Retirement Health Care Planning: Complete Medicare Guide & Healthcare Budget for Seniors 2025

#Retirementhealthplanning

#Medicareoptionsforretirees

#Healthcarecostsinretirement

#Retirementbudgeting

#Preventivehealthcare

#Healthyagingstrategies

#Long-termcareinsurance

#Earlydetectionscreening

#Retirementincomestreams

#Medigapinsurance

Planning for health care after retirement is a critical aspect of ensuring a comfortable and secure future. At Healthy Retirement Strategies, we understand the complexities of navigating this important decision.

Our comprehensive guide will walk you through the essential steps to create a robust health care plan for your retirement years. We'll cover everything from assessing your health needs to understanding Medicare options and budgeting for future medical expenses.

Understanding Your Health Care Needs in Retirement

Assess Your Current Health

Start your retirement health care planning by evaluating your current health status. A complete guide to 27 proven health screening tests and services for better aging, based on USPSTF & Medicare recommendations, can help you assess your health comprehensively. This includes blood work, screenings, and discussions about any ongoing conditions or concerns. The Centers for Disease Control and Prevention reports that about 85% of older adults have at least one chronic health condition. Your current health status will serve as a foundation for anticipating future needs. - https://betterhealthwhileaging.net/preventive-health-services-for-older-adults-healthy-aging-checklist-part-5/

Project Future Health Care Requirements

While you can't predict the future with certainty, you can make educated estimates about your health care needs. Consider your lifestyle habits, current health conditions, and any symptoms you're experiencing. For example, if you have high blood pressure now, you might require more cardiovascular care in the future. The National Institute on Aging states that the average 65 year old can expect to live another 19 to 21.5 years. Plan for potential health issues that may arise during this time frame.

Factor in Family History

Your family's health history plays a significant role in your future health needs. Collect information about health conditions that run in your family. If there's a history of heart disease, cancer, or diabetes, you may face a higher risk and should plan accordingly. The National Institutes of Health emphasizes that family health history is one of the strongest risk factors for many chronic diseases.

Consider Long-Term Care

Don't overlook the potential need for long-term care. Using the Cost of Care Survey tool, You and your family can calculate the cost of long-term care across the US, now and in the future. This could range from in-home care to nursing home facilities. Include these potential costs in your planning. - https://www.carescout.com/cost-of-care

Review and Adjust Regularly

Your health care needs will likely change over time. We recommend reviewing your health status and care needs annually. This practice allows you to adjust your plans as necessary and ensures you're always prepared for what's ahead.

Understanding your health care needs in retirement forms the foundation of effective planning. With this knowledge in hand, you can now explore the various Medicare and supplement insurance options available to meet these needs.

Medicare Options for Retirees

Original Medicare: Parts A and B

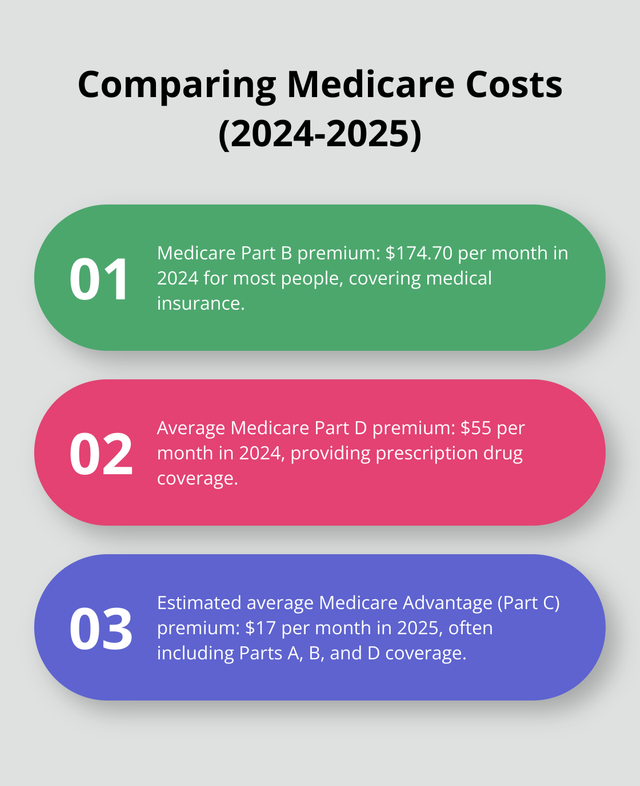

Medicare provides essential health coverage for retirees. Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance). Most people receive Part A premium-free if they or their spouse paid Medicare taxes for at least 10 years. Part B requires a monthly premium($174.70 in 2024 for most people, according to Medicare.gov). Original Medicare doesn't cover everything(e.g., most dental care, eye exams for glasses, or long-term care).

