China’s rare earth industry is becoming a trend

China’s rare earth industry index is taking visibility as HK-Stock market shows some confidence.

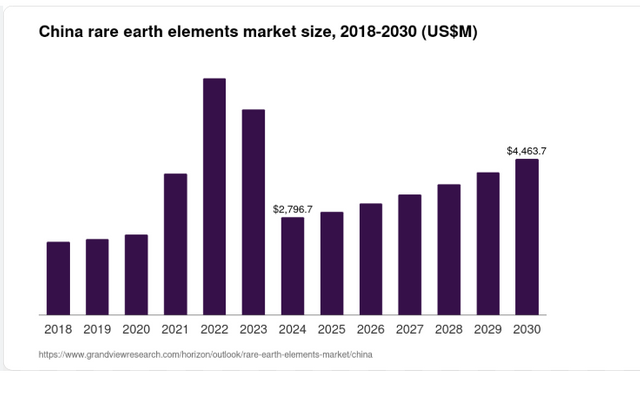

China's rare earth industry plays a crucial role in the global supply chain for critical materials used in various high-tech applications, including electronics, renewable energy, and military equipment.

Here’s an overview of the current state of China's rare earth industry and its implications:

Overview of China's Rare Earth Industry

Dominance in Supply Chain: China currently controls approximately 62% of the global supply of rare earth materials, processing about 90% of these metals. This dominance gives China significant leverage in international trade, particularly with countries reliant on these materials for technology and defense industries[4].

Strategic Importance: Rare earth elements (REEs) are essential for manufacturing products like electric vehicle batteries, smartphones, and military hardware. The strategic importance of these materials has led to heightened global interest and competition, especially from the United States, which has historically relied on China for its rare earth supplies[5].

Recent Developments

Export Controls: In recent months, China has implemented export controls on certain rare earth materials, particularly heavy rare earths, which are critical for various high-tech applications. This move has caused significant disruptions for companies in the U.S. and Europe that depend on these materials, as they now require Beijing's approval to obtain them[5].

U.S. Response: The U.S. has recognized the vulnerabilities in its supply chain and is actively working to establish a domestic rare earth supply chain. The Department of Defense has allocated substantial funding to develop sustainable sources of rare earths within the U.S. by 2027. Companies like USA Rare Earth are investing in domestic production capabilities to reduce reliance on Chinese imports[5].

Future Outlook

Potential Shift in Dominance: A recent report from the Chinese Academy of Sciences suggests that China's dominance in the rare earth sector may be nearing an end. The report indicates that new mining projects in countries like Australia and Greenland could significantly alter the global landscape for rare earth supplies, potentially reducing China's market share to about 28% by 2035[4].

Investment in Technology: China has historically invested heavily in the technology and research needed to maintain its lead in the rare earth sector. However, as other countries ramp up their production capabilities and technological advancements, the competitive landscape may shift, providing opportunities for nations like the U.S. to reclaim some market share[4].

Conclusion

China's rare earth industry remains a critical component of the global economy, with significant implications for technology and national security. As geopolitical tensions rise and supply chain vulnerabilities are exposed, both China and the U.S. are likely to continue investing in their respective rare earth capabilities, shaping the future of this vital industry.

That’s all for now, my friends!

Thank You for Your Support!

Don’t forget to engage, comment, and share your thoughts—let’s grow together in this community!

Connect with Me:

Learn about BTC in Spanish:

Cursos-videos relacionados con BTC y Criptomonedas:https://criptomonedastv.com/tienda/

X: https://x.com/Aljif7

Facebook: https://www.facebook.com/profile.php?id=718459769

IG: https://www.instagram.com/aljif7/?hl=en

Academia de IA:https://academy.gptzone.net/?aff=AJIMENEZ