These important rules of UPI have changed from today, know what will be the effect on common users

These important rules of UPI have changed from today, know what will be the effect on common users

📰 UPI rules have changed from today: Know full details

New Delhi, August 1, 2025 — The National Payments Corporation of India (NPCI) had announced some new rules regarding UPI (Unified Payments Interface), which has become the largest medium of digital payment in India, which have come into effect from today.

The main objective of changing these rules is to strengthen the UPI ecosystem, balance the cost of banks and control large and business transactions.

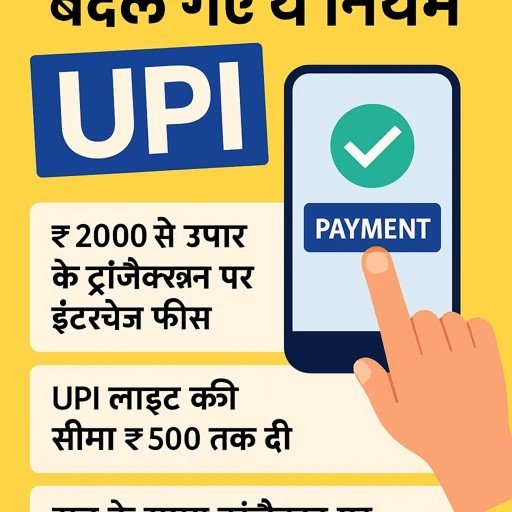

🔄 What changes have been made?

- Interchange fee on transactions above ₹2,000

Now if you make a transaction of more than ₹2,000 with a merchant (such as online shopping or payment by scanning QR code in a shop), then an interchange fee of 0.5% to 1.1% will be charged on it.

This rule will only apply to payments made from PPI (prepaid payment instrument) wallets such as PhonePe wallet, Paytm wallet, etc.

There will be no charges for P2P (person to person) transactions or QR scans directly from the bank.

- UPI Lite limit increased

The UPI Lite feature can now be used for payments up to ₹500 (earlier the limit was ₹200).

The daily limit has been increased from ₹2,000 to ₹4,000.

- Bank control over number of transactions

NPCI has now allowed banks to limit the number of UPI transactions per day, especially through PPIs.

This rule will prevent spam or fraudulent transactions.

- Monitoring transactions at night

An additional authentication layer is being added to transactions made between 11 pm and 6 am.

This will increase user security and reduce fraud.

🧍 Impact on common users

✅ What hasn't changed?

There will be no charges on person-to-person transactions (P2P).

Merchant transactions up to ₹2,000 will also remain free.

Direct payment from bank account (UPI QR) will still remain free.

❗ What precautions should be taken?

When making payment to the merchant, check whether the payment is being made from UPI wallet or directly from the bank.

To avoid fraud, take OTP or biometric alerts seriously while making transactions at night.

📲 What is UPI Lite?

UPI Lite is a special feature through which small payments (up to ₹500 now) can be made without internet and without PIN. This feature is specially designed for low network area and faster payments.

🏦 Bank and wallet companies' stance

Companies like Paytm, PhonePe and Google Pay have given mixed reactions to this. While on one hand the companies called it a step towards making UPI profitable, it also said that this could shock merchant users.

📈 UPI statistics

Year Monthly transaction total value (₹ lakh crore)

2020 ₹1.3 billion 2.3

2023 ₹7.8 billion 14.1

2025 (July) ₹11.2 billion 21.3

UPI today has overtaken both ATM and card transactions and has become India's largest digital payment system.

🧠 What do experts say?

According to digital payments expert Ajay Sarin:

"The purpose of levying PPI charges is not to extract money from the user but to provide stability to merchant payments."

NPCI Chairman Dilip Asbe said:

"It is not possible to keep UPI free for long. We have to make it sustainable."

🔐 Tips for secure transactions:

Use only bank-authorised UPI apps.

Always check the recipient's name while scanning QR.

Pay attention to SMS and OTP after any transaction.

Double-confirm while transacting at night.

🔍 Conclusion:

Although the new UPI rules will make digital payments more secure and stable, some people may still be shocked initially. Nevertheless, it is clear that India is at the forefront of the digital revolution and these changes will prove beneficial in the long run.