Understanding Islamic Hire Purchase Financing in Malaysia: A Comprehensive Analysis

Written by: 👤 Anak Malaysia 👤

⭐ Introduction ⭐

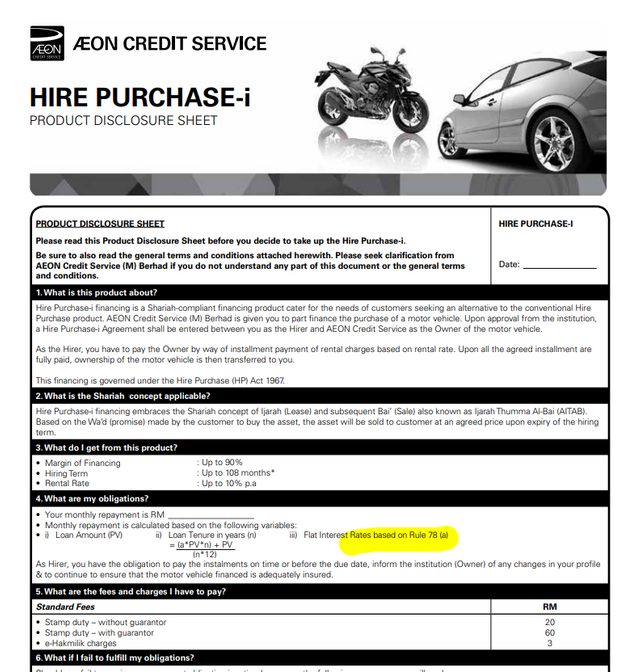

Islamic banking has emerged as a rapidly growing alternative to conventional banking, offering financial solutions that adhere to the principles of Shariah law. One of the key products in Islamic banking is the Hire Purchase-i (HP-i) financing, designed to cater to customers seeking a Shariah-compliant alternative to conventional hire purchase products. In this article, we will delve into the intricacies of HP-i financing, analyzing its compliance with Islamic banking rules and exploring the implications of the "Rule of 78" method, a controversial practice in the industry.

⭐ Understanding Hire Purchase-i Financing ⭐

Hire Purchase-i financing is based on the Shariah concept of Ijarah Thumma Al-Bai' (AITAB), which involves leasing an asset to the customer and subsequently selling it to them at an agreed price upon the expiry of the hiring term. This structure avoids the payment or receipt of interest, which is prohibited in Islamic finance, and instead utilizes rental charges during the lease period and a sale price at the end of the term

Key Features of Hire Purchase-i

Shariah Concept:

The product adheres to the Shariah concept of AITAB, ensuring compliance with Islamic principles

Prohibition of Riba (Interest):

The financing structure avoids interest, which is prohibited in Islamic finance, by using rental charges and a sale price

Profit and Loss Sharing:

While not explicitly mentioned, the AITAB structure inherently involves the bank bearing the risk of ownership until the asset is fully paid for by the customer.

Prohibition of Gharar (Uncertainty):

The terms and conditions are clearly outlined, reducing uncertainty and ensuring transparency

Ethical Investments:

The product is designed for the purchase of motor vehicles, which is a permissible (halal) activity under Islamic law

Asset-Backed Financing:

The financing is backed by the motor vehicle being purchased, ensuring that the transaction is tied to a tangible asset

Zakat (Charity):

The document does not mention the collection or distribution of zakat, which is typically a broader responsibility of Islamic financial institutions

⭐ The Controversy: Rule of 78 ⭐

One aspect of HP-i financing that has raised concerns regarding Shariah compliance is the use of the "Rule of 78" method for calculating compensation charges in case of default payments. The Rule of 78 is a method that frontloads interest payments to the earlier part of the loan tenure, which can be seen as unfair to the borrower and potentially violating the Shariah principle of avoiding riba and ensuring fairness in financial transactions

According to the CCOB Task Force in Malaysia, the Rule of 78 method is recognized globally as unfair to borrowers, and its practice is prohibited in jurisdictions like Australia, New Zealand, the United Kingdom, and some states in the United States. This raises questions about its compatibility with Islamic finance principles and the need for alternative methods that ensure fairness and transparency.

⭐ Regulatory Framework and Compliance ⭐

In Malaysia, Islamic banking is regulated to ensure compliance with Shariah principles. The Islamic Financial Services Act 2013 (IFSA) and the Shariah Governance Framework 2010 (SGF) prescribe the structures and processes that need to be followed by the Islamic finance industry to ensure Shariah compliance.

The IFSA requires Islamic financial institutions (IFIs) to comply with standards and guidelines issued by Bank Negara Malaysia, including the establishment of Shariah Advisory Councils (SACs) and internal Shariah Committees (SCs) to oversee Shariah compliance. The SGF further outlines the duties and roles of the Board of Directors, management, and SCs in ensuring Shariah compliance, as well as the implementation of Shariah review, audit, and risk management functions.

While the regulatory framework aims to ensure Shariah compliance, the use of the Rule of 78 method in HP-i financing raises concerns and may require further evaluation by Islamic finance experts and Shariah scholars to determine if an alternative method that ensures fairness and avoids any semblance of riba should be adopted instead.

⭐ Conclusion ⭐

Islamic banking, with its emphasis on ethical and socially responsible financial practices, continues to gain traction globally. The Hire Purchase-i financing product offers a Shariah-compliant alternative to conventional hire purchase products, adhering to principles such as the prohibition of interest, profit and loss sharing, and ethical investments.

However, the use of the Rule of 78 method for calculating compensation charges has raised concerns regarding its fairness and compatibility with Islamic finance principles. As the industry continues to evolve, it is crucial for regulatory bodies, Islamic finance experts, and Shariah scholars to address these concerns and ensure that Islamic financial products remain true to their core values of transparency, fairness, and adherence to Shariah law.

Islamic banking, with its emphasis on ethical and socially responsible financial practices, continues to gain traction globally. The Hire Purchase-i financing product offers a Shariah-compliant alternative to conventional hire purchase products, adhering to principles such as the prohibition of interest, profit and loss sharing, and ethical investments.

However, the use of the Rule of 78 method for calculating compensation charges has raised significant concerns regarding its fairness and compatibility with Islamic finance principles. The Rule of 78 method, which frontloads interest payments to the earlier part of the loan tenure, is globally recognized as unfair to borrowers, particularly those who wish to settle their loans early. This practice results in higher principal amounts outstanding and contradicts the core values of transparency, fairness, and the prohibition of riba in Islamic finance.

It is imperative that the relevant authorities, particularly Bank Negara Malaysia (BNM) and the Shariah Advisory Council (SAC), take immediate action to prohibit the use of the Rule of 78 method in Islamic banking. Allowing such practices to continue unchecked is a dereliction of duty by the responsible regulatory bodies and Shariah advisors, whose primary role is to ensure Shariah compliance in the industry.

The government of Malaysia must send a clear message that practices violating Islamic principles, such as the Rule of 78 method, will not be tolerated in the Malaysian Islamic finance industry. By fostering open dialogue, continuous improvement, and a commitment to upholding Islamic principles, the Islamic finance industry can continue to provide ethical and socially responsible financial solutions that meet the needs of Muslim communities