Best Dividend ETFs for European Investors in 2025: Low-Fuss, High-Quality Choices

“Compound interest is the eighth wonder of the world. He who understands it, earns it.” — Attributed to Albert Einstein.

I’m a big believer in building wealth the calm, steady way. Not with hype. Not with guesswork. With a plan. For most people—especially beginners—long-term investing in diversified, high-quality funds is the safest and most effective path to financial freedom. In this guide, I’ll walk through why long-term investing matters, why dividend strategies shine, and how European investors can build a smart income-focused portfolio—even without access to popular U.S. funds like SCHD. I’ll also introduce a standout option: Fidelity Global Quality Income UCITS ETF (FGEQ). It’s one of my favorite dividend ETFs for European investors who want reliable dividends with global diversification.

Let’s get into it.

Why Invest—And Why Think Long Term

Investing isn’t about timing the market—it’s about time in the market. Markets go up and down in the short term, but over long periods, quality companies tend to grow earnings and reward shareholders through dividends and appreciation. Staying invested helps capture compounding: reinvested dividends buy more shares, which produce more dividends, creating a snowball effect over years.

For beginners, long-term investing:

Reduces risk from daily volatility by focusing on decades, not days.

Keeps decisions simple: automate contributions, reinvest dividends, and stay the course.

Aligns with real goals—financial independence, travel freedom, and peace of mind.

Dividend vs. Growth vs. Value: What’s the Difference?

Dividend investing focuses on companies that share profits with investors through regular cash payments, often from mature, cash-rich businesses.

Growth investing targets companies reinvesting heavily to expand, prioritizing revenue and earnings growth over immediate payouts.

Value investing looks for undervalued stocks with strong fundamentals trading below intrinsic value, sometimes including dividend payers.

Why dividends can be powerful:

They provide tangible cash flow that can be reinvested or used as income—great for building passive income streams.

They encourage discipline and reduce the temptation to chase hot trends.

Historically, dividends have contributed a meaningful portion of total stock market returns over long horizons.

Dividend investing isn’t about “high yield at any cost.” It’s about reliable, growing payouts from high-quality companies. That’s where smart dividend ETFs come in.

Why Diversification Matters—And Where Dividends Fit

Putting money into a single stock is like flying without a parachute. One unexpected earnings report can wreck a portfolio. Diversification spreads risk across sectors, countries, and companies, reducing the impact of any single disappointment. Dividend ETFs can be a one of the strong components because they:

Hold dozens or hundreds of companies, spreading risk.

Tilt toward profitable, established businesses.

Offer consistent income, which can stabilize returns in choppy markets.

Dividend ETFs shouldn’t be the only holding, but they deserve a spot in a balanced strategy—especially for investors seeking predictable cash flow and long-term compounding.

The SCHD Problem for Europeans (And the Workaround)

In the U.S., SCHD (Schwab U.S. Dividend Equity ETF) is a rockstar among dividend ETFs thanks to its quality screen and strong track record. However, European investors can’t buy U.S.-domiciled ETFs like SCHD due to PRIIPs regulations and KID documentation requirements. The solution? Use UCITS-compliant European ETFs that follow similar quality and dividend-growth principles.

The Four Best Dividend ETFs for European Investors

Here are four excellent, accessible ETFs for Europe-based investors who want dividend income with quality and diversification. These cover U.S. and global angles so you can select the one that is aligned with your investing strategy.

Fidelity Global Quality Income UCITS ETF (FGEQ)

What it is: A global, quality-focused dividend ETF from Fidelity, designed to capture companies with durable profitability and sustainable dividends across regions.

Why it stands out: Emphasis on “quality” helps avoid yield traps and prioritizes consistency, not just high payouts.

Use case: Core global dividend holding for long-term investors seeking resilience and broad diversification.

WisdomTree U.S. Quality Dividend Growth UCITS ETF (DGRW)

What it is: European UCITS version of a popular U.S. strategy that targets companies with strong profitability and dividend growth characteristics.

Why it stands out: Focuses on future dividend growth potential tied to earnings quality, not just historical yield.

Use case: A strong U.S. sleeve within a global dividend strategy for those who want growth plus dividends.

iShares MSCI World Quality Dividend UCITS ETF

What it is: A global developed-markets dividend ETF that screens for quality and sustainability of dividends.

Why it stands out: Broad global coverage with a persistent quality tilt and diversified sector exposure.

Use case: Complement or alternative to FGEQ for global dividend exposure with a large-cap bias.

Vanguard FTSE All-World High Dividend Yield UCITS ETF

What it is: A high-dividend global ETF capturing companies with above-average yields across developed and emerging markets.

Why it stands out: Massive diversification and straightforward methodology focused on income.

Use case: A yield-tilted global building block that can pair well with quality-focused funds like FGEQ or DGRW.

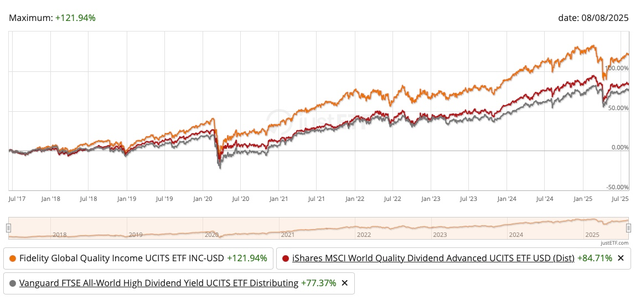

Below is the performance comparison in terms of total return (including dividends) of the three Global ETF options mentioned above.

