"Ethereum’s Onchain Boom Signals a $5,000 Price Surge!"

Hello Steam users. I hope you're doing well. I have some exciting (and slightly surprising) news to share with you today. As you know, I always strive to bring you new and exciting news.

Yo, crypto fam! Let’s talk about Ethereum (ETH), the blockchain beast that’s been making waves lately. Priced at around $4,475 right now, ETH recently teased us by spiking past $4,700 over the weekend, only to cool off a bit. But don’t sleep on it—there’s some serious action happening onchain and in the markets that’s got folks whispering about a potential run to $5,000. Here’s my take on what’s driving this and what to watch out for.

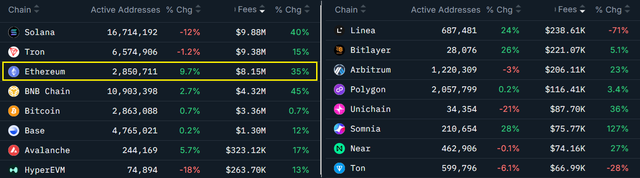

Ethereum’s Network Is Buzzing Like Never Before

Ethereum’s blockchain is popping off! Network fees have shot up by 35% compared to last week, and active addresses are up 10%. Why does this matter? Every transaction, smart contract, or DeFi move on Ethereum needs ETH to pay for gas. More activity = more demand for ETH, which keeps the price steady even when the market gets shaky.Higher fees also mean validators (the folks securing the network) are earning more. This boosts Ethereum’s security and powers its burn mechanism, which reduces the total supply of ETH over time. Less supply, same or growing demand? You do the math—bullish vibes!

Corporate Giants Are Stockpiling ETH

Big players are jumping on the ETH train, and it’s not just retail traders. Companies like Bitming Immersion Tech (BMNR), SharpLink Gaming (SBET), and The Ether Machine (ETHM) have been stacking ETH like there’s no tomorrow. In just the last 30 days, these corporate treasuries scooped up 877,800 ETH—that’s about $4 billion at today’s prices! Many of these companies are either staking their ETH or planning to, which locks up supply and adds more fuel to the price rally.

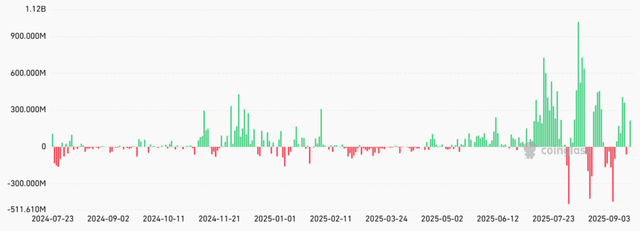

Spot ETH ETFs Are a Game-Changer

If you’re wondering why ETH is outpacing the crypto market (by 21% in the last two months, no less), look no further than spot Ether ETFs. These regulated investment vehicles are letting big institutional players get exposure to ETH without touching a crypto wallet. Right now, ETH ETFs have $24.7 billion in assets under management, with $213 million flowing in just last Thursday. That’s a lot of money betting on ETH’s future!Plus, exchange balances are at their lowest in over five years, with 2.69 million ETH pulled off platforms in the last two months. Less ETH on exchanges means less available for quick sales, which is another bullish signal.

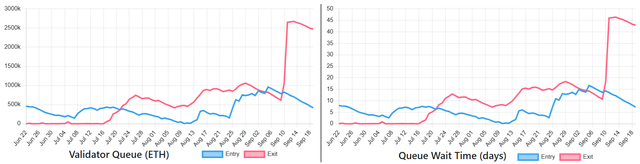

The Staking Queue Drama

Not everything’s rosy, though. Ethereum’s unstaking queue hit a wild 2.67 million ETH over the weekend, with a 46-day wait to exit staking. That’s about $12 billion worth of ETH waiting to be unlocked. Now, unstaking doesn’t always mean selling, but it’s got some traders nervous, especially since the staking entry queue is shrinking. This could cause some short-term price dips if the market gets spooked.But here’s the flip side: once this queue stabilizes, and with corporate accumulation and ETF demand still strong, ETH could shake off the jitters and charge toward that $5,000 mark.

My Two Cents

Ethereum’s looking like a solid bet right now. The combo of booming network activity, corporate hoarding, ETF inflows, and shrinking exchange supply is setting the stage for a potential breakout. Sure, the unstaking queue is a bit of a speed bump, but long-term, the fundamentals are strong. If traditional finance (TradFi) keeps piling in and onchain growth stays hot, $5,000 could be closer than we think.What do you guys think? Are you holding ETH, staking, or just watching from the sidelines? Drop your thoughts below, and let’s keep the convo going!