TIB: Today I Bought (and Sold) - An Investors Journal #322 - US Retail, Corn, US Interest Rates

Volatility is back with big intraday swings. News flow was about Brexit and China. Trade action is taking a short term view on the US Consumer and back short on US Interest rates. Margin calls get covered selling corn for profit.

Portfolio News

Market Selloff With a rout in Europe financials on Brexit news US markets started on a low footing

Markets got worse and then rebounded to close higher for the day led by tech stocks who like the sound of a softening stance on trade talks between US and China.

The real news of the day flowed around Brexit. While Theresa May did win approval from her Cabinet for the new EU deal, she did lose her Brexit minister plus a few others. That spooked the pound which dropped dramatically after a quiet day the day before. So much for me thinking the pound felt the deal would pass Parliament - it does not think that any more.

Another wild day in Natural Gas. Inventory data pointed to rising stocks but price moved a whole lot more than that data would support - sounds to me like a mighty squeeze caught out a few traders at the open with a gap down of nearly 10% on the United States gas Fund ETF (UNG ). The squeeze is on long oil - short natural gas trades.

Cannabis Carnival Canada is running out of supplies.

What has gone wrong? It seems that the real problem is the regulations that apply for growing are burdensome and suppliers have not been able to come on stream as fast as they would like. There is talk that it could take more than a year for supplies to catch up with demand. Oh, the joys of forecasting in a new industry - I remember doing it in the Dot Com era - we mostly made it up. The lessons flow through to picking stocks - pick those with proven production and distribution capacity.

https://globalnews.ca/news/4662574/legal-marijuana-canada-shortage-cannabis-producers/

Bought

SPDR S&P Retail ETF (XRT) US Retail. Jim Cramer talked about a technical setup for Home Depot (HD) which could be applied to US Retail ETF (XRT) - been profitable every year for 33 years.

Buy on Thursday before Thanksgiving (Nov 22) and close 10 days after.

I am comfortable with US consumer spending and thought I would explore an options trade to test out the idea on XRT. I chose XRT as it is an equal weighted ETF rather than the Van Eck Vectors Retail ETF (RTH) which is a market capitalisation weighted ETF. I felt that it was weighted too heavily specifically to Amazon (AMZN). I am already holding the XRT stock - hence looking for options. I selected weekly options with options expiry of November 30 - 8 days after Thanksgiving. I did look back a few years and found about a 5% uptick in price from the week before Thanksgiving - that set the range for the spreads. Bought November 30 47.5/50 bull call spread for net premium of $0.73 offering maximum profit potential of 242% if price closes above $50 on November 30 - i.e., a 5% move.

Let's look at the charts which shows the bought call (47.5), and breakeven as pink rays and the sold call (50) as a red ray with the expiry date the dotted green line on the right margin.

I have checked price scenarios for the same period in prior years and cloned one of them across to now (the pink arrow). The trade has a chance of reaching the maximum profit potential - might be a little bit short. What I like is price has just to get back the last highs to make the max.

Sold

Corn Futures Japan Governemnt Bonds prices spiked pushing my IG Markets account into margin call (again). I closed out one of my long Corn contracts to book profits and release margin. Profit was 21.2 points per contract (6%). The chart shows a tidy entry and exit.

Trade holding costs are quite high - smarter approach might be to run this as a trading position and trade the reversals rather than holding through the consolidation phases. Profit on the trade more than covered holding costs even leaving some behind to fund Bitcoin holding costs.

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ). With margin improving in my IG Markets account as Japan Bond yields rose I added back one more short contract to replace those closed yesterday using a reversal on a 4 hour chart.

Expiring Options

Invesco QQQ ETF (QQQ): Nasdaq Index. Nasdaq moved up overnight but stayed below the level of the sold put (173) - I decided to leave the trade open and will close out tonight before expiry. The after hours results from Nvidia (NVDA) and Applied Materials (AMAT) are sure to drag Nasdaq index down on Friday, irrespective of what China trade discussions news is - my view

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $442 (7.8% of the high). Price pushed lower than prior day's low but closed above the support level (the dotted green line two from the bottom). Buyers are keen to snap up Bitcoin anywhere around the $5500 level. The day's volatility was totally normal for Bitcoin a short 3 or 4 months ago - get used to it again as those days are back.

