EV Charger On-Chain Warfare: Hong Kong Challenges Singapore’s $16T RWA Hegemony with 9,000 Chargers

"This isn't ordinary crypto—it's a financial pipeline piercing through the real economy," remarked a fund manager. "Hong Kong has turned charging stations into capital weapons."

01 Dual-City Gambit: The $16T Prize & Asymmetric Competition

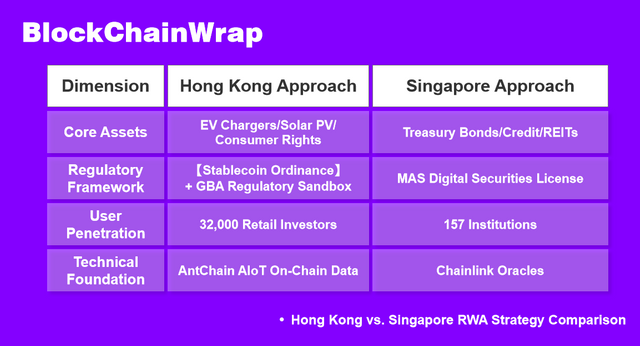

When Boston Consulting Group projected $16 trillion in tokenized assets by 2030, Asia’s twin financial hubs launched divergent RWA (Real World Asset) strategies:

Hong Kong’s Physical Anchors:

-Langxin Technology tokenized revenue rights for 9,000 EV chargers via AntChain

-Slashed financing costs for SMEs from 15% to 6.8% APR

Singapore’s Financial DNA:

-BlackRock’s BUIDL Fund issued tokenized Treasuries on Ethereum

-75 ultra-wealthy individuals control 93% of shares ($500K minimum entry)

This contest is fundamentally about financial sovereignty. In 2024, Singapore’s wealth management AUM surged 42%, attracting Goldman Sachs and Citi to establish RWA hubs. Hong Kong counterpunched with its Stablecoin Ordinance (effective August 1), permitting commercial paper reserves—sparking a 7% single-day rally in Web3 stocks like Boyaa Interactive.

02 Charger Revolution: AntChain’s Physical Asset Offensive

Langxin’s charger securitization pioneers RWA empowerment of real-economy assets. AntChain’s blockchain implants a "financial brain" into each charger:

-Real-time current data on-chain

-Revenue distributed per second

-Investors trade revenue rights via digital wallets

Solving Critical Pain Points:

-85% of China’s public chargers are privately operated

-82% of operators own <10 stations

-Traditional lenders reject loans due to fragmented assets + high due diligence costs

AntChain’s “AIoT + Blockchain” solution slashes due diligence costs by 90%.

Core Tech Breakthroughs (per AntChain engineers):

-Dynamic Ownership Verification: Freezes assets if chargers idle >48hrs via current fluctuations

-Direct Revenue Routing: Charging fees bypass operators to on-chain accounts

-Risk Tiering: Downtown chargers yield 12% APR vs. 19% in remote areas

The first 9,000 chargers raised ¥100 million ($14M), compressing SME financing cycles from 3 months to 72 hours. A Zhejiang operator testified: “I mortgaged property for $70K before—now 6 charriers get me $170K.”

03 Regulatory Shadow War: Sandbox Duel & Compliance Blitzkrieg

While Hong Kong Monetary Authority (HKMA) tested bond tokenization, Singapore’s MAS abruptly tightened digital securities licensing—escalating regulatory combat into tech warfare.

Hong Kong’s Lightning Tactics:

-“Regulatory Sandbox Fast Track” for Alibaba affiliates: Langxin project approved in 27 days

-Allowed commercial paper reserves for stablecoins → AntChain’s solar farm tokens greenlit

Singapore’s Counterstrike:

-Mandated real-time audit systems: Reserve proofs updated hourly

-35% penalty tax on closed-source contracts (targeting ZKsync’s $2.2B “shadow bank”)

Deeper Legal Clash:

-Leveraged Greater Bay Area courts for direct on-chain evidence retrieval

-Deployed mutable smart contracts to auto-freeze sanctioned assets

-MiCA regulations demanded daily compliance reports—accelerating East-West legal conflict on-chain.

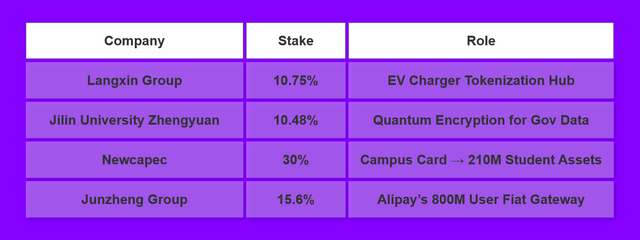

04 Ant Matrix: Alibaba’s RWA Ecosystem Domination

Behind AntChain, Alibaba built an end-to-end “affiliated company ecosystem” for physical assets:

Expanding Empire:

-GCL Energy: Tokenized solar panel output

-Yuanlong Yatu: Split-traded Winter Olympics “Bing Dwen Dwen” IP rights

-Shibei Hi-Tech: Monetizing Shanghai’s 20M resident data

“Ant aims to stuff China’s entire real economy into blockchain,” declared an investment bank director—noting Alibaba-affiliated stocks outperformed Hang Seng Index by 31% post-RWA launch.

05 Endgame: Two Civilizations Collide in $16T Market

As Citi forecasts $5T in tokenized securities by 2030, the Hong Kong-Singapore war transcends financial rivalry—becoming a clash between physical-asset digitization vs. traditional-finance tokenization.

Singapore’s Fatal Allure:

-BlackRock BUIDL: 5.3% APR but 93% owned by 75 elites

-Maple Finance: 10% yields backed by Vietnamese real estate bubble loans

Hong Kong’s Breakthrough:

-Charger tokens attracted 32,000 retail investors (avg. $430 each)

-Converting Greater Bay Area manufacturing capacity into RWA assets

Monetary Sovereignty Battle:

-Permits RMB-pegged RWA → Building de-dollarized value networks via chargers/solar/baijiu

-Clings to USD hegemony

-Trump’s GENIUS Act mandates 100% U.S. Treasury backing for stablecoins

June 15, 2025 Epilogue:

Singapore’s MAS approved the first Chinese RWA fund. That same day, Hong Kong’s Exchange Square unveiled a towering message:

“Here, what’s being put on-chain isn’t just numbers—it’s the productive power of 1.4 billion people.”

As AntChain connects Gobi Desert solar farms to blockchain, and Blackrock slices Saigon villas into tokens, this war will answer civilization’s pivotal question:

Does finance’s future belong to Wall Street’s code sorcery—or the electric pulse of factory floors?