Home market is reacting in Hong Kong

Aljif7's Blog

Monday 22 September, 2025

AREA: Finance

Last week Home market made great moves closing the week. One of the stock I follow for years is Kaisa Prosperity Holdings. Since last Thursday and Friday is showing volatility.

This Monday 22 September closed at 2.14 HKD; while during the day it hit 3 HKD.

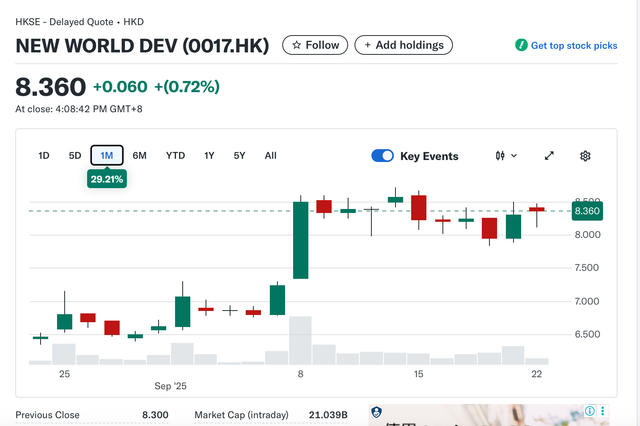

While CK Assets Hld closed at 36.74 and New World Development closed at 8.36 on Monday 22 September.

Hong Kong Homebuyers Rally Amid U.S. Rate Cuts: A Surge in Property Demand

In a striking display of renewed confidence, Hong Kong homebuyers have shown strong interest in the city’s property market following the recent cut in U.S. interest rates—a move that has significantly influenced local real estate dynamics.

The latest evidence comes from the city’s first major property sales event after the U.S. Federal Reserve’s rate cuts. At two new developments by major developers New World Development and CK Asset Holdings, 120 apartments were sold—accounting for 66% of the 190 units offered. The event drew large crowds, with many buyers braving storm signals to secure their homes, underscoring the urgency and enthusiasm in the market.

This surge in demand is closely tied to the broader impact of the U.S. reducing its benchmark interest rates. As global financial conditions shift, lower borrowing costs in the U.S. have led to reduced interest rates in Hong Kong, where monetary policy often aligns with the U.S. dollar. This has made mortgages more affordable for local buyers, effectively lowering the barrier to homeownership.

For many Hong Kong residents, who have long faced sky-high property prices and tight credit conditions, this moment represents a rare window of opportunity. With mortgage rates dropping and housing supply tightening, potential buyers are acting fast to lock in deals before prices rise again.

Experts suggest that the combination of cheaper financing and pent-up demand could fuel further activity in the coming months. However, they also caution that market stability remains fragile, especially given the city's high property price-to-income ratio and ongoing economic uncertainties.

As Hong Kong’s property sector experiences a revival, the ripple effects of U.S. monetary policy continue to shape local decisions—from individual home purchases to broader investment trends. For now, one thing is clear: Hong Kong’s homebuyers are not just watching the market—they’re rushing to get in.

Remember this is not a Financial advise, you should do your own diligences.

📈 Keep an eye on tech stocks—they’re not just leading the charge; they’re setting the pace.

Don't forget to share your thoughts or questions in the comments below!

🌟

That’s all for now my friends!

Thank you for your support!

Don’t forget: Engage, comment interact and we all grow here!

Learn about BTC in Spanish: Cursos-videos relacionados con BTC y Criptomonedas: https://criptomonedastv.com/tienda/

X: @aljif7

Facebook: https://www.facebook.com/profile.php?id=718459769

IG: https://www.instagram.com/aljif7/?hl=en

Academia de IA: https://academy.gptzone.net/?aff=AJIMENEZ

Cypto-Tips are welcome:

Some Satochis=BTC fraction: bc1q5qzx9cg3r88dp96jnx9hk4z8s8fpw3xuzsmatk

Lite-coin Fraction: LTC: MAt4qZUmz8hi6FEZVx1JvUKJxqy3YjBRnu

ADA: addr1qxeaxcansdg6cpk3zt6lthge9ftdme0l34k0eqyj4zgngycpyws7cy2senka3mjlft6a4udr6dfhxmhvd5fdf6mf5jnqczdnkl

AXS: ronin-Wallet: 0x33D171feD3Dc3D46E57273E2d104E57C2789b795

Source: South China Morning Post – "Hong Kong’s homebuyers brave storm signal at city’s first post-rate cut property sales"