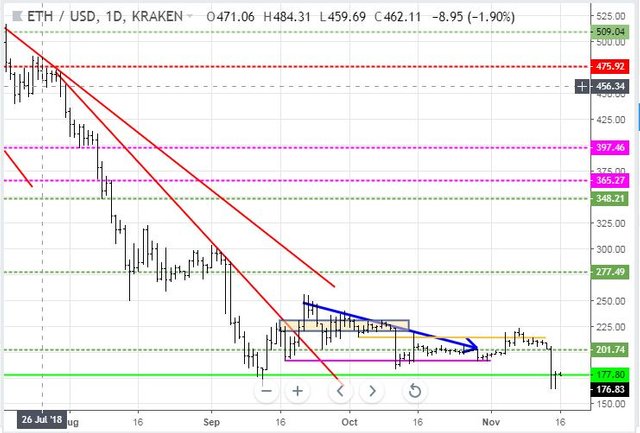

Ethereum (ETHUSD): Price range for the day was $16 (8.8% of the high). Price matched the low from the prior day and also closed above the support level (fluoro green line). The surprising part of the day was volatility was not very different to Bitcoin.

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-69%), ZEC (-63%), DASH (-66%), LTC (-54%), BTS (-58%), ICX (-83%), ADA (-72%), PPT (-82%), DGD (-83%), GAS (-86%), SNT (-61%), STRAT (-78%), NEO (-83%), ETC (-62%), QTUM (-78%), BTG (-72%), XMR (-42%), OMG (-69%).

Coins moved in a tight band of 1 or 2 points down. XMR dropped 3 and BTS 4. This small drop really surprised me given how much Bitcoin and Ether dropped. ETC (-62%) and XMR (-42%) dropped a level. GAS (-86%) slid another point and remains the worst coin.

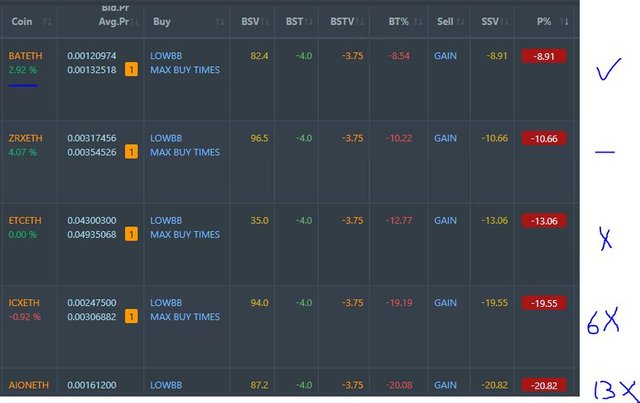

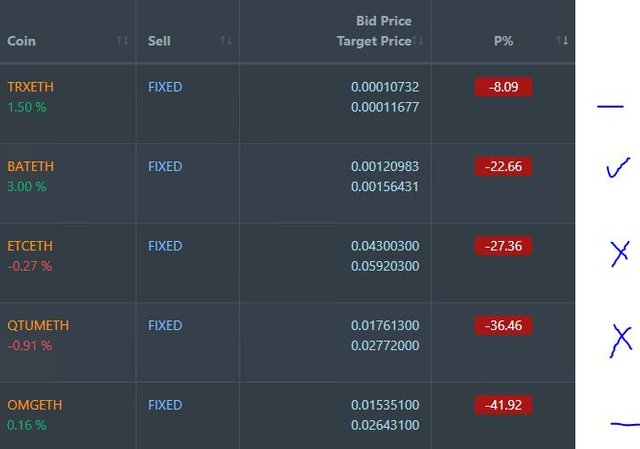

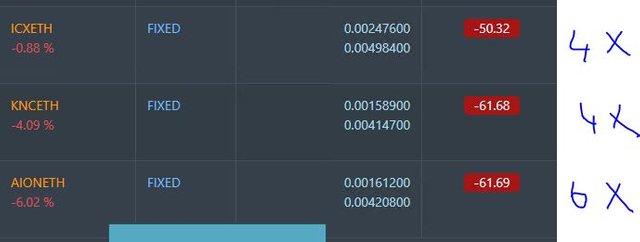

Profit Trailer Bot No closed trades.

There remain 5 coins on the Dollar Cost Average (DCA) list. 1 coin improved and 1 traded flat with 3 worse and AION dropping 13 points. I will add ZRX to PT Defender action

Pending list remains at 8 coins with 1 coin improving, 2 coins trading flat and 5 worse. This looked better than I expected

PT Defender continues defending 6 coins with no changes.

New Trading Bot Trading out using Crypto Prophecy. No closed trades. Trades open on VET, TRX, SC and NXS. Only TRX looks like it can close some time soon.

Currency Trades

Forex Robot closed 4 trades (0.13% profit) and is trading at a negative equity level of 1.9% (higher than prior day's 1.7%).

Outsourced MAM account Actions to Wealth closed out 2 trades for 0.66% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

November 15, 2018