Warren_Buffett_Style_Stock_Analysis_for_Ordinary_Investors

How Does Warren Buffett Rapidly Evaluate Stocks?

When picking stocks, Warren Buffett typically begins by scrutinizing companies' financial statements. As recounted in his book Tap Dancing to Work, when a journalist inquired, "Where do your investment ideas originate?" Buffett responded: "Solely through reading. My daily work fundamentally involves constant reading."

By thoroughly reviewing annual reports and assessing critical financial metrics, Buffett performs initial screenings of potential investments.

1. Return on Equity (ROE)

This measure gauges how efficiently a company deploys its capital. The standard calculation is ROE = Net Profit ÷ Average Shareholder’s Equity. Through DuPont Analysis, ROE decomposes into: ROE = Net Profit Margin × Asset Turnover × Financial Leverage. As a standalone metric, ROE offers a holistic view of corporate performance. Buffett targets companies with ROE consistently above 15%. (Illustrated below using Kweichow Moutai’s 2023-2024 financial data.)

Example: Moutai achieved ROE of 34.19% (2023) and 36.02% (2024), marking a 2-point improvement. Given its substantial idle cash reserves, Moutai’s cash-adjusted ROE approached 50% in 2024 – implying potential investment recovery within two years.

2. Gross Profit Margin

Gross Profit Margin = (Operating Revenue – Operating Costs) ÷ Operating Revenue. This ratio directly indicates a product’s profit capacity. For instance, a ¥100 product with ¥40 production costs yields a 60% margin. Buffett prioritizes margins exceeding 40%, as they signal strong product differentiation, wide economic moats, and operational resilience.

China’s liquor sector exhibits notably high margins. Moutai maintained 92.11% (2023) and 92.01% (2024) gross margins, showing a marginal 0.1-point annual dip.

3. Net Profit Margin

Net Profit Margin = Net Profit ÷ Operating Revenue. This reveals actual profitability after all expenses. High gross margins can be eroded by excessive administrative or sales costs. Buffett favors firms sustaining net margins above 5%.

Moutai’s net margins reached 49.5% (2023) and 51.2% (2024), climbing 1.7 points year-over-year, suggesting optimized cost management.

These represent three core filters in Buffett’s strategy, though comprehensive analysis also incorporates P/E ratios and competitive advantages.

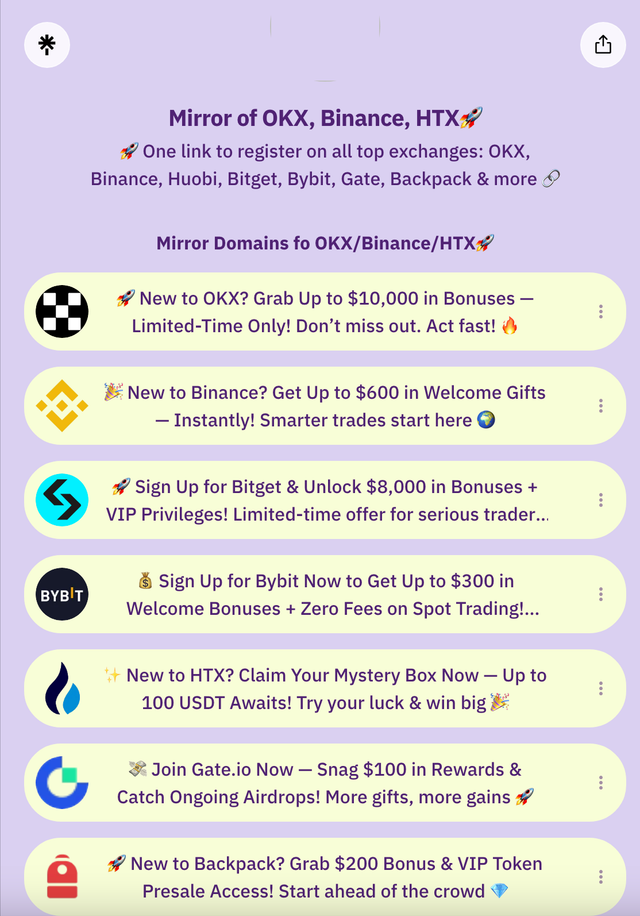

🎁 Exclusive New User Offer – Claim a Bitcoin Mystery Box (20+ USDT Value)!

Register seamlessly across premier crypto platforms: OKX, Binance, Huobi, Bitget, Bybit, Gate, Backpack & others.

👉🏻 Secure uninterrupted access by bookmarking official backup domains: https://linktr.ee

🔥 Must-Read Articles

🔥 Accessing Exchanges via Mirror Domains

Geographical restrictions often slow or block exchange domains. Users may mistake this for platform failures, though it primarily stems from network limitations. Exchanges like OKX and Binance proactively update backup domains to maintain accessibility.

- OKX alternatives: Overseas OKX - VPN Required or Alternate Link

- Binance backup: Binance

- Bitget access: Bitget

- Bybit portals: Bybit/Bybitglobal

- HTX (Huobi) entry: HTX (Huobi)

- Gate.io gateway: Gate.io

🔥 Airdrop Optimization Tools

1️⃣ Axiom Dog-Rush Utility: https://axiom.trade

2️⃣ Gmgn Airdrop Accelerator: https://gmgn.ai

3️⃣ dbot Automation Suite: https://app.debot.ai

4️⃣ Morelogin Multi-Account Manager: www.morelogin.com

Trending Queries

Bitcoin purchasing, Buffett investment analysis, Trump Coin acquisition, optimal Chinese exchanges, OKX registration steps, Binance App configuration, Binance buying tutorial, Binance airdrop instructions, Binance iOS installation, Dogecoin procurement, RMB-to-Bitcoin conversion, OKX download guide, Web3 airdrop strategies, Bitget China signup, OKX passport enrollment, DeFi staking protocols, NFT creation basics, crypto beginner resources, OKX leverage trading, Binance vs OKX comparison, liquidation avoidance, contract leverage explanation, crypto profit methods, loss prevention tactics, and more...