2025_Dogecoin_Starter_Essential_Guide

01 Establishing Awareness

Before entering a new field, it is essential to develop a comprehensive understanding; otherwise, the activity becomes pure gambling.

Prepare Your Mindset:

Engaging in meme coin trading resembles purchasing lottery tickets—be prepared for your principal to potentially vanish. However, you can enhance your odds of success through continuous learning.

Build Basic Cognition:

- What is a meme coin? A meme coin emerges from community sentiment and cultural trends.

- Why participate in meme coins? The goal is to achieve substantial gains with minimal investments, targeting transformative returns rather than mere doubling.

- Where do risks lie in meme coins? These coins are rife with conspiracies, group manipulations, and extreme volatility.

Learn Basic Concepts:

- Pi Xiu Coin (貔貅币): Contracts maliciously restrict trades, allowing purchases but blocking sales; investments often result in total loss.

- Trap (夹子): Front-runner bots execute trades with higher gas fees, forcing regular traders into unfavorable buy-high-sell-low positions while traps profit from spreads.

- Smart Money: On-chain wallet addresses that consistently achieve high returns; these can be tracked to identify promising investments.

- Inner Market / Outer Market: Tokens not yet launched reside in the inner market; after adding liquidity on a decentralized exchange (DEX), they transition to the outer market.

Meme Coin Categories:

- Hotspot Type: Capitalizes on trending keywords (e.g., Musk, CZ, Vitalik) or major events, attracting massive short-term traffic.

- Narrative Type: Issued based on popular industry narratives, such as DeSci + Meme or AI + Meme.

- Cultural Type: Requires cultural context, often featuring animal themes like Sad Frog or Doge memes.

- Mechanism Type: Incorporates innovative structures, such as $people as the first DAO.

- Pyramid Scheme Type: Promoted through online and offline multi-level marketing, typically lacking substance.

Daily Routine of Meme Coin Players:

- Follow Tweets: Monitor numerous English and Chinese KOL accounts on Twitter for the latest meme coin updates.

- Join Groups: Participate in various discussion groups to gauge collective sentiment.

- Follow the Chain: Track tokens moving from inner markets (small-scale) to outer markets (large-scale).

Overall Principles:

- Speed is paramount in this domain.

- Avoid stubbornness or "diamond hands" mentality.

- Manage risks effectively by taking profits and cutting losses promptly.

02 Practical Operations: Methodology

Step 1: Discover Potential New Coins (Chain Scanning)

Analyze Token Contract Safety:

- Is it a Pi Xiu trap? Use common tools to inspect contract code for trade restrictions or lock mechanisms.

- Is the contract open source? Open-source contracts allow public review, enhancing transparency and preventing backdoors.

- Has token minting permission been renounced? Renunciation prevents issuers from arbitrarily increasing supply.

- Is liquidity locked? Locked liquidity pools deter sudden withdrawals by issuers or large holders that could crash prices.

Analyze Tokenomics:

- Token market cap: Aim for liquidity pools exceeding 100 SOL.

- Number of holders: Prefer addresses numbering over 1,000.

- Recent trading activity: Target more than 60 transactions per minute or over 600 within five minutes.

- Top 10 holders’ stake: Healthy ranges are 15%-25%, sub-healthy 25%-35%, and unhealthy above 35%.

Analyze Project Background:

- Did the dev team run away? Investigate past projects for abrupt halts in updates or disappearances.

- Did the team buy ads on Dexscreener? Paid advertisements indicate project confidence.

- Official token Twitter account: Assess activity, follower count, community engagement, and content quality.

- Telegram group link: Evaluate activity, member numbers, admin responsiveness, and regular AMA events.

- Are there KOL endorsements? More promoters typically signify stronger community support.

Step 2: Track Smart Money Movements (Copy Trading)

Officially labeled addresses offer limited value; instead, build a personalized smart money watchlist. Identify smart money by targeting early large holders of successful meme coins, high-yield traders, or early buyers. You can also follow addresses of active meme coin players or KOLs who frequently lead on-chain rushes. Tailor your watchlist to your trading style to minimize information noise.

Step 3: Final Buy and Sell (Trading)

- Market sentiment: Key to success; exit promptly during extreme FOMO. Identify FOMO through community sentiment and on-chain indicators, relying on subjective judgment.

- Risk management: Set strict stop-loss points to avoid emotional decisions like chasing highs or selling lows; discipline is crucial.

- Timing selection: Focus on news events and social media hotspots. Technical indicators often fail with event-driven meme coins, so act swiftly based on related occurrences.

- Stage selection: Determine if the coin is in consolidation (early sellers balanced by buyers) or distribution (early profit-takers selling); consider exiting during distribution.

