Managing Health Care Expenses in Retirement

#RetirementHealthcarePlanning

#MedicareBenefits

#HealthcareCostsRetirement

#SeniorHealthInsurance

#RetirementMedicalExpenses

#MedigapCoverage

#HealthSavingsAccount

#MedicareEnrollment

#RetirementFinancialPlanning

#PreventiveCareForSeniors

At the bottom of this post are links to My Story, My Products, Information about my website, My Home Page, in addition to posts related to Health topics.

Managing Healthcare Costs in Retirement: Complete Guide to Medicare Benefits and Savings Strategies

At Healthy Retirement Strategies, we understand that managing healthcare expenses in retirement is a top concern for many individuals. As medical costs continue to rise, it's essential to plan ahead and develop retirement healthcare planning strategies to keep these expenses under control.

In this post, we'll explore practical ways to manage your healthcare costs during retirement, from understanding common expenses to maximizing Medicare benefits. We'll also share tips on how to reduce your out-of-pocket medical expenses without comprising your health and well-being.

The Big Three: Medicare, Supplemental Insurance, and Out-of-Pocket Expenses

Retirement healthcare planning changes many aspects of life, especially how you manage health insurance for seniors. Understanding these costs can significantly impact your retirement financial planning.

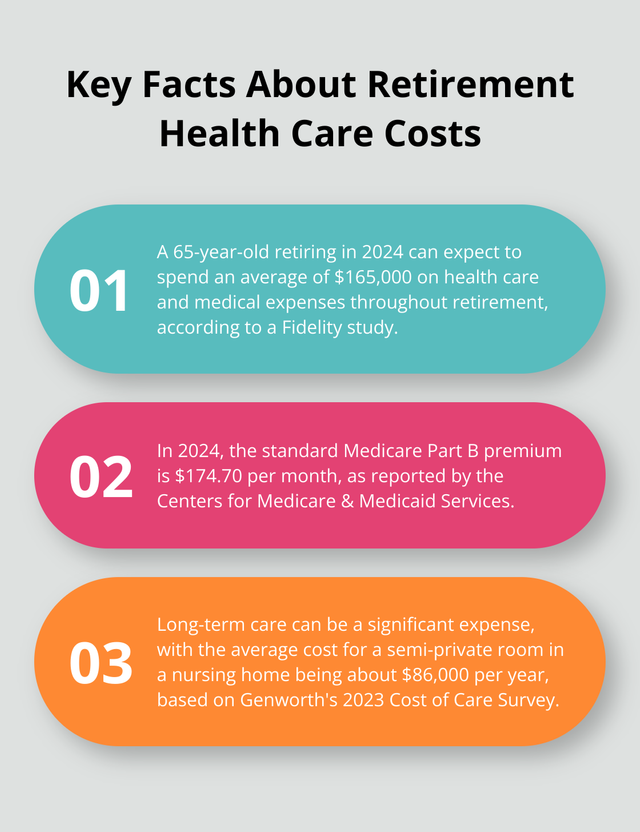

Medicare coverage forms the foundation of healthcare for retirees, but it doesn't cover everything. In 2024, the standard Medicare Part B premium is $174.70 per month (according to the Centers for Medicare and Medicaid Services). Many senior citizens choose supplemental insurance to fill gaps in Medicare coverage, which can add $150 to $300 per month in expenses.

Out-of-pocket healthcare costs often surprise retirees. These include deductibles, copayments, and services not covered by Medicare (such as dental care and hearing aids). A study by Fidelity suggests that a 65-year-old retiring this year can expect to spend an average of $165,000 in healthcare and medical expenses throughout retirement. - https://newsroom.fidelity.com/pressreleases/fidelity-investments--releases-2024-retiree-health-care-cost-estimate-as-americans-seek-clarity-arou/s/7322cc17-0b90-46c4-ba49-38d6e91c3961

Factors That Can Increase Your Healthcare Costs.

Several factors can significantly impact your healthcare expenses in retirement.

Chronic conditions: Managing ongoing health issues like diabetes or heart disease can substantially increase medical costs for seniors.

Prescription drug costs: Medication expenses can be a major burden, especially for specialty drugs and Medicare Part D coverage gaps.

Long-term care costs: Often overlooked, this can be the most expensive health-related cost in retirement. The average cost for a semi-private room in a nursing home is about $86,000 per year (Genworth's 2023 Cost of Care Survey).