Image from JustETF.Com

Don’t Chase Yield—Focus on Total Return

When choosing a dividend ETF, there is a critical thing that you need to consider. High yield can look tempting, but it doesn’t tell the whole story—total return does. Total return captures both price growth and dividends (including the boost from reinvesting payouts), giving a better picture of how an ETF actually grows wealth over time. A sky‑high yield can even signal risk, like weak fundamentals or future cuts, while a quality ETF with moderate yield plus steady appreciation can deliver stronger, smoother compounding over the long run. In short: judge dividend ETFs by total return first, then yield—because compounding and price gains are what move the needle for long-term investors.

Introducing Fidelity Global Quality Income UCITS ETF (FGEQ)

FGEQ sits at the intersection of what long-term dividend investors want: quality, diversification, and reliable income.

What makes it compelling:

Global exposure: Access to dividend payers across the U.S., Europe, and developed markets for balanced risk.

Quality-first approach: Targets companies with strong profitability and sustainable cash flows—key to maintaining dividends through cycles.

Income you can build on: Designed to deliver regular distributions with the stability of global, high-quality businesses.

UCITS compliant: Fully accessible for European investors seeking a core dividend ETF.

This combination makes FGEQ a strong candidate for the core dividend position in a European investor’s portfolio.

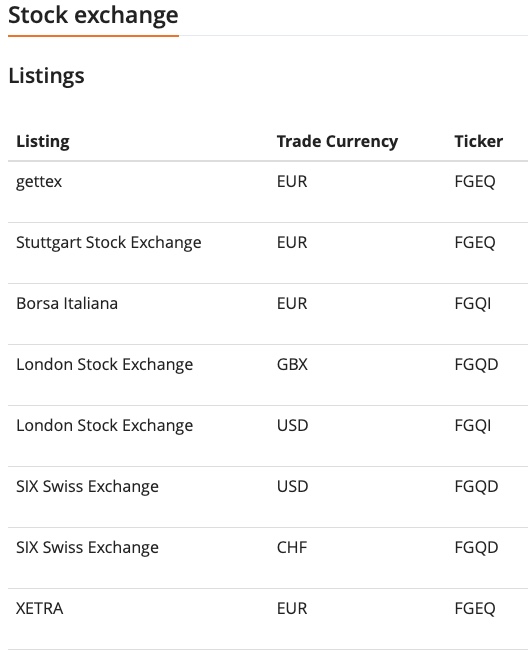

Fidelity Global Quality Income ETF is traded in a number of stock exchanges in EU & UK with different ticker. It's also available in different currencies (EUR, GBX, USD, CHF). You can use the below table from JustETF.com to find the best option that fits your portfolio.

dividend ETFs for European investors

Image from JustETF.Com

Mind the Taxes: Dividends Aren’t Always Advantageous

Before chasing yield, check how dividends are taxed where you live—and where the ETF is domiciled. Many countries withhold tax at source on dividends, and if that tax can’t be fully credited or reclaimed in your home country, it can erode returns far more than expected. Rates and rules vary widely across Europe, and in some places dividends face higher taxes than capital gains, making accumulating ETFs or total-return strategies more efficient for certain investors. Always review local rules on withholding taxes, credits, and treaty rates—or talk to a tax professional—because dividends aren’t equally beneficial in every country.

How to Buy FGEQ as a European Investor

Getting started is straightforward: open a brokerage account that offers UCITS ETFs and search for “FGEQ” (Fidelity Global Quality Income UCITS ETF). Platforms popular with European investors—like Interactive Brokers ,Trading 212 or Lightyear—provide access to FGEQ and make it easy to set up recurring buys and dividend reinvestment for hands-off compounding. If you are just starting, you can register through the affiliate links on the blog to unlock any available sign-up perks, then automate contributions and stay consistent—simple, steady, and built for the long run.

Key Takeaways

Long-term investing wins because compounding needs time—and dividends turbocharge that compounding when reinvested.

Diversification is non‑negotiable; dividend ETFs help spread risk across sectors and countries while delivering cash flow.

U.S. favorites like SCHD aren’t available to EU investors, but UCITS alternatives like FGEQ and DGRW deliver quality, income, and accessibility.

Fidelity Global Quality Income UCITS ETF (FGEQ) stands out as a best‑in‑class core option for European investors seeking sustainable dividend income and global diversification.

Conclusion

I like simple portfolios that work while life happens. Dividend ETFs keep things steady, pay you along the way, and help your wealth compound quietly in the background. For European investors, Fidelity Global Quality Income UCITS ETF offers a smart, quality-first way to capture global income without overthinking it.

Stay diversified.

Reinvest.

Be patient.

That’s how we build freedom—step by step, year by year.

-You can find more investing guides and ideas on [Travel & Invest Blog] (https://travelandinvest.com/)

-This article was initially published on [Travel & Invest Blog] (https://travelandinvest.com/best-dividend-etfs-europe/)

-© 2025 [Travel & Invest Blog] (https://travelandinvest.com/) All rights reserved.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Investing in the stock market carries risks, including the potential loss of principal. Before making any investment decisions, it is essential to conduct thorough research and consider consulting with a qualified financial advisor. Additionally, please note that investment platforms and brokers may have specific terms, conditions, and fees that should be carefully reviewed before opening an account or executing trades.