03 Long-Term Learning

🔥🔥🔥 Practical Tools for Finding Golden Meme Coins

1️⃣ Axiom Dog-Chasing Tool https://axiom.trade

2️⃣ Gmgn Dog-Chasing Tool https://gmgn.ai

3️⃣ dbot Dog-Chasing Tool https://app.debot.ai

4️⃣ Morelogin Multi-Account Fingerprint Browser www.morelogin.com

04 Summary

Trading meme coins demands diligent effort to improve win rates. Experienced players often operate around the clock, monitoring markets and executing trades. For ordinary users, participating in this fast-paced environment is worthwhile—not solely for profit, but to gain insights into trading dynamics and learn valuable lessons. I will continue updating my meme coin learning progress to assist others.

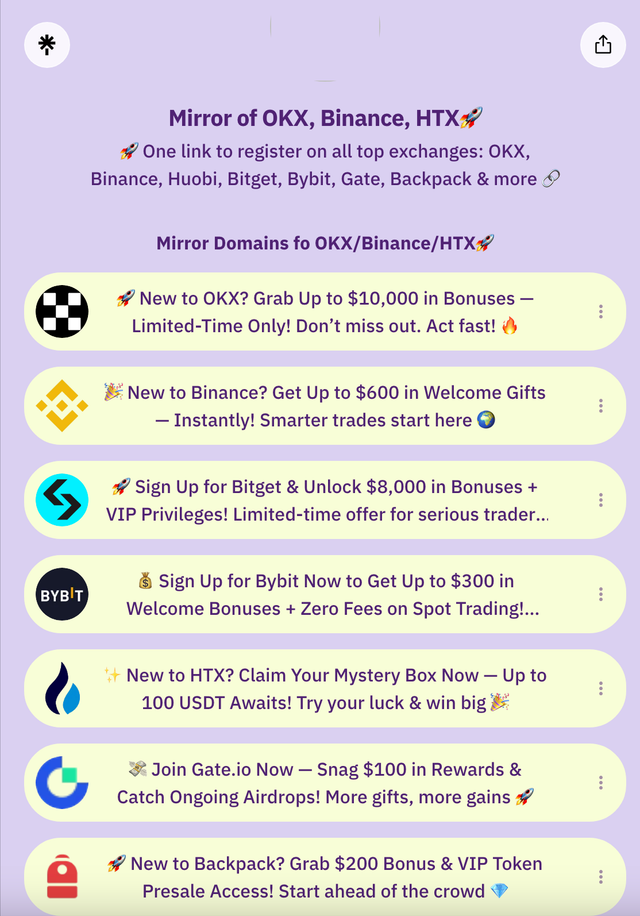

🎁 Limited-Time Bonus — New Users Get a Bitcoin Mystery Box Worth 20+ USDT, Guaranteed!

Sign up for top crypto exchanges like OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack & more — all in one place!

👉🏻 Bookmark the latest official backup domains to avoid missing out: https://linktr.ee

🔥 Related Reading

How to Solve the Issue of Not Being Able to Access OKX Exchange from mirror sites

Access issues with exchange domains often stem from network environments, as servers are overseas, not service outages. To ensure continuity, exchanges like OKX and Binance regularly update alternative domains.

- OKX Backup Domains OKX Overseas - Requires VPN or Backup Domain

- Binance Backup Domain Binance

- Bitget Backup Domain Bitget

- Bybit Backup Domain Bybit/Bybitglobal

- Huobi HTX Backup Domain Huobi (HTX)

- Gate.io Backup Domain Gate.io

Popular Searches

Buying Bitcoin, depin Grass staking, taker mining, taker diamond, how to claim Grass airdrop, crypto exchanges, okx download & registration, okx recharge, Binance App registration & download, Binance coin buying tutorial, Binance registration, bianace airdrop registration, Binance iPhone download, how to buy President coin, how to buy Dogecoin, RMB to Bitcoin, how to download OKX, web3 token farming, web3 free farming, Bitget China download & registration, OKX passport registration, OKX download, Binance download, crypto side hustle, OKX contracts, how to recharge RMB on OKX, how to recharge OKX, how to set up NFT wallet, how to recharge Huobi with RMB, beginner tutorials for crypto, btc8848.com, Tony’s contract trading mindset, bit leveraged trading, DeFi mining, crypto farming, crypto airdrops still available?, how to deal with liquidation, how to buy President coin on OKX & Binance, how to buy Ethereum on OKX & Binance, how to play DeFi staking mining, can NFT still be played?, web3 airdrops, beginner crypto tutorials btc8848.com, how to make money trading, what is contract leverage, DeFi mining, how to farm crypto, OKX airdrops, node staking, liquidation, financial freedom, heiyetouzi.xyz