The Futures Market for Chinese Medicinal Herbs: The Next “Liquid Gold”?

In recent years, with growing global attention to health and natural products, the Chinese medicinal herbs market has emerged as an investment hotspot. In the futures market, these herbs, due to their scarcity, price volatility, and complex supply chains, have been dubbed “liquid gold” by some investors. This metaphor not only highlights their high value but also suggests their market potential and liquidity. However, can the futures market for Chinese medicinal herbs truly become the next investment frontier? By analyzing the current market and specific cases, we may gain some insights.

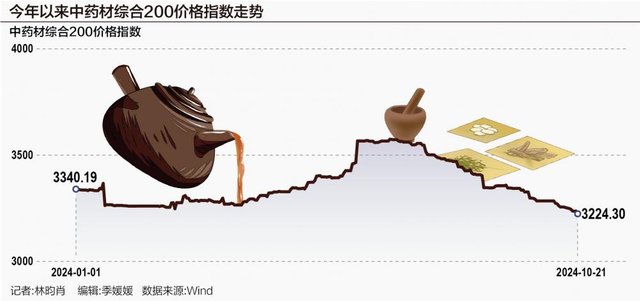

As the cornerstone of traditional Chinese medicine, Chinese medicinal herbs carry thousands of years of cultural heritage. In recent years, global acceptance of Chinese medicine has risen, driving sustained market demand. According to national statistics, the Chinese medicinal herbs market exceeded 200 billion yuan in 2023, with an annual growth rate above 10%. However, prices are highly volatile, influenced by factors such as regional climate, policy regulations, and market demand. For instance, in 2022, the price of Panax notoginseng (Sanqi) surged from 200 yuan per kilogram to 400 yuan due to drought-induced production cuts in Yunnan, attracting significant speculative capital.

The futures market provides a hedging tool for such price fluctuations. Compared to traditional spot trading, futures markets, with standardized contracts and centralized trading, reduce transaction costs and enhance market transparency. Currently, the Zhengzhou Commodity Exchange and Dalian Commodity Exchange in China have piloted derivatives for herbs like Astragalus and Angelica sinensis, though market scale and participation remain limited.

Case Study 1: The Exploration of Sanqi Futures

Take Sanqi as an example—its price volatility creates a natural fit for the futures market. In 2021, the Wenshan Sanqi Industry Association in Yunnan collaborated with an exchange to pilot Sanqi futures contracts, aiming to stabilize farmers’ incomes and attract institutional investors. In the early stages, trading volumes grew steadily, particularly during the 2022 price surge, when the futures market allowed farmers to lock in profits. However, due to limited market awareness and low liquidity, the pilot was not fully rolled out. This case suggests that while Sanqi futures hold potential, they require more robust supporting mechanisms, such as market education and risk management tools.

Case Study 2: The Internationalization of Ginseng Futures

Ginseng, a high-value medicinal herb, has gained significant traction in international markets. In 2020, South Korea and Jilin Province in China jointly launched ginseng futures contracts to attract global capital through cross-border trading. Ginseng from Jilin’s Changbai Mountain, known for its superior quality, commands consistently high prices but is also prone to speculative bubbles. The futures contracts not only provided price protection for farmers but also drew participation from overseas hedge funds. However, challenges emerged: differing quality standards across countries complicated contract execution, limiting market liquidity. This underscores the need to address issues like standardized quality metrics and regulatory coordination for the internationalization of medicinal herb futures.

While likening Chinese medicinal herb futures to “liquid gold” is compelling, the market faces significant hurdles. First, the non-standardized nature of herbs is a major bottleneck. Unlike gold or crude oil, the quality of medicinal herbs varies by origin, harvest year, and processing techniques, making uniform standards elusive. Second, market participants are predominantly from the supply chain, with limited involvement from institutional investors, resulting in low liquidity. Finally, policy risks loom large, as regulatory changes in the Chinese medicine industry can directly impact market expectations.

Nevertheless, the opportunities are equally compelling. The rise of the global health industry provides a vast market for medicinal herbs, and China’s Belt and Road Initiative is accelerating the internationalization of Chinese medicine. Technological advancements also offer solutions for market standardization. For example, blockchain can ensure traceability and quality consistency, while big data analytics can predict price trends and enhance trading efficiency.

To become “liquid gold,” the Chinese medicinal herbs futures market must focus on several key areas: first, improving market mechanisms by designing standardized contracts and lowering entry barriers; second, enhancing market education to attract more institutional investors; and third, deepening international cooperation by drawing on the global success of gold and oil futures to build a globalized trading platform for medicinal herbs. Only then can this market fully realize its potential.

References

- National Bureau of Statistics. (2023). Chinese Medicinal Herbs Market Size Data. http://www.stats.gov.cn/

- Wenshan Sanqi Industry Association. (2021). Sanqi Futures Pilot Report. http://www.wenshan.gov.cn/

- Jilin Provincial Department of Commerce. (2020). China-Korea Ginseng Futures Cooperation Project. http://swt.jl.gov.cn/