India Water Purifier Market Size & Share 2025: Growth Analysis, Statistics and Forecast Report 2033

India Bancassurance Market 2025-2033

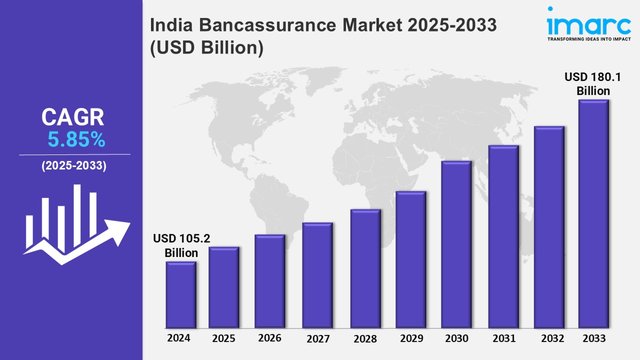

According to IMARC Group's report titled "India Bancassurance Market Report by Product Type (Life Bancassurance, Non-Life Bancassurance), Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture), and Region 2025-2033", the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Bancassurance Industry ?

The India bancassurance market size was valued at USD 105.2 Billion in 2024 and is projected to grow to USD 180.1 Billion by 2033, with an expected compound annual growth rate (CAGR) of 5.85% from 2025 to 2033.

India Bancassurance Market Trends:

India's market for Bancassuration is going through significant changes due to consumer taste as well as technological progress. Banks and insurance companies are working together to provide specific insurance products that take advantage of Bancassurance as low -cost distribution channels. Digitalization plays an important role in this, as banks are adopting AI-powered platforms and mobile applications to accelerate policy sales and claims processing. In addition, increasing middle class and increasing financial literacy is increasing the demand for bundle insurance options such as health, life and motor insurance, which are associated with banking products.

In addition, the support of regulatory agencies like IRDAI (Insurance the Regulatory and Development Authority in India) is encouraging innovations that encourage banks to diversify the limits of insurance products that they provide. Another major change is a step for customer-focused business models, in which banks appoint data analytics to customize their offerings and increase customer retention. Apart from this, the cooperation between traditional banks and fintech companies will further promote market growth through increasing access and ease of use. Along with paperless transactions, E-KYC (Electronic knows its customer) is simplifying the policy to pay attention to procedures that make the Bancassuance more efficient. These development collectively point to a developed market in which technological progresses and alliances with strategic partners are changing in such a way that insured are changing the way they distribute their products through banks.

Request Free Sample Report: https://www.imarcgroup.com/india-bancassurance-market/requestsample

India Bancassurance Market Scope and Growth Analysis:

Aided by the growing penetration of huge networks and insurance of banks in India, India has a major possibility of market development. Banks are an excellent platform for insurance companies, especially in semi-urban and rural areas, with their giant customer base, with their giant customer base. In addition, increasing awareness about financial safety and the advantages of insurance are leading to greater acceptance of products from the banksurons industry. In addition, due to the increasing need of security-based products through princes, such as pushing for financial inclusion by the government, life and health insurance segments are predicted to become the most popular.

In addition, bangsunces are becoming popular with young generations that are more comfortable with the feature of digital transactions on traditional insurance. This market is also benefiting due to the arrival of private sector players, offering new products that offer flexible premium options. Apart from this, banks are investing in improving the cross-selling capabilities of their employees and increasing the overall efficiency of the market. With a favorable regulatory structure and increasing confidence between consumers in banks and banks, the market is ready to continuously grow with attractive opportunities for banks and insurers for banksurons.

India Bancassurance Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India bancassurance market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Regional Analysis:

- North India

- West and Central India

- South India

- East India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=4628&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145