Prescription Drug Coverage: Part D

Medicare Part D offers prescription drug coverage. The average monthly premium for Part D coverage in 2024 is $55 (Centers for Medicare & Medicaid Services ). Premiums vary based on the chosen plan and location. We recommend an annual review of your medications and plan comparison to optimize your coverage.

Medicare Advantage: Part C

Private companies approved by Medicare offer Medicare Advantage plans (Part C). These plans include Part A, Part B, and usually Part D coverage. Many Medicare Advantage plans provide additional benefits not covered by Original Medicare (dental, vision, and hearing coverage). The estimated average monthly Medicare Advantage plan premium for 2025 is expected to decrease slightly to $17 from $18.50 in 2024. - https://www.ncoa.org/article/what-are-the-costs-of-medicare-advantage-part-c/

Medigap Policies

Medigap (Medicare Supplement Insurance) fills the "gaps" in Original Medicare coverage. These policies help pay for copayments, coinsurance, and deductibles. The average premium for Plan G was $164, ranging from $140 to $236. - https://www.kff.org/medicare/issue-brief/key-facts-about-medigap-enrollment-and-premiums-for-medicare-beneficiaries/

Choosing the Right Coverage

When selecting between Original Medicare with a Medigap policy or a Medicare Advantage plan, consider your health needs, budget, and preferred doctors. Original Medicare with Medigap typically offers more flexibility in choosing healthcare providers but may have higher premiums. Medicare Advantage plans often have lower premiums but may restrict you to a network or providers.

Enroll in Medicare on time to avoid late enrollment penalties. Your initial Enrollment Period begins three months before your 65th birthday and ends three months after. We suggest reviewing your Medicare coverage annually during the Open Enrollment Period (October 15 to December 7) to adjust your coverage based on the current health needs and financial situation.

Understanding these Medicare options forms the foundation for effective retirement health care planning. The next step involves creating a comprehensive health care budget to ensure you're financially prepared for your medical needs in retirement.

How Much Should You Budget for Health Care?

Estimating Out-of-Pocket Expenses

Creating a comprehensive health care budget for retirement is essential financial security. A proactive approach to estimating and planning for health care costs will help you prepare for future expenses.

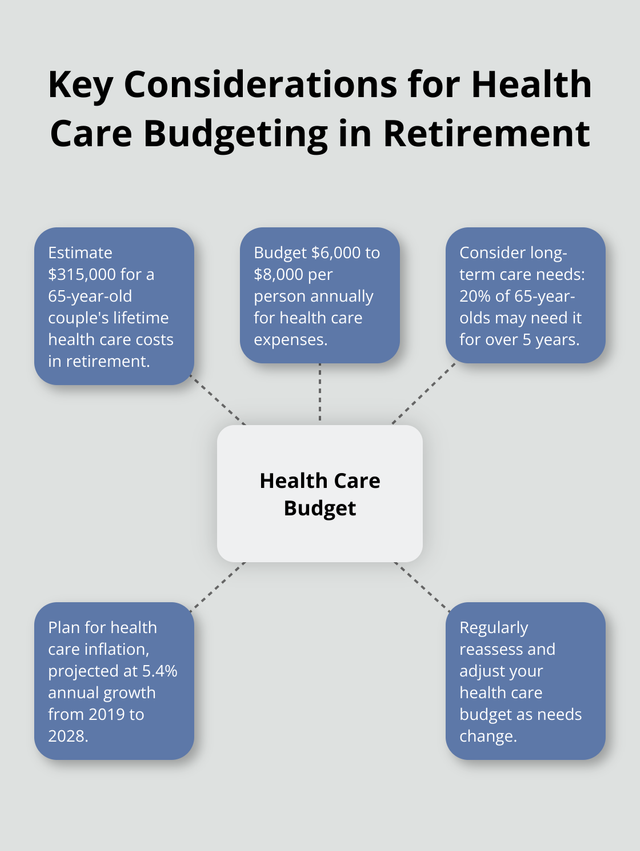

Fidelity Investments reports that a 65-year-old couple retiring in 2024 can expect to spend an average of $315,000 on health care throughout retirement. This figure includes premiums, copayments, and out-of-pocket expenses not covered by Medicare. To break this down annually, you should plan for approximately $6000 to $8000 per person per year.