Location: Healthcare costs vary widely depending on where you live. Some states have much higher average medical expenses than others.

The Importance of Retirement Healthcare Planning

Planning for healthcare expenses in retirement is essential. Without proper retirement planning, these costs can quickly deplete your retirement savings. Here's why it matters:

Healthcare costs rise faster than inflation. High inflation, even for a short period, will significantly impact medical expenses. - https://hvsfinancial.com/2022/03/03/the-long-term-impact-of-short-term-inflation/

Medicare doesn't cover everything. Many retirees are surprised to learn that. Medicare doesn't cover long-term care, most dental care, eye exams related to prescription glasses, or hearing aids.

Healthcare needs typically increase with age. As we get older, we usually require more medical care, which means higher costs.

Strategies for Effective Retirement Healthcare Planning

To prepare for healthcare costs in retirement, consider these strategies:

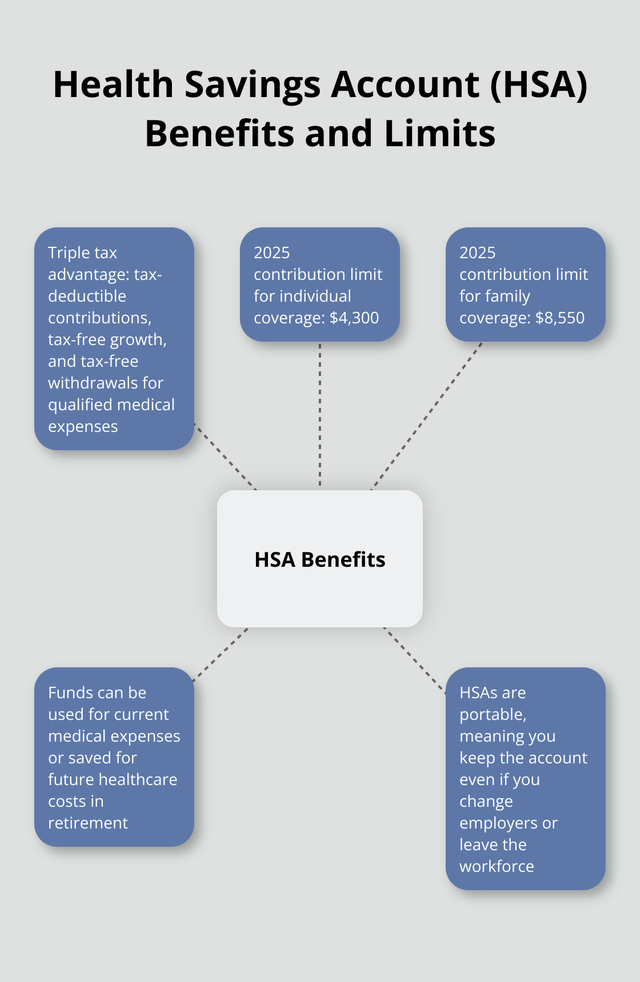

Set up a Health Savings Account (HSA) if you're eligible. HSAs offer triple tax advantages for healthcare expenses.

Consider long-term care insurance in your 50s or early 60s when premiums are more affordable.

Research Medicare options thoroughly. Understanding the different parts of Medicare coverage (A, B, C, and D) can help you make informed decisions about your coverage.

Stay healthy: Regular exercise, a balanced diet, and preventive care can reduce your healthcare costs.

How Can You Cut Healthcare Costs in Retirement?

Embrace Preventive Care for Seniors

Preventative healthcare such as routine checkups, vaccinations, and health screening, reduces overall health costs in the long run by catching diseases early. Medicare covers many preventive services at no cost to you. These include annual wellness visits, flu shots, and screenings for various conditions like cancer and heart disease. - https://www.investopedia.com/retirement-health-care-costs-how-to-prepare-8601902

Early detection of health issues helps you avoid more expensive treatments later on. For example, regular dental checkups prevent costly procedures in the future.

A healthy lifestyle dramatically reduces your risk of chronic diseases. Regular exercise, a balanced diet, and stress management are key. Even moderate physical activity, like a daily 30-minute walk, lowers your risk of heart disease, diabetes, and other costly conditions.

Shop Smart for Senior Health Insurance

Not all insurance plans offer equal benefits. Take time to compare different Medicare Advantage plans and Medigap policies. Look beyond monthly premiums and consider factors like deductibles, copayments, and coverage limits.

