Bitcoins_Astonishing_16_Year_Journey_From_Zero_to_Global_Asset

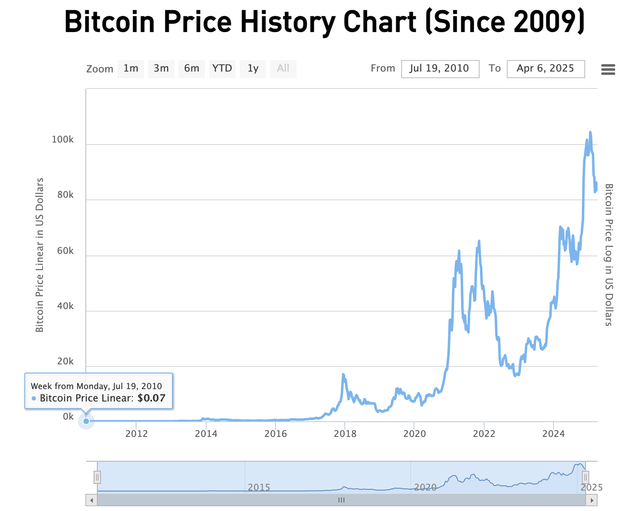

Since Bitcoin emerged in 2009, its price path has mirrored an exhilarating roller-coaster journey. Transforming from a niche "geek toy" to a globally acknowledged "digital gold," Bitcoin has not only fueled investor enthusiasm but also sparked a revolution across the global financial landscape. Over the past decade, Bitcoin's K-line charts—those alternating red and green candlesticks—have documented every surge and plunge, visually depicting opening, closing, high, and low prices. To many, the...

Bitcoin Price Milestones (2009–2025): A Grand and Tumultuous Journey

Bitcoin's 16-year evolution unfolds like a dramatic saga. Here is a comprehensive overview of pivotal milestones and turning points:

Early Exploration (2009–2012)

- February 9, 2011: Bitcoin first exceeded $1. Rising from mere cents as an "experimental token" to enter the dollar era, this ignited cryptocurrency's wildfire expansion.

- November 28, 2012: Bitcoin experienced its initial halving. Block rewards decreased from 50 to 25 BTC, heightening scarcity and amplifying market excitement and price swings.

Rise and Volatility (2013–2016)

- December 1, 2013: Bitcoin soared to an unprecedented peak of $1,150. This rally drew worldwide attention to its potential and sowed seeds for future frenzies.

- April 11, 2014: Prices plummeted to $314 amid a bubble burst, unsettling investors with extreme volatility.

- August 25, 2015: It dipped below $200, hitting a six-month low. Bearish sentiment spread, with many declaring Bitcoin "dead."

- July 9, 2016: The second halving reduced rewards to 12.5 BTC. Prices fluctuated intensely, but market confidence steadily recovered.

- September 2, 2016: Total transaction volume surpassed $100 billion, marking Bitcoin's explosive global growth.

Mania and Awakening (2017–2019)

- January 2, 2017: Prices rebounded to $1,000. Microsoft's announcement of Bitcoin payment support added legitimacy.

- October 13, 2017: It climbed above $5,000. Investor fervor surged, and media coverage intensified.

- December 18, 2017: Nearing $20,000 as CME launched Bitcoin futures, institutional capital flooded in, fueling euphoric highs.

- August 8, 2018: SEC delayed VanEck Bitcoin ETF approval. Prices fell below $6,700, signaling an early bubble cool-down.

- June 22, 2019: It recovered to $10,000, revitalizing market hopes with remarkable resilience.

Mainstream Adoption & Turbulence (2020–2022)

- January 8, 2021: Bitcoin broke $40,000 for the first time. Institutional investors like MicroStrategy drove momentum.

- April 14, 2021: It surged past $60,000. Tesla's $1.5 billion investment cemented Bitcoin as a mainstream asset.

- May 2021: China cracked down on crypto, shutting mining farms and restricting trading. Prices dropped to $30,000 amid panic.

- August 2021: El Salvador adopted Bitcoin as legal tender—a historic move reigniting global interest and price recovery.

- November 2021: It hit a record $68,000. Institutions and retail investors propelled a final wave of mania.

- May 2022: Fed rate hikes and global tightening triggered a crypto winter. Bitcoin fell near $20,000, testing investor resolve.

Resilience & Rebirth (2023–2025)

- March 2023: Amid global economic uncertainty, Bitcoin rebounded above $30,000 as institutions bet on its safe-haven appeal.

- October 2023 (hypothetical): U.S. approval of a Bitcoin ETF boosted market sentiment. Prices broke $50,000, symbolizing regulatory-crypto reconciliation.

- May 2024 (after April halving): Block rewards cut to 6.25 BTC. Reduced supply and rising demand pushed prices to $70,000.

- November 2024 (trend projection): Global central banks explored digital currencies. Bitcoin, as a decentralization benchmark, approached $80,000.

- April 2025 (projection): Bitcoin stabilized between $75,000 and $80,000. Volatility eased, increasingly viewed as a mature asset class.

Fortune Formula or Market Mirror?

Bitcoin's K-line charts transcend mere numbers—they mirror greed, fear, and hope. For short-term traders, each candlestick offers buy-sell signals. For long-term holders, they gauge policy shifts, tech progress, and market maturity.

Over 16 years, patterns emerged: post-halving bull runs, sharp volatility after key events, and recurring cycles of frenzy and calm. These charts aren't just "treasure maps" but keys to crypto's essence. Whether novice or veteran, they provide glimpses of the future—if you dare to wager on this digital revolution.

From $1 to $100,000 and back to $80,000, Bitcoin has chronicled a journey from fringe experiment to financial cornerstone. Its K-line charts don't just record prices—they encapsulate dreams and despair.

By 2025, will Bitcoin keep climbing? The answer may lie in the next candlestick's color. Are you prepared for the ride?

🎁 Limited-Time Bonus — New Users Get a Bitcoin Mystery Box Worth 20+ USDT, Guaranteed!

Register on leading crypto exchanges like OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack & more—all in one place!

👉🏻 Bookmark the latest official backup domains to avoid missing out: https://linktr.ee

🔥 Recommended Reading

How to Access OKX If It’s Blocked from mirror sites

Some exchange domains face blocks or slowdowns due to server locations or network issues, not platform faults. Exchanges like OKX and Binance regularly update mirror domains for uninterrupted access.

- OKX Mirror Domain (VPN required): OKX Global or Alternative URL

- Binance Mirror Domain: Binance

- Bitget Mirror Domain: Bitget

- Bybit Mirror Domain: Bybit

- Huobi (HTX): Huobi

- Gate.io: Gate.io

🔥 Alpha-Hunting Tools for Airdrop Degen Farmers

1️⃣ Axiom: https://axiom.trade

2️⃣ Gmgn: https://gmgn.ai

3️⃣ dbot: https://app.debot.ai

4️⃣ Morelogin Multi-Account Fingerprint Browser: https://www.morelogin.com

Trending Searches

Purchase Bitcoin, crypto exchange rankings, OKX reliability, Binance safety, OKX registration, Binance App for China, buying BTC on Binance, Web3 airdrops, zero-cost farming, Bitget China sign-up, OKX passport registration, contract trading, leverage trading, NFT staking, Bitcoin wallet setup, beginner crypto guide, BTC8848.com, contract trading mindset, DeFi yield farming, crypto airdrop value, post-liquidation steps, Ethereum purchase, inscription minting...