Stocks nudge up and Gold …

Aljif7's Blog

Friday 8 August, 2025

AREA: Finance

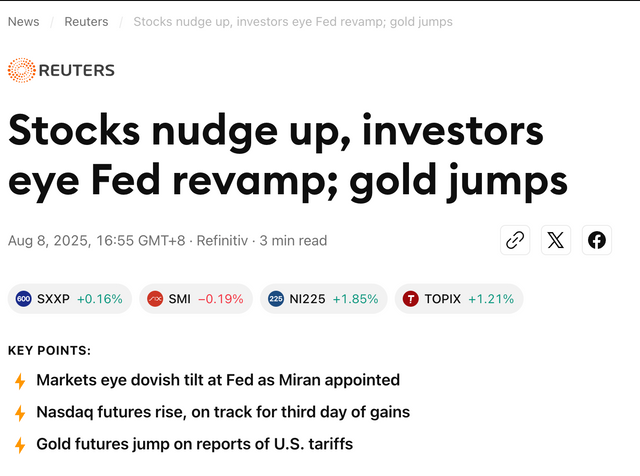

📊 Stocks Nudge Up, Investors Eye Fed Revamp; Gold Jumps

Key Points for today:

Markets Anticipate a Dovish Tilt at the Fed

- The appointment of Miran as the new Fed chair has sparked speculation about a shift toward a more dovish monetary policy stance. This expectation is driving optimism in equity markets, as investors hope for lower interest rates and increased liquidity to support economic growth.

Nasdaq Futures Rise, On Track for Third Day of Gains

- Tech-heavy Nasdaq futures continued their positive momentum, extending gains into a third consecutive day. This suggests that investors are increasingly confident in the resilience of tech companies, despite ongoing concerns about inflation and economic slowdowns.

Gold Futures Jump on Reports of U.S. Tariffs

- Gold prices saw a significant jump as reports emerged about potential U.S. tariffs on certain goods. Such trade tensions typically boost demand for safe-haven assets like gold, as investors seek protection against market volatility and geopolitical risks.

Gold price at the moment of this post is 3,488 USD.

Market Performance Highlights:

SXXP (Swiss Market Index): +0.16%

- The Swiss stock market index showed modest gains, reflecting broader global optimism.

SMI (Swiss Market Index): -0.19%

- Despite the overall positive sentiment, the SMI experienced a slight dip, indicating mixed investor sentiment within the Swiss market.

NI225 (Nikkei 225): +1.85%

- Japanese stocks performed strongly, with the Nikkei 225 leading gains among major indices. This could be attributed to improving economic data and expectations of further stimulus measures.

TOPIX (Tokyo Stock Exchange Price Index): +1.21%

- Similar to the Nikkei 225, the TOPIX also rose, benefiting from positive regional and global market trends.

What’s Driving the Market?

Fed Expectations: The appointment of Miran, known for her鸽派(dovish)立场,has shifted investor focus toward potential rate cuts or slower tightening cycles. This could provide relief to heavily indebted sectors and boost consumer spending.

Tech Sector Resilience: The continued rise in Nasdaq futures indicates that tech companies are weathering economic headwinds better than expected. Strong earnings reports and innovation-driven growth prospects are likely contributing to this resilience.

Geopolitical Uncertainty: Reports of U.S. tariffs have heightened concerns about trade disruptions and supply chain challenges. As a result, investors are flocking to gold as a hedge against uncertainty.

What to Watch Next:

Fed Policy Meeting: The upcoming Fed meeting will be crucial in determining the direction of interest rates and monetary policy. Any hints of a dovish pivot could further fuel market optimism.

Earnings Season: As companies continue to report quarterly earnings, investor attention will shift toward corporate performance and guidance for the remainder of the year.

Trade Developments: Escalating trade tensions between major economies could lead to further volatility in markets. Investors will closely monitor any developments regarding tariffs and negotiations.

Final Ideas:

Today’s market movements reflect a delicate balance between optimism over potential Fed policy changes and caution due to geopolitical risks. While equities showed resilience, the surge in gold highlights lingering uncertainties. Investors will need to stay vigilant as key events unfold in the coming weeks.