Investments for non-experts: fixed income, variable income, and the crypto world

Greetings, friends of the PussFi community. Today I want to share something I've been thinking about for a while. It relates to a topic I discussed with a friend a few days ago: the dichotomy of "fixed income or variable income," the one many experts mention when talking about investments. I know it sometimes sounds sophisticated, difficult for some to understand, as if only people in suits and ties could do it, but believe me, it's not that complicated.

As I often say, I'm not a financial guru or anything like that, but I like to understand what's going on, especially since I live in Colombia, where we talk about COP pesos all day long and feel the brunt of inflation and devaluation. The same thing is probably happening in your countries.

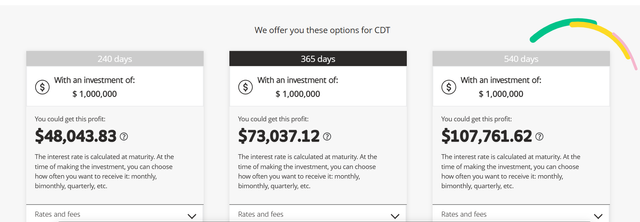

First, let's start with the most traditional approach: fixed-income. This means investing in products that pay you a stable interest rate over time. This could be a CDT issued by a bank or Colombian government bonds. From what I can see, a CDT can currently pay between 7% and 10% annually in pesos, depending on the bank and the term. This works perfectly for those who want security in their earnings. For example, I have an account with Bancolombia, and if I invested 1 million pesos (an average of $250) in it, I would earn the following returns, depending on the time:

Of course, that gives you peace of mind: you know how much you're going to earn and you're not exposed to large fluctuations, although you're not going to earn spectacularly either, unless you have large amounts invested, which isn't my case 😅 But it's an option that works for many, and that's fine.

On the other hand, traditional equity, on the other hand, involves shares on the local or international stock market, where you don't know how much you can win or lose. For example, if you buy shares in a Colombian company like Ecopetrol, you could receive dividends and see the price rise, but you can also lose if the economic situation worsens, something that has been happening lately.

To use the same Ecopetrol example, about 6 months ago the share was worth almost $12; as you can see, the current price is $8. Let's be clear: this is an option for those motivated by the prospect of high returns, even if it means sacrificing stability, and it's definitely not for everyone.

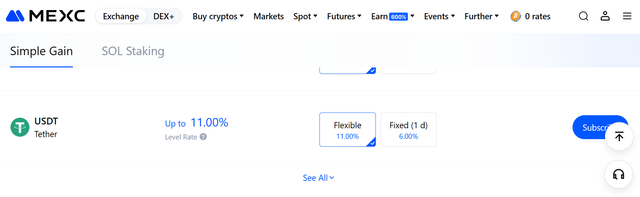

Now, the interesting thing is that we can apply the same debate to the crypto world, where there are also fixed and variable income, albeit with more striking names. In crypto fixed income, there would be staking (which I recently told you about) or digital savings accounts. Platforms like MEXC, an exchange, offer up to 10% APY on certain cryptocurrencies, such as USDT, but if you look at other currencies, you can have much higher returns, of course, keeping in mind that they are more volatile when we talk about altcoins and not stablecoins (like USDT or USDC).

We also have staking on chains like Solana, in a decentralized manner, like the one offered by SOLFLARE, with Solana or with USCD. These are options where the responsibility is entirely yours, since it is decentralized, so whatever you do must be done with absolute caution.

If we have investments in stablecoins, we will know how much we will earn, but when we move to cryptocurrencies, this can vary greatly, depending on many factors.

What is known in the crypto world as DeFi and yield farming are riskier bets, and we can relate them more to equities, since variations in both the prices of the currencies involved and the profit percentages are quite variable, which means we can have a lot of variability in our income and, logically, is much riskier.

In the end, the key is balancing security and opportunity, peace of mind and growth. Knowing that every investment involves expenses, I always opt for diversification, because if one investment doesn't do very well, another will. It's a simple strategy, and always with a long-term focus. What I've shared so far is not investment advice; it's primarily for informational purposes. Be well, and I'll say goodbye.

@tipu curate

Upvoted 👌 (Mana: 2/8) Get profit votes with @tipU :)

https://x.com/josevas217/status/1946700074051919971?t=gnvHDL_fbU63y2x3uQ3spw&s=19

https://x.com/josevas217/status/1946551389410181222?t=iYqCEq2FYIaTRkwKeWA83g&s=19

https://x.com/josevas217/status/1946552412140945788?t=gzbAU_-BUzLUfcNt6NyPDA&s=19

https://x.com/josevas217/status/1946553159045743002?t=oVXRJEFuyAM4u43TGPI2aw&s=19

Note:-

Regards,

@adeljose

Congratulations, your post has been manually

upvoted from @steem-bingo trail

Thank you for joining us to play bingo.

STEEM-BINGO, a new game on Steem that rewards the player! 💰

How to join, read here

DEVELOPED BY XPILAR TEAM - @xpilar.witness