TIB: Today I Bought (and Sold) - An Investors Journal #491 - Online Retail, French Utility, Dutch Bank, Marijuana, US Fast Food, Emerging Markets, Australian Bank, Corn, Soybeans, Bitcoin, Ethereum, Ripple

Mood in markets feels upbeat - is this a warning? Find a cash neutral way to invest in Amazon. Perfect storm in cryptocurrency and agricultural commodities and weekend markets smashes leveraged trading strategy.

Portfolio News

Market Rally

Markets continue to edge higher

Some say nervously. As I listen to the talking heads, there seems a level of confidence that the trade deal will happen and markets are reflecting that.

Agriculture commodity prices are telling a different story with big drops in prices every time there is a wrinkle in the trade news.

Cannabis Carnival

US House of Representatives takes a further step to decriminalize marijuana at Federal level.

The House Judiciary Committee has approved a bill Wednesday that would decriminalize marijuana at the federal level. The Marijuana Opportunity Reinvestment and Expungement Act of 2019, or MORE Act, passed 24-10 after more than two hours of debate. It now heads to the full House. The bill would remove marijuana from the list of federally controlled substances, allow states to set their own marijuana policy and require federal courts to expunge prior convictions for marijuana offenses. A 5% tax on marijuana products would also establish a trust fund for programs designed to help people disproportionately impacted by the "war on drugs," including job training and treatment for substance abuse.

Marijuana stocks jump all around the world

Bought

Amazon.com, Inc. (AMZN): US Retail. One of the talking heads was asked about his trade of the day - Amazon. He says people have been watching it move and say they will wait for a pullback which never comes. I have nibbled at it buying 2 shares at a time - 1 share is $1745. He then talked about price action - has seen on a long uptrend (green line) but is now 18% off the 2019 highs and has held above support at $1660 a few times. If the market keeps moving upwards, there is scope to get 18% upside with only 4% stop loss protection needed.

Now the challenge with Amazon is the high price - I looked for ways to enter a trade using options. A January 2022, 1750/1930 bull call spread carried an option premium of $85 which means one needed $8,500 to buy 1 contract. I then looked to find what premium I could get for selling a 1660 strike put option sometime with earlier expiry. I landed up at June 2020. Bought a 1750/1930/1660 call spread risk reversal with call spread premium of $75.86 funded by the sold put premium of $85.76 (i.e., I got paid $9.90 per contract = $990). The call spread has maximum profit potential of 137% for a price rise of 11% with price protection at 5%. Risk in the trade is that if price falls more than 5% and stays down lower before June 2020 expiry. A quick look at the base chart.

The uptrend is clear. The short term support at $1660 has been tested 3 times in 2019. The technical factors to be wary of - double top testing $2025; potential head and shoulders formed; support is above the 0.618 Fibonacci retracement level which was tested in December 2018; price did make a lower high and two lower lows at the same time the S&P500 made higher highs.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

ENGIE SA (ENGI.PA): French Utility. Trade made off a chart cycling on a new uptrend having another go at breaking a long downtrend.

Price has made 3 cycles after the late 2018 lows and has retested back to the trend line. Dividend yield 5.35% is attractive. I did also buy January 2023 14.58 call options - just looking for a long term continuation of price on a blue arrow price scenario.

ING Groep (INGA.AS): Dutch Bank. I did write in TIB490 that ING was maybe the better bank to buy in Europe - so I did just that to average down entry price in one portfolio. I also wrote covered calls against the new holding.

Schlumberger (SLB): Engineering Services. Added a small holding - Jim Cramer idea. Dividend 5.77%. I also wrote covered calls against the new holding.

Canopy Growth Corporation (WEED.TO): Canadian Marijuana. Marijuana markets have been in turmoil. They took a big jump when the MORE Act passed committee stage. I had written covered calls at $24 on Canopy Growth last week. Price jumped well over the sold strike during the week. Rather than buy back the calls, I bought another parcel of stock to average down. As it happens, price sagged to close back closer to the sold strike at $24.47. I want to stay invested.

Starbucks Corporation (SBUX): US Fast Food. Price has held up since my first small parcel purchase. Rounded up my holding to be able to write covered calls following a Jim Cramer idea to top up. Immediately wrote a covered call.

iShares MSCI Emerging Markets ETF (EEM): Emerging Markets Index. Taking a longer view that emerging markets will benefit from US-China trade deal progress, bought a January 2022 44/50 bull call spread. With a net premium of $1.20 this offers maximum profit potential of 400% for a 16% improvement from $42.87 closing price.

