Microspheres Market—Lightweighting, Coatings, and Europe’s Lead

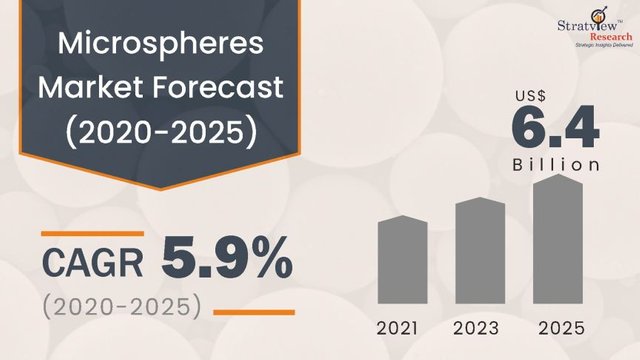

Microspheres—minute spherical particles produced from glass, polymers, ceramics, or metals—pack a lot of function into a tiny footprint. Their low density, spherical geometry, and tunable crush strength help manufacturers cut weight, improve dimensional stability, and lower resin use across paints & coatings, plastics & rubber, construction materials, and life sciences. Stratview Research estimates the global microspheres market will grow at a 5.9% CAGR (2020–2025) to reach USD 6.4 billion by 2025, underscoring durable demand for performance fillers that raise throughput and reduce cost-in-use.

Download the sample report here:

https://stratviewresearch.com/Request-Sample/802/microspheres-market.html#form

Trends

Hollow wins on weight: By microsphere type, hollow grades remain dominant thanks to specific densities often below 0.6 g/cm³—far lighter than traditional fillers (talc, CaCO₃, clay), enabling significant part-weight reduction without sacrificing volume or strength. This is especially valuable in transport and molded plastics where fuel-efficiency and handling benefits accrue.

Hollow glass microspheres (HGM) lead by material: Within materials, hollow glass microspheres are the value leader, prized for high filler loading at lower viscosities, shrinkage reduction, and solar-reflective properties that enhance specialty coatings. Their UV/Vis/NIR reflectivity also supports cool-surface and durability goals in paints.

Coatings stay the top application: Paints & coatings are the largest application by value. Microspheres’ spherical shape improves flow, reduces resin demand (and therefore VOCs), shortens drying time via higher solids, and enhances optical performance—advantages over conventional pigments/fillers. In plastics & rubber, microspheres are steadily replacing mineral fillers as OEMs hunt for lightweighting.

Polymer microspheres carve out niches: Expanded polymer microspheres are steadily capturing share in select paint systems, aided by elasticity and stability where HGMs can deform at >600 °C over exposure. In polymer microspheres, life sciences & pharmaceuticals represent the largest application by value, reflecting the use of functionalized spheres in diagnostics and drug delivery.

Regional pattern: Europe leads the overall microspheres market today; in glass microspheres specifically, Europe retains leadership through 2025 (with Germany as a growth engine), while Asia-Pacific rebounds fastest post-2021 as China, India, and Japan scale applications in plastics, coatings, and construction.

Drivers

1. Productivity & quality: Spherical particles reduce viscosity and shrinkage, improve dimensional stability, and enable higher SOLIDS in coatings—lifting line speed and finish quality while trimming resin consumption.

2. Lightweighting & efficiency: In molded parts and composites (SMC/BMC, injection-molded components), microspheres can cut 10–30% weight versus mineral fillers, supporting fuel-efficiency targets and easier handling.

3. Performance tuning: Tailored density/crush strength and surface properties (including UV/Vis/NIR reflection) extend use across road-marking, adhesives/putties, syntactic foams, and buoyancy modules.

Conclusion

Backed by a 5.9% CAGR to USD 6.4B by 2025, microspheres are cementing their role as high-value, process-friendly fillers. Expect hollow types—especially hollow glass—to anchor coatings and lightweight plastics, while expanded polymer grades grow in select coatings and life-science uses. With Europe holding today’s lead and Asia-Pacific accelerating, suppliers that pair application expertise with precise particle engineering will capture the next leg of growth.