RE: TIB: Today I Bought (and Sold) - An Investors Journal #291 - Turkey, Greece, Airlines, Video Gaming, Japan Govt Bonds

What the charts tell me is that in the last 12 months Greece has not under-performed a European index. Yes it has been a whole lot more volatile.

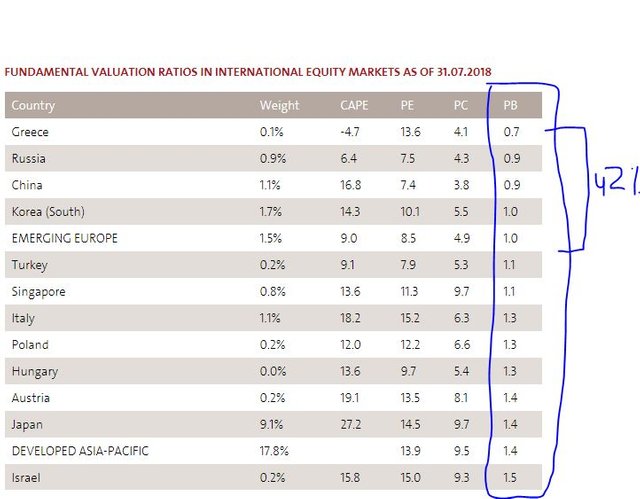

What the Price to Book Valuation table tells me is the book values are low. If they have taken enough action to write down the book values, there is potential for stock values to rise. There is a 42% gap in valuation to Emerging Europe and more to Turkey. Close half that gap and there is a 20% stock advance.

Is all the bad news is already in the price? Is most of the bad news in the price? Can it get any worse? How much worse can it go? That is the step of belief in making the trade.

https://www.starcapital.de/en/research/stock-market-valuation/

Now Turkey is a different situation. Yes it has a PB of 1.1. It can go down to where Emerging Europe is or worse to where Greece is.