seeing opportunity beyond the stock market.

Pillar One: Overcoming Financial Inertia

The Math Magic People Ignore

In thread after thread, there’s a tone of disbelief — and a touch of regret — when people finally grasp the sheer force of compound interest. One attorney trainer tells of high-earning young lawyers unmoved even by personalized growth projections. Others admit they understood the math but never felt the urgency.

A man in his 40s recalls that the small investments he made in his late 20s — which he forgot about for years — now make up half his retirement savings. Another, who started in his 30s, laments that reaching millionaire status will take him until 55, “which feels so old.”

The real enemy, it turns out, is “present bias”: the tendency to value today’s desires over tomorrow’s security. Charts and lectures rarely work. The trick is making the future feel real enough to act on now.

Why System Design Beats Willpower

Some of the most compelling success stories come from people who saved almost by accident. One man credits half his nest egg to his company’s switch from opt-in to opt-out 401(k) enrollment: “I forgot I was even contributing.”

Behavioral economists would nod knowingly. If inertia is the default human setting, the smartest play is to design systems that turn doing nothing into doing the right thing — automatic enrollment, default contribution increases, even policy nudges.

Starting Small to Break the Spell of Complexity

Finance intimidates. Many smart, capable people freeze at the thought of managing their own money. The antidote? Start small, early, and simply. The first $500 invested isn’t about the return — it’s tuition for learning the habit when the stakes are low.

Pillar Two: The Partnership Multiplier

Two Incomes, Not Double the Expenses

Romantic as it sounds, choosing a life partner may be your single biggest financial move. Couples in the know point to economies of scale — one rent or mortgage, one set of bills — and double the tax-advantaged accounts.

Maxing out two 401(k)s, two IRAs, and two HSAs can catapult savings. Add dual Social Security benefits and possible inheritances, and the math becomes compelling.

Why Alignment Beats Income

But raw income isn’t the magic. One frugal-minded spouse can accelerate financial independence faster than two high-earning spenders. As one man put it, “The size of your nest egg will be largely impacted by the chick you marry.”

Yet few couples talk about money before making the leap. Online veterans warn: treat financial compatibility as seriously as any other deal-breaker.

The Divorce Factor

If marriage can multiply wealth, divorce can vaporize it. From legal costs to asset splits, the financial damage can be permanent. Maintaining a healthy relationship isn’t just “soft” work — it’s financial risk management.

Pillar Three: The Psychological Battlefield

The Seduction of the “Sexy” Bet

Regret looms large in these communities — not just over what was lost, but over what was missed. Users replay “what if” scenarios about Amazon in ’98, Bitcoin at $5, or Tesla at its IPO.

But the long-term winners almost always tell a quieter story: decades of steady 401(k) contributions into broad index funds. “The boring non-sexy stuff is the best,” says one multimillionaire.

Living With Regret Without Letting It Drive You

Missed windfalls sting, sometimes for years. One man admits selling Tesla stock early cost him a $2 million paper gain. Another walked away from stock options worth millions to pursue love — and still feels the loss.

The wise learn to separate process from outcome. Documenting the thinking behind each decision — in a “decision journal” — helps inoculate against hindsight bias and the destructive urge to chase losses.

Market Timing: A Lesson Best Learned From Others

The cautionary tales are legion. One investor sold Tesla to lock in a $500,000 gain, planning to buy back in after a dip. The dip never came. The experience cured him of market timing for good.

Pillar Four: Expanding the Definition of Investment

Human Capital Pays the Biggest Dividends

The wealthiest contributors often credit not financial moves, but personal growth: leadership skills, empathy, networking. These pay off in promotions, negotiations, and opportunities for decades.

Small Businesses, Big Impact

Entrepreneurship appears in surprising forms — from niche YouTube channels to local service businesses solving very specific problems. The “big idea” is often just a small, well-executed solution.

Debt: Friend and Foe

High-interest consumer debt is poison. But low-interest leverage — used wisely — can amplify returns. And ignoring “free money” from employer matches or stock purchase plans is an equally costly mistake.

Conclusion – The Open Secrets of Wealth

What Reddit and Quora ultimately reveal isn’t hidden at all. Start early. Choose partners wisely. Master your own mind. Invest in yourself as much as your portfolio.

The challenge isn’t finding these truths — it’s living them, every year, for decades. The biggest missed opportunity isn’t ignorance. It’s inaction.