Sold

Margin closures in agriculture

Corn Futures (CORN): Corn. 2.7 contracts closed for average loss of $47.53 per contract (10.7%)

Soybean Futures (SOYB): Soybeans. 0.2 contracts closed for average loss of $46.50 per contract (4.9%)

Shorts

Westpac Banking Corporation (WBK): Australian Bank. Westpac share price fell hard after they were charged for failing to report money transfers under money laundering regulations.

I closed out the short position for a 12% profit since March 2019 (8.4% effective profit as I had to pay away the last dividend). The story seems a lot worse as some of the remittances not reported related to payments relating to child pornography images. I will close out the other short position I have overnight. The original trade was predicated on a softening Australian housing market - action by Reserve Bank of Australia to drop interest rates has reduced that possibility = solid alternate exit.

Expiring Options

Cisco Systems, Inc. (CSCO): Network Equipment. With price closing at $44.85, strike 45 put options I sold are exercised. I took delivery of the stock and immediately sold a covered call against it.

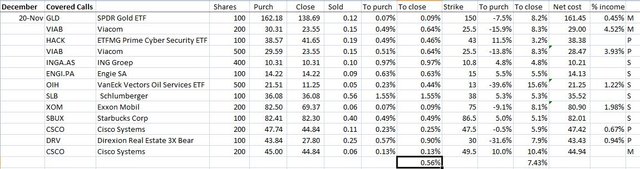

Income Trades

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. With price closing at $26.76, strike 26 naked put expired in my favour. I will write again overnight again at $26.

13 covered calls written at an average premium of 0.56% with coverage ratio of 7.43%. With one week already passed this equates to 0.74% average premium.

Cryptocurency

Bitcoin (BTCUSD): Price range for the five days was $1446 (17.5% of the high). price tried a bounce in no mans land and then failed dropping through the bottom of the last consolidation range ($7761) and took out the previous low. It tried to recover around $6800 and failed heading back to that level.

Something has spooked Bitcoin holders => I am going to suggest China and Hong Kong with so much Bitcoin mining activity in China, they hold more than most. The edgy news out of US-China trade negotiations does not help.

Ethereum (ETHUSD): Price range for the five days was $39 (22% of the high). With collapse in Bitcoin price, price dropped away from the $177 level and plumbed right below prior lows and tested support at $146 briefly before failing there too. Next level down is $132.

Ripple (XRPUSD): Price range for the five days was $0.03995 (15% of the high). Price did push up from support at $0.24754 for two days and then followed Bitcoin down and is now testing the prior spike low as I write this

The big drop in crypto and agricultural commodity prices hit at the same time. This drove major margin activity in one of the night sessions (for me) in my IG Markets account. They closed out a whole tranche of my positions - disappointing part is they chose to close most of the crypto positions rather than the agriculture positions. I would have closed out the positions that had the highest margin requirements (i.e., larger in size).

Bitcoin: 3.1 contracts closed for average loss of $3213 per contract (29%)

Ethereum: 48 contracts closed for average loss of $334 per contract (64.7%)

Ripple: 150 contracts closed for average loss of $0.16181 per contract (10.7%)

The trading strategy is high risk using leverage to buy and hold for the long term on markets that trade 24 hours a day, including the hours I am asleep. Time to stop doing it this way and just buy and hold on an average down basis or to use funds to buy crypto mining contracts.

CryptoBots

Profit Trailer Bot One closed trade (0.96% profit) bringing the position on the account to 9.92% profit (was 9.90%) (not accounting for open trades).

Dollar Cost Average (DCA) list drops to 6 coins with KNC moving off and onto profit after one level of DCA.

Pending list remains at 10 coins.

PT Defender continues defending 10 coins though I note that support for this has been deprecated.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 9 trades on EURUSD, USDJPY, AUDNZD, for 1.01% profits for the three days. Trades open on AUDCAD, NZDUSD, EURNZD, EURAUD, USDJPY, EURUSD (0.89% positive). It still feels like too many trades open but the last cycle did end positive. Trades are essentially long NZD and AUD and short USD.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and CBS News. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

November 20-24, 2019

Hi, @carrinm!

You just got a 0.37% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

@carrinm You have received a 100% upvote from @botreporter because this post did not use any bidbots and you have not used bidbots in the last 30 days!

Upvoting this comment will help keep this service running.