Medical Device Packaging 2025–2030: Sterility by Design, Scale by Plastics

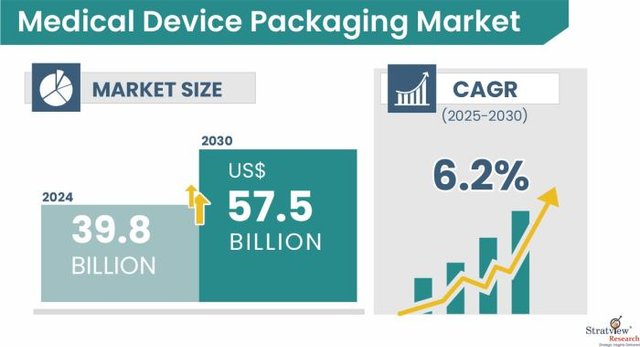

Medical device packaging is a safety system as much as a container: it must preserve sterility, protect performance, and survive global supply chains. Stratview Research estimates the medical device packaging market at USD 39.8 billion in 2024 and projects it to reach USD 57.5 billion by 2030, a 6.2% CAGR (2025–2030). The study segments demand by application (sterile vs. non-sterile), material (plastics, paper & paperboard, metal), product (bags & pouches, trays, clamshell & blister packs, boxes), and region.

Request a sample report to preview our in-depth analysis:

https://www.stratviewresearch.com/Request-Sample/4021/medical-device-packaging-market.html#form

Healthcare and device innovation. Advancements across diagnostics, minimally invasive tools, and implantables require packaging that maintains integrity and sterility, raising the bar for materials and formats. Stratview identifies overall healthcare expansion and device innovation as primary demand engines.

Rising chronic disease burden and spending. A growing prevalence of chronic illnesses and higher healthcare outlays are pushing more volumes through hospital and home-care channels—directly lifting packaging needs from pouches to thermoformed trays.

Emerging-market expansion. As healthcare infrastructure scales in Asia (China, India, Japan, South Korea), demand for compliant, sterile packaging accelerates—representing a meaningful opportunity for suppliers.

Industry capacity moves. Recent announcements underscore supply-side confidence and reconfiguration: Berry Global’s plan to separate and merge its HHNF unit with Glatfelter, and Amcor’s expansion of thermoforming capacity in North America to serve medical and pharma demand.

Trends

Sterile packaging dominates. Among applications, sterile packaging is the leading segment because it preserves sterility through storage and transit—critical for devices from syringes to implants.

Plastics on top. Plastics are expected to maintain dominance and the highest growth rate, thanks to light weight, formability, barrier performance, cost, and regulatory familiarity. Use cases span trays, pouches, bags, and films.

Format rotation toward bags & pouches. Bags & pouches are set to grow faster than other product types, offering efficient protection, good sterility maintenance, and packing-line flexibility across instrument sets and disposables.

Regional leadership. North America is expected to be both the dominant and fastest-growing region over the forecast period, supported by high healthcare spend, a large device manufacturing base, and continued technology investment.

Conclusion

From regulatory compliance to patient safety, packaging is inseparable from the medical device itself. Through 2030, expect sterile formats to anchor volume, plastics to extend their lead, bags & pouches to outpace other formats, and North America to set the growth cadence—supporting Stratview’s pathway to USD 57.5 billion. Suppliers that pair validated materials with sterilization know-how and agile thermoforming/pouching capacity will capture disproportionate value.