If you're still working and your employer offers a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA), consider this option. HSAs offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawls for qualified medical expenses. In 2025, you can contribute up to $4,300 if you are covered by a high-deductible health plan just for yourself or $8,550 if you have coverage for your family. - https://www.fidelity.com/learning-center/smart-money/hsa-contribution-limits

Leverage Technology and Resources

Technology becomes a powerful ally in managing healthcare costs. Telehealth services, which gained popularity during the COVID-19 pandemic, save you money on office visits for minor issues. Many insurance plans now cover these services.

Don't overlook prescription drug costs. Use apps or websites to compare drug prices at different pharmacies. Sometimes, paying out-of-pocket costs less than using your insurance. Ask your doctor about generic alternatives to brand-name drugs.

Negotiate Medical Bills

Many people don't realize that medical bills are often negotiable. If you receive a large medical bill, don't hesitate to contact the billing department. Ask for an itemized bill and review it carefully for errors.

How to Maximize Your Medicare Benefits

Understanding Medicare's Components

Medicare consists of several parts, each covering different aspects of healthcare. Medicare Part A covers hospital stays, skilled nursing facility care, and some home health care. Medicare Part B covers outpatient care, preventative services, and medical supplies.

Medicare Part C, also known as Medicare Advantage, offers an alternative to Original Medicare through private insurance companies. Medicare Part D covers prescription drugs and can be added to Original Medicare. - https://www.medicare.gov/basics/get-started-with-medicare/get-more-coverage/your-coverage-options/compare-original-medicare-medicare-advantage

Medicare Enrollment Timing

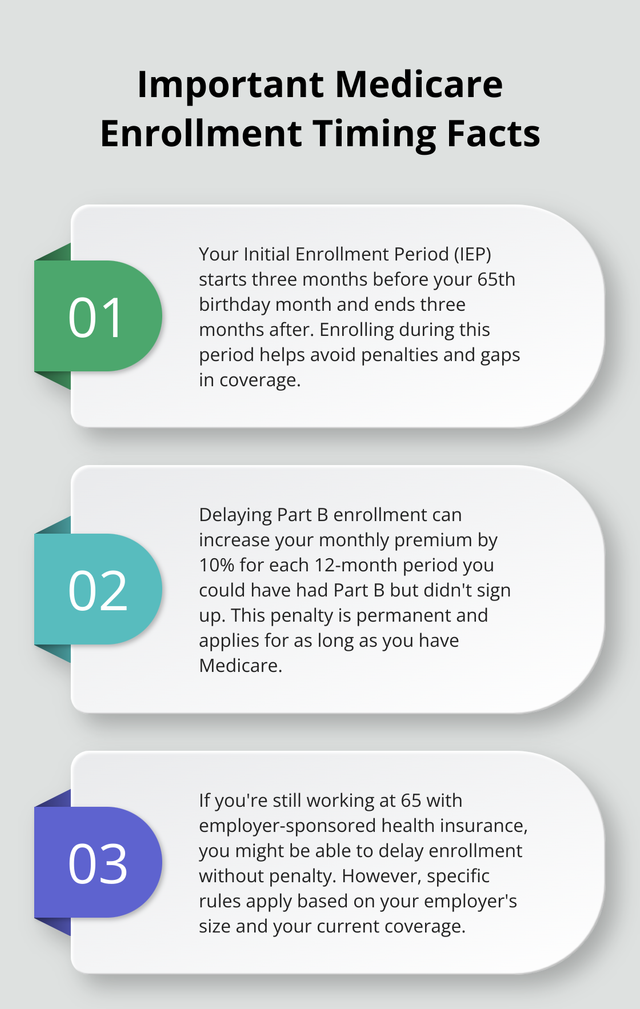

Enrolling in Medicare at the right time prevents penalties and gaps in coverage. Your Initial Enrollment Period (IEP) starts three months before your 65th birthday month and ends three months after.

Delaying Medicare enrollment can increase your monthly premium by 10% for each 12 month period you could have had Medicare Part B but didn't sign up.

How I'm Beating Healthcare Costs in Retirement Through Smart Prevention

After battling prostate cancer 10 years ago, I completely transformed my retirement healthcare planning strategy. Here's how I'm keeping my medical expenses low while staying healthier than ever.

My Proactive Healthcare Game Plan

Preventative care for seniors became my secret weapon. I learned the hard way that catching health issues early saves thousands in healthcare costs in retirement. Now I'm religious about:

Annual physicals with PSA testing (non-negotiable after cancer)

Regular dental checkups (preventing expensive procedures)

Annual eye exams (catching problems before they worsen)

Listening to my body and seeing my doctor immediately when something feels seriously off.