You should review your current health care spending. Analyze your medical bills from the past few years to identify patterns and recurring costs. Factor in potential increases as you age. The Bureau of Labor Statistics reports that health care spending tends to rise with age, peaking for those 75 and older.

Long-Term Care Considerations

Long-term care is a significant expense often overlooked in retirement planning. One-third of today's 65 year-olds may never need long-term care support, but 20 percent will need it for longer than 5 years. The average cost of a private room in a nursing home exceeds $100,000 per year (according to Genworth's Cost of Care Survey). - https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

You should consider long-term care insurance or hybrid policies that combine life insurance with long-term care benefits. These can help mitigate the financial impact of extended care needs. Start exploring these options in y our 50's or early 60's when premiums are generally more affordable.

Inflation-Proofing Your Health Care Budget

Health care inflation historically outpaces general inflation. The Centers for Medicare & Medicaid Services projects health care spending to grow at an average annual rate of 5.4% from 2019 to 2028. To combat this you should consider several strategies.

Maximize your Health Savings Account (HSA) contributions if eligible. HSAs offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawl for qualified medical expenses. - https://www.irs.gov/publications/p969

Invest a portion of your retirement savings in assets that have historically outpaced inflation, such as stocks or real estate investment trusts(REITs).

Consider working part-time in retirement to offset rising health care costs and potentially delay tapping into your retirement savings.

Stay healthy: Regular exercise, a balanced diet, and preventive care can significantly reduce your health care expenses over time.

Regular Budget Reassessment

You should reassess your health care budget regularly. As your health needs change and new medical technologies emerge, your financial plan should evolve accordingly. An annual review of your health care budget will ensure you're adequately prepared for the years ahead.

Final Thoughts

Planning for health care after retirement requires a comprehensive approach. You must assess your current health, project future needs, and understand Medicare options to create a solid foundation for your retirement years. A well-structured health care budget will account for out-of-pocket expenses, long-term care and inflation, ensuring financial stability throughout your retirement.

Your health care needs will change as you age. necessitating regular reviews and adjustments to your plan. New treatments may become available, and health care costs may fluctuate, so staying informed about these changes will help you adapt your strategy effectively. We at Healthy Retirement Strategies recommend seeking professional advice for personalized planning tailored to your specific circumstances.

Healthy Retirement Strategies is committed to helping you achieve a healthy and fulfilling retirement. Our approach focuses on natural and sustainable methods to maintain your well-being without relying on expensive medications or quick fixes. We provide insights to empower you in taking control of your health during retirement, setting you up for a healthier, happier future. - https://healthyretirementstrategies.blogspot.com/

My Journey to Healthy Retirement Living: A Personal Story of Prevention, Planning, and Purpose

The Foundation of Healthy Aging

You know what they say about retirement planning – everyone focuses on the money, but what about planning for your health? I consider myself incredibly blessed. At my age, I'm not popping pills every morning or dealing with chronic pain that keeps me up at night. But here's the thing – this didn't happen by accident.

My healthy lifestyle isn't just about feeling good today; it's my insurance policy for a vibrant retirement. Think about it: what good is that nest egg if you're too sick to enjoy it?

My Daily Health Prevention Strategy

Let me share what keeps me going strong. My preventive healthcare routine might seem intense, but it's actually become second nature:

Morning rituals start with thorough dental care – I brush twice daily religiously because gum disease is linked to heart problems. Adequate sleep isn't negotiable; I aim for 7-8 hours because that's when your body repairs itself.

Exercise for seniors doesn't mean running marathons. I stay active with activities I actually enjoy. Sun protection is huge – skin cancer is no joke, and those UV rays age you faster than anything.

Here's what I've cut from my diet: smoking (never started), drugs (obviously), excess sugar, salt, and refined carbs. I've said goodbye to fried foods, red meat, and seed oils. Sounds restrictive? It's actually liberating when you feel this good.

The Wake-Up Call That Changed Everything

Here's where things get real. Ten years ago, I discovered something that could have derailed my entire retirement health planning. During a routine check-up, my doctor found signs of prostate cancer.

Early detection literally saved my life. Because I caught it early, the surgery was successful, and I'm cancer-free today. This experience taught me that being proactive about your health isn't paranoia – it's smart retirement planning.

