Why Bitcoin's Final Top Might Still Be Ahead

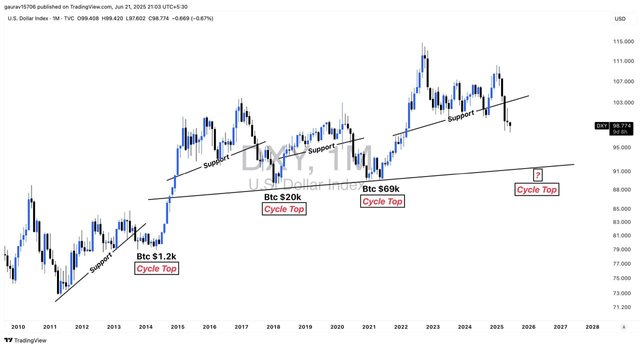

Good evening to all my friends. I hope you all are doing well. I was very busy from last few weeks but finally I am back to work. Let's talk about crypto market. Over the past few weeks, we’ve been discussing whether Bitcoin has reached its final cycle top, and why that top might still be ahead. Many investors are concerned as Bitcoin is recovering, but altcoins are still struggling. This blog aims to explain why Bitcoin's performance is crucial for the entire crypto market and why it's too early to say we've entered a bear market. We’ve looked into historical indicators like the DXY (Dollar Strength Index), gold-copper correlation, and technical patterns to understand the timing of Bitcoin’s tops in past cycles – such as in 2013, 2017, and 2021. These tops usually occurred when the DXY formed a bottom and began to rise again, leading to selling pressure across markets. Currently, the DXY is approaching a similar critical support trend line, and if it bounces again, it could indicate a potential top for Bitcoin in this cycle too.

In addition, we’re observing structures like bear flags forming on the USD dominance chart, which often lead to breakdowns followed by Bitcoin price rallies. Despite short-term volatility and fear due to global news or market corrections, it's essential to focus on the larger trend. Technical patterns suggest the final leg up in Bitcoin may still be coming. Investors should avoid making emotional decisions based on 1-hour or 4-hour charts. Instead, by studying the longer-term signals and macro indicators, we can better understand the market’s direction. As always, stay updated with real-time chart analysis on our Telegram channel, and remember – don’t panic; stay informed and strategic. That's it for today. Thanks & have a good day!!