This preventative healthcare approach has dramatically reduced my out-of-pocket medical expenses.

The 50-Pound Weight Loss That Changed Everything

Two years ago, I dropped 50 pounds and completely revolutionized my healthy lifestyle for seniors. The secret? A combination that actually works:

My Exercise Routine:

Rucking (Walking with a weighted backpack)

Weight Lifting for strength and bone density

Consistent daily movement

My Nutrition Strategy: I've eliminated the big health destroyers:

❌ No red meat

❌ No fried foods

❌ No seed oils

❌ Minimal sugar and carbs

❌ Low salt intake

❌ Alcohol only on special occasions (hello, Pinad Coladas!)

What I DO Eat to Stay Healthy in Retirement

My senior nutrition plan focuses on inflammation-fighting foods:

Lean Proteins: Chicken, turkey, fish, beans, quinoa and peanut butter

Healthy Fats: Daily handful of pumpkin seeds, walnuts and cashews

Breakfast Superfoods: Chia seeds and fennel seeds every morning

The Bottom Line on Retirement Healthcare Savings

This healthy aging approach isn't just about feeling great - it's about reducing healthcare expenses in retirement. Every dollar I invest in preventative case and healthy eating for seniors saves me hundreds (maybe thousands) in future medical costs.

My advice? Start treating your body like the investment it is. Retirement health planning isn't just about insurance - it's about making choices today that keep you out of the doctor's office tomorrow.

Want to slash your healthcare costs in retirement? Focus on prevention, not just coverage.

Check out my website Healthy Retirement Strategies where you can view many posts related to Weight Loss, Weight Lifting, Rucking, Healthy Eating, Healthy LIving and Remembering the Past. There is something there for everyone. - https://healthyretirementstrategies.blogspot.com/

Final Thoughts on Retirement Healthcare Planning

Managing healthcare expenses in retirement requires careful planning and proactive strategies. You can reduce out-of-pocket costs by understanding Medicare components, timing enrollment correctly, and exploring supplemental insurance options.

Healthcare costs often increase faster than inflation, so you must factor these expenses into your retirement planning. Tools like Health Savings Accounts provide tax advantages and help prepare for future medical needs.

Explore More:

Products -https://healthyretirementstrategies.blogspot.com/p/products_20.html

My Weight Loss Story -https://healthyretirementstrategies.blogspot.com/p/my-story.html

Home Page - https://healthyretirementstrategies.blogspot.com/ - Check out posts related to Weight Loss, Weight Lifting, Rucking, Healthy Eating, Exercise to Prevent Decline, Dealing with Aging, Looking at the Past and Thriving in Retirement

Information about myself and my website -https://healthyretirementstrategies.blogspot.com/p/information-regarding-myself-and-my.html

My Latest YouTube Video -

More Posts You Might Like:

All Things Retirement -https://healthyretirementstrategies.blogspot.com/p/all-things-retirement.html

Aging Gracefully -https://healthyretirementstrategies.blogspot.com/2025/02/aging-gracefully.html

Fitness After 60: How I Transformed My Health With a Healthy Retirement Lifestyle - https://healthyretirementstrategies.blogspot.com/2025/05/fitness-after-60-how-i-transformed-my.html

Healthy Eating - Seed Oils -https://healthyretirementstrategies.blogspot.com/2024/12/health-seed-oils.html

Healthy Eating - Are Microwaves Safe -https://healthyretirementstrategies.blogspot.com/2024/12/healthy-eating-are-microwaves-safe.html

Healthy Living - Fruits and Vegetables -https://healthyretirementstrategies.blogspot.com/2024/12/healthy-eating-fruits-and-vegetables.html

Are Carbs Good or Bad -https://healthyretirementstrategies.blogspot.com/2024/12/are-carbs-good-or-bad.html

Quick Weight Loss -https://healthyretirementstrategies.blogspot.com/2025/01/how-to-quickly-lose-weight-update.html

Healthy Dessert -https://healthyretirementstrategies.blogspot.com/2024/09/healthy-dessert.html

Please like, comment (include name and email), and share - would love to hear your story!

Please check out my website “Healthy Retirement Strategies” for many more Health Related posts. No matter your age, there should be something there that will interest you - https://healthyretirementstrategies.blogspot.com/