I can't stress this enough: listen to your body. When something feels off, get it checked. That weird pain, that unusual fatigue, that change in your routine – these could be your body's early warning system.

Managing Health Challenges in Retirement

Let's be honest – even with the best healthy aging strategies, stuff happens. My wife has osteoporosis, but we're managing it effectively with proper treatment and lifestyle adjustments. I've got some blood leaking into my right eye, but my eye doctor assures me it's treatable.

The key is retirement budgeting that includes healthcare costs. We don't spend like we're invincible, even though our current medical expenses are manageable. Financial planning for retirement means expecting the unexpected.

Creating Income Streams in Retirement

When retirement income becomes a concern, you've got options. Initially, I looked for traditional employment after retiring, but the job market for seniors? Let's just say it's challenging.

That's when I pivoted to online business for retirees. I launched my Health and Fitness website

(https://healthyretirementstrategies.blogspot.com/ ) almost a year ago, and hitting over 10,000 visitors in June was incredible! Now I'm working on monetizing through my Shopify store, Printify products, and affiliate marketing with Amazon, Google, ClickBank, and DigiStore24.

My dream? Generate enough passive income to help my three kids with down payments for their first homes. With today's housing market, they need all the help they can get.

The Bigger Picture of Retirement Success

Successful retirement isn't just about having enough money – it's about having the health to enjoy it and the purpose to make it meaningful. Whether you're planning for retirement or already there, remember:

Prevention is cheaper than treatment – invest in your health now

Early detection saves lives – don't skip those check-ups

Diversify your income – explore new ways to earn in retirement

Plan for healthcare costs – they're probably higher than you think

Stay purposeful – find ways to contribute and stay engaged

Your Next Steps

If you're approaching retirement or already there, start with an honest assessment of your health and finances. Create a retirement health plan that includes regular screenings, preventive care, and lifestyle modifications.

And remember – it's never too late to start making positive changes. Your future self will thank you for every healthy choice you make today.

Explore More:

Products & Services -https://healthyretirementstrategies.blogspot.com/p/products_20.html

My Weight Loss Story -https://healthyretirementstrategies.blogspot.com/p/my-story.html

Home Page - https://healthyretirementstrategies.blogspot.com/ - Check out posts related to Weight Loss, Weight Lifting, Rucking, Healthy Eating, Exercise to Prevent Decline, Dealing with Aging, Looking at the Past and Thriving in Retirement

Information about myself and my website -https://healthyretirementstrategies.blogspot.com/p/information-regarding-myself-and-my.html

Please like, comment (include name and email), and share - would love to hear your story!

More Posts You Might Like:

Fitness & Exercise:

• Why Rucking? -https://healthyretirementstrategies.blogspot.com/2025/01/why-rucking-updated.html

• Best Workout Split -https://healthyretirementstrategies.blogspot.com/2025/02/what-is-best-workout-split.html

• Morning vs Evening Workouts -https://healthyretirementstrategies.blogspot.com/2025/02/morning-vs-evening-workouts-which-is.html

• Cold Weather Workouts -https://healthyretirementstrategies.blogspot.com/2025/01/updated-is-it-safe-to-workout-in-cold.html

• Eye Exercises -https://healthyretirementstrategies.blogspot.com/2025/01/can-eye-exercises-really-improve-your.html

Weight Loss & Wellness:

• How to Quickly Lose Weight -https://healthyretirementstrategies.blogspot.com/2025/01/how-to-quickly-lose-weight-update.html

• Intermittent Fasting -https://healthyretirementstrategies.blogspot.com/2025/04/intermittent-fasting-after-50-what-you.html

• Exercise for Depression -https://healthyretirementstrategies.blogspot.com/2025/01/can-exercise-and-diet-help-with.html

• Sleep Dangers -https://healthyretirementstrategies.blogspot.com/2025/01/how-dangerous-is-it-not-to-get-enough.html

• Should BMI Be Ditched? -https://healthyretirementstrategies.blogspot.com/2025/01/should-bmi-be-ditched.html

Other:

• Productivity Lists -https://healthyretirementstrategies.blogspot.com/2025/01/lists-productivity-hack-or-overrated.html

• Avatar Animations -https://healthyretirementstrategies.blogspot.com/2025/02/all-avatar-animations.html

Please check out my website “Healthy Retirement Strategies” for many more Health Related posts. No matter your age, there should be something there that will interest you - https://healthyretirementstrategies.blogspot.com/