Master the Crypto Market: 3 Simple STEEM Trading Strategies for Beginners.

Are you tired of watching the crypto market from the sidelines? Do you want to start trading but feel overwhelmed by the jargon and complex charts? This post is for you. We'll break down three simple, effective trading strategies you can use to start making informed decisions and grow your STEEM portfolio today.

Section 1: The "HODL" Method - Set it and Forget It

This is the most straightforward strategy and perfect for new investors. HODL is a popular crypto term that originated from a typo for "hold." It simply means buying a cryptocurrency, such as STEEM, and holding onto it for a long period, regardless of short-term price fluctuations.

How it works:

Buy STEEM: Invest a small amount of money you're comfortable losing.

Hold: Do nothing. Avoid checking the price every five minutes.

Wait: Wait for months or even years for the price to increase significantly.

Why it's effective: This strategy removes the stress of daily trading and has proven to be very successful in the long run for many crypto investors.

Section 2: The DCA (Dollar-Cost Averaging) Strategy

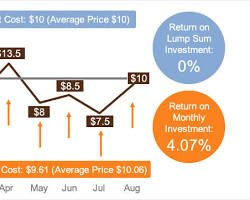

Instead of trying to "time the market" by buying all at once, you can use Dollar-Cost Averaging (DCA). This strategy involves buying a fixed amount of an asset at regular intervals, regardless of its price.

How it works:

Set a schedule: Decide how often you'll buy (e.g., every week or month).

Choose an amount: Invest the same amount of money each time (e.g., $10 worth of STEEM).

Repeat: Consistently buy on your schedule.

Why it's effective: DCA reduces the risk of buying all your assets at a market high and averages out your purchase price over time.

Section 3: The "Dip Buying" Approach

This strategy requires a bit more nerve but can be very rewarding. A "dip" is a short-term drop in the price of an asset. "Buying the dip" means purchasing more of the asset when its price falls, expecting it to rebound.

How it works:

Identify a dip: Watch the STEEM price chart for a significant drop.

Buy: Purchase a small amount of STEEM during this low period.

Expect a rebound: Wait for the price to recover.

Why it's effective: When done correctly, buying the dip can significantly lower your average purchase price and increase your potential profits.

Conclusion:

There's no single "right" way to trade, but these three strategies are excellent starting points. Remember, the key to success is to only invest what you're willing to lose and to consistently educate yourself